In an unprecedented case that underscores the complex regulatory environment in the European Union, Jupiter Asset Management was compelled to divest its XRP Exchange Traded Product (ETP) investment valued at approximately $2.5 million. This decision underscores the complexities and regulatory discrepancies within the European Union concerning cryptocurrency investments.

The Forced XRP ETP Sale

The incident, which was initially reported by the Financial Times, involved Jupiter’s Ireland-domiciled Gold & Silver fund. The fund had invested $2,571,504 in 21Shares’ Ripple XRP ETP during the first half of 2023, a move that was subsequently flagged by Jupiter’s compliance department.

“The trade was made, picked up by our regular oversight process and then cancelled,” a Jupiter spokesperson articulated, emphasizing the rigorous internal review processes that led to the identification and rectification of the regulatory misalignment.

Ireland’s firm stance against incorporating crypto assets into Undertakings for Collective Investment in Transferable Securities (UCITS) funds mandated the reversal of this investment. Consequently, the cryptocurrency ETP holding was sold for $2,570,670, resulting in a nominal loss of $834, which the firm addressed.

“Jupiter sold the cryptocurrency ETP holding for $2,570,670, at a loss of $834, according to a financial statement. The firm has made up the difference,” confirmed a spokesperson from Jupiter.

This development is particularly noteworthy as it contrasts with the regulatory positions of other EU countries. For instance, Germany’s regulator permits a more flexible approach, allowing crypto ETP exposure in UCITS funds under specific conditions, as demonstrated by DWS’s Fintech fund maintaining an investment in an Ethereum exchange-traded note.

Inconsistent Directives Within The EU

The incident has sparked a broader discussion on the need for a harmonized regulatory approach within the EU. The discrepancy not only affects investment strategies but also impacts the overall investment ecosystem, creating a fragmented market.

This is further complicated by the varying interpretations and applications of the UCITS directive across different member states, leading to a lack of clarity and uncertainty for fund managers looking to innovate their investment portfolios.

Regulatory bodies in Ireland and France have recently affirmed their positions against the inclusion of crypto assets in UCITS funds, underscoring a cautious approach towards investor protection within regulated fund structures. Meanwhile, the UK and Germany adopt distinct stances, with the latter allowing certain crypto exposures under defined criteria.

This incident is not only highlighting the complexities involved in navigating the regulatory landscape for crypto investments but also emphasizes the need for a unified regulatory framework within the European Union.

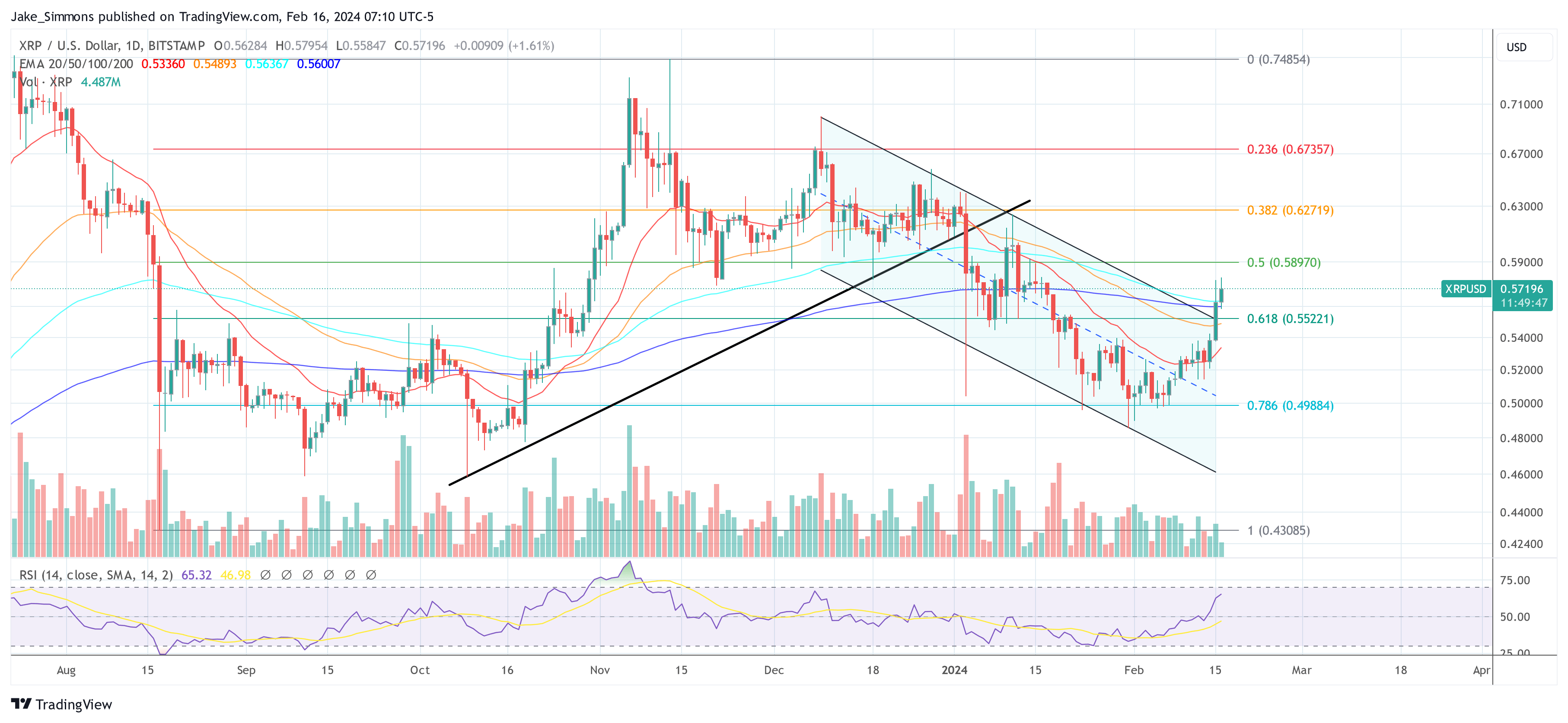

XRP Price Confirms Breakout

At press time, the XRP price stood at $0.57196. As predicted yesterday, XRP has managed to break out of the descending channel and rise above the 20-, 50-, 100- and 200-day EMA cluster. This means that the XRP bulls have a good chance of gaining the upper hand again. A breakout above the 0.5 Fibonacci level at $0.5897 would be another important step.