Aligned within a year of its three halving events, Bitcoin had three major bull runs in its 15-year history. After each one, in 2013, 2017 and 2021, Bitcoin price typically drops significantly until the next one.

However, the post-Bitcoin ETF landscape seems to have created new rules of engagement. Since February 16th, Bitcoin ETF flows since January 11th racked up nearly $5 billion in net inflows. This represents 102,887.5 BTC buying pressure for that period, per BitMEX Research.

As expected, BlackRock’s iShares Bitcoin Trust (IBIT) leads with $5.3 billion, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) at $3.6 billion, and ARK 21Shares Bitcoin ETF (ARKB) in third place with $1.3 billion.

Over five weeks of Bitcoin ETF trading brought in $10 billion AUM cumulative funds, bringing the total crypto market cap closer to $2 trillion.This level of market engagement was last seen in April 2022, sandwiched between Terra (LUNA) collapse and a month after the Federal Reserve began its interest rate hiking cycle.

The question is, how does the new Bitcoin ETF-driven market dynamic look to shape the crypto landscape moving forward?

Impact of $10 Billion AUM on Market Sentiment and Institutional Interest

To understand how Bitcoin price impacts the entire crypto market, we first need to understand:

- What drives Bitcoin price?

- What drives the altcoin market?

The answer to the first question is simple. Bitcoin’s limited 21 million BTC supply translates to scarcity, one that is enforced by a powerful computing network of miners. Without it, and its proof-of-work algorithm, Bitcoin would’ve been just another copypasted digital asset.

This digital scarcity, backed by physical assets in hardware and energy, is heading for the fourth halving in April, bringing Bitcoin’s inflation rate under 1%, at 93.49% bitcoins already mined. Moreover, the sustainability hosting vector against Bitcoin miners has been waning as they increased renewable sources.

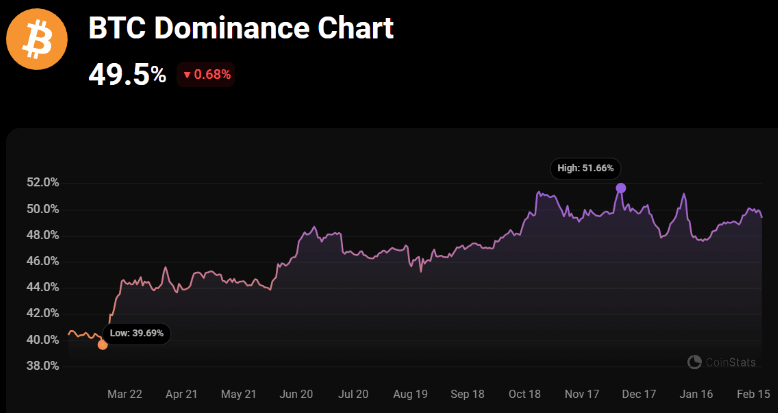

In practical terms, this paints Bitcoin’s perception as sustainable and permissionless sound money, unavailable for arbitrary tampering as is the case with all fiat currencies. In turn, Bitcoin’s simple proposition and pioneering status dominates the crypto market, presently at 49.5% dominance.

Consequently, the altcoin market revolves around Bitcoin, serving as the reference point for market sentiment. There are thousands of altcoins to choose from, which creates a barrier to entry, as their fair value is difficult to gauge. The rise in Bitcoin price boosts investor confidence to engage in such speculation.

Because altcoins have a greatly lower market cap per individual token, their price movements result in greater profit gains. In the last three months, this has been demonstrated by SOL (+98%), AVAX (+93%) and IMX (+130%) among many other altcoins.

Investors looking to expose themselves to higher profits from smaller-cap altcoins then benefit from Bitcoin interest spillover effect. On top of this dynamic, altcoins provide unique use-cases that go beyond Bitcoin’s sound money aspect:

- decentralized finance (DeFi) – lending, borrowing, exchange

- tokenized play-to-earn gaming

- cross-border remittances at near-instant settlements and negligible fees

- utility and governance tokens for DeFi and AI-based protocols.

With Bitcoin ETFs now in play, institutional capital is in the driving seat. The rapid AUM growth in spot-traded Bitcoin ETFs has been unadulterated success. Case in point, when SPDR Gold Shares (GLD) ETF launched in November 2004, it took one year for the fund to reach the total net assets level of $3.5 billion, which BlackRock’s IBIT reached within a month.

Moving forward, whales will continue to drive up Bitcoin price with strategic allocations.

Strategic Integration of Spot Bitcoin ETFs into Investment Portfolios

Having received the legitimacy blessing from the Securities and Commission Exchange (SEC), Bitcoin ETFs gave financial advisors the power to allocate. There is no greater indicator to this than US banks seeking the SEC approval to grant them the same power.

Together with the Bank Policy Institute (BPI) and the American Bankers Association (ABA), banking lobby groups are pleading with the SEC to revoke the Staff Accounting Bulletin 121 (SAB 121) rule, enacted in March 2022. By looking to exempt banks from on-balance sheet requirements, they could scale up cryptocurrency exposure for their customers.

Even without the banking piece of Bitcoin allocation, the potential for inflows into investment portfolios is substantial. As of December 2022, the size of the US ETF market is $6.5 trillion in total net assets, representing 22% of assets managed by investment companies. With Bitcoin being a hard counter against inflation, the case for its allocation is not difficult to make.

Stefan Rust, Truflation CEO per Cointelegraph said:

“In this environment, Bitcoin is a good safe-haven asset. It’s a finite resource, and this scarcity will ensure that its value grows along with demand, making it ultimately a good asset class for storing value or even increasing value.”

Without holding actual BTC and tackling self-custody risks, financial advisors can easily make the case that even 1% of Bitcoin allocation has the potential for increased returns while limiting market risk exposure.

Balancing Enhanced Returns with Risk Management

According to Sui Chung, CEO of CF Benchmarks, mutual fund managers, Registered Investment Advisors (RIA) and wealth management companies using RIA networks are abuzz with the Bitcoin exposure via Bitcoin ETFs.

“We are talking about platforms who individually count assets under management and assets under advisory in excess of a trillion dollars…A very big sluice gate that was previously shut will open, very likely in about two months time.”

Sui Chung to CoinDesk

Prior to Bitcoin ETF approvals, Standard Chartered projected that this sluice gate could bring in $50 to $100 billion inflows in 2024 alone. Matt Hougan, Chief Investment Officer for Bitwise Bitcoin ETF (now at $1 billion AUM) noted that RIAs have set portfolio allocations between 1% and 5%.

This is based on the Bitwise/VettaFi survey published in January, in which 88% of financial advisors viewed Bitcoin ETFs as a major catalyst. The same percentage noted that their clients asked about crypto exposure last year. Most importantly, the percentage of financial advisors who advise larger crypto allocations, above 3% of portfolio, has more than doubled from 22% in 2022 to 47% in 2023.

Interestingly, 71% of advisors prefer Bitcoin exposure over Ethereum. Given that Ethereum is an ongoing coding project fit for purposes other than sound money, this is not that surprising.

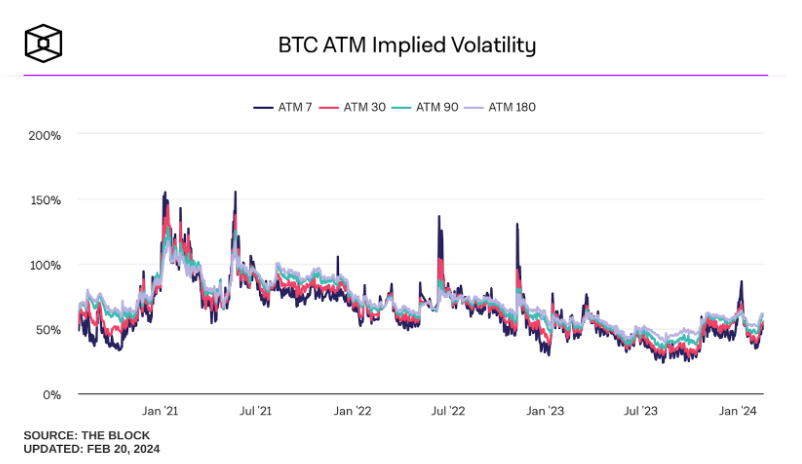

In a feedback loop, greater Bitcoin allocations would stabilize Bitcoin’s implied volatility. Presently, Bitoin’s at-the-money (ATM) implied volatility, reflecting market sentiment on likely price movement, has subsided compared to the sharp spike leading to Bitcoin ETF approvals in January.

With all four time periods (7-day, 30-day, 90-day, 180-day) heading above the 50% range, the market sentiment is aligned with the crypto fear & greed index going into the high “greed” zone. At the same time, because a greater wall of buyers and sellers is erected, a greater liquidity pool leads to more efficient price discovery and reduced volatility.

However, there are still some hurdles ahead.

Future trends in crypto investment and spot Bitcoin ETFs

Against Bitcoin ETF inflows, Grayscale Bitcoin Trust BTC (GBTC) has been responsible for $7 billion worth of outflows. This selling pressure resulted from the fund’s relatively high fee of 1.50% compared to IBIT’s 0.12% fee (for the 12-month waiver period). Combined with profit-taking, this exerted substantial selling pressure.

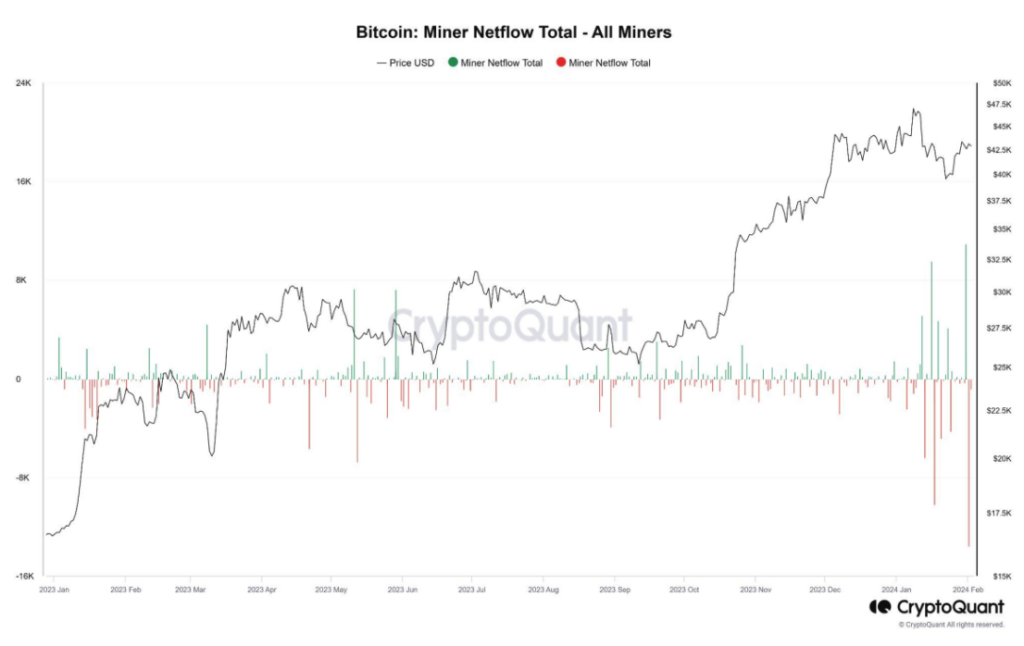

As of February 16th, GBTC holds 456,033 bitcoins, four times greater than all the Bitcoin ETFs combined. In addition to this yet-resolved selling pressure, miners have been gearing up for Bitcoin’s post-4th halving by selling BTC to reinvest. According to Bitfinex, this resulted in 10,200 BTC worth of outflows.

On a daily basis, Bitcoin miners generate around 900 BTC. For the weekly ETF inflows, as of February 16th, BitMEX Research reported +6,376.4 BTC added.

So far, this dynamic has elevated BTC price to $52.1k, the same price Bitcoin held in December 2021, just a month after its ATH level of $68.7 on November 10th, 2021. Moving forward, 95% of Bitcoin supply is in profit, which is bound to exert selling pressures from profit-taking.

Yet, the pressure on the SEC from the banking lobby indicates that the buying pressure will overshadow such market exits. By May, the SEC could further boost the entire crypto market with the Ethereum ETF approval.

In that scenario, Standard Chartered projected that ETH price could top $4k. Barring major geopolitical upheaval or stock market crash, the crypto market could be looking for a repeat of 2021 bull run.

Conclusion

The erosion of money is a worldwide problem. An increase in wages is insufficient to outpace inflation, forcing people to engage in ever-more risky investment behavior. Secured by cryptographic math and computing power, Bitcoin represents a remedy to this trend.

As the digital economy expands and Bitcoin ETFs reshape the financial world, investor and advisor behaviors are increasingly digital-first. This shift reflects broader societal moves towards digitalization, highlighted by 98% of people wanting remote work options and, therefore preferring purely digital communications. Such digital preferences influence not just our work but also investment choices, pointing to a broader acceptance of digital assets like Bitcoin in modern portfolios.

Financial advisors are poised to see Bitcoin exposure as a portfolio returns booster. During 2022, Bitcoin price was severely suppressed following a long string of crypto bankruptcies and sustainability concerns.

This FUD supply has been depleted, leaving bare market dynamics at work. The approval of Bitcoin ETFs for institutional exposure represents a game-changing reshaping of the crypto landscape, leading BTC price to inch ever closer to its previous ATH.

The post What is the role of spot Bitcoin ETFs in modern investment portfolios? appeared first on CryptoSlate.