Bitcoin has broken above the $59,000 level recently as whales have been making huge withdrawals from the cryptocurrency exchange Bitfinex.

Bitcoin Whales Have Taken Out $240 Million Worth Of BTC From Bitfinex

As explained by analyst James Van Straten in a new post on X, Bitcoin’s latest push towards the $60,000 level has, in part, come from the large outflows Bitfinex has observed recently.

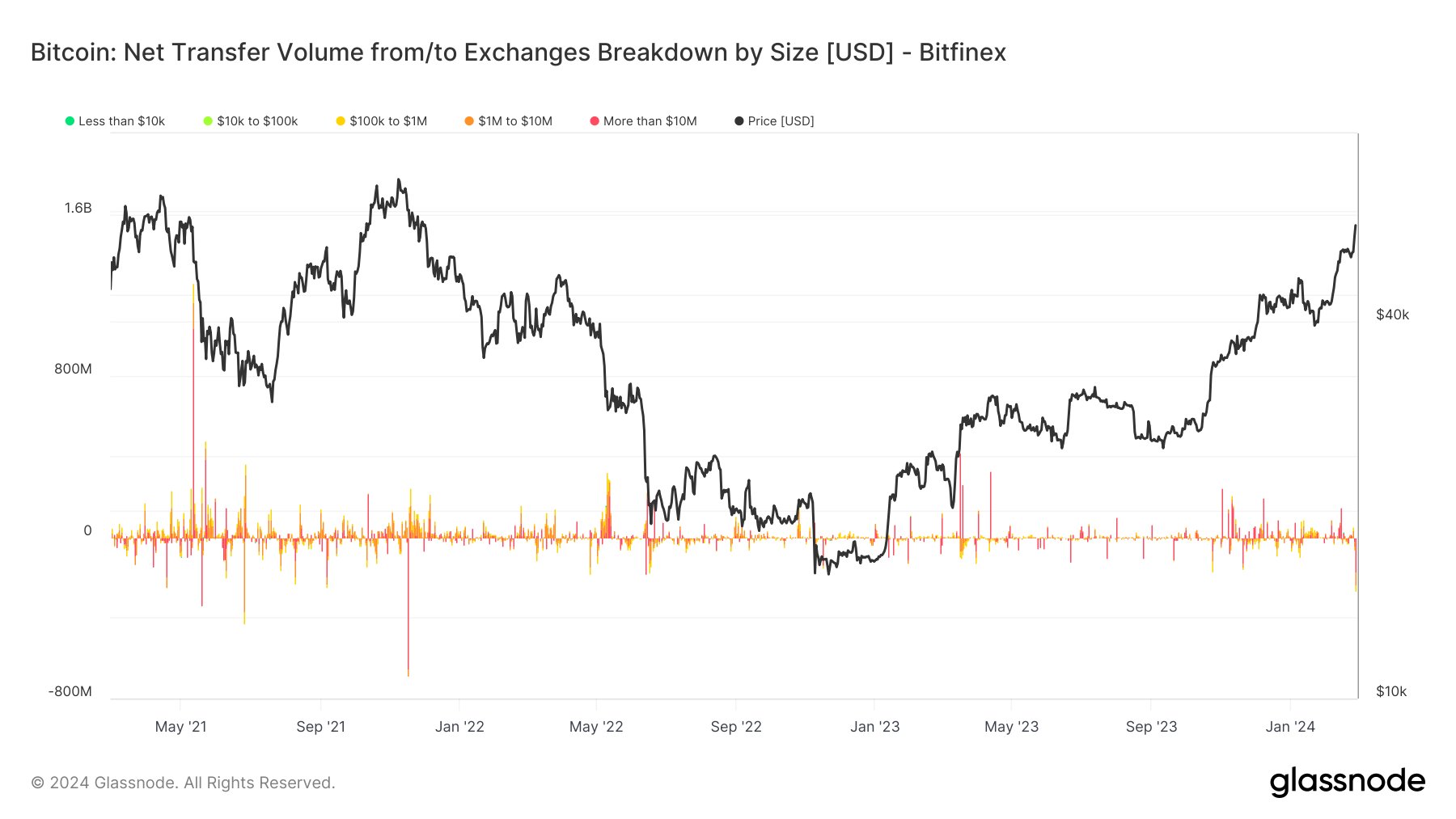

Below is the chart shared by the analyst that shows the data for the net transfer volume going to or coming out of Bitfinex over the past few years:

As displayed in the above graph, the netflow volume for the exchange has been negative recently, implying that the outflows have been overwhelming the inflows.

Generally, investors make deposit to exchanges whenever they want to make use of one of the services that the platform provides, which can include selling. Due to this reason, large exchange inflows can be something to watch out for, as they may indicate that selling is going on.

On the other hand, holders usually take their coins off the custody of these platforms whenever they plan to hold onto them for extended periods. Outflows may even correspond to fresh buying, as some buyers prefer to immediately jump into cold storage once they have made their purchase.

Whatever the case, a net amount of volume going out of the exchanges is generally a positive sign. In the case of Bitfinex in particular, this trend may be especially bullish, as according to Straten, the whales on Bitfinex are “smart money.”

As such, it’s not surprising that the Bitcoin price has shot up to break above the $59,000 level as the latest large net outflows from the Bitfinex whales have come. In total, more than $240 million worth of the cryptocurrency has left the platform in this potential buying spree.

While the picture on Bitfinex has been positive, the trend in the sector as a whole may not be so bright. As an analyst pointed out in a CryptoQuant Quicktake post, the Bitcoin inflows going towards all spot exchanges have registered a large spike recently.

As these large inflows have come alongside the latest rally in the cryptocurrency, they could be signs of profit-taking. However, it’s hard to say whether this means a top for the asset, given that the smart money whales have been backing the coin instead through this rally.

A large spike in the inflows was also observed back in December, but the deposits back then were going towards derivative platforms instead, which means that the investors were only looking to open up derivative positions.

This time around, however, the Bitcoin inflows are towards the spot exchanges, which the investors use for buying and selling.

BTC Price

Bitcoin has been approaching the $60,000 level in the past day following an uplift of around 4%.