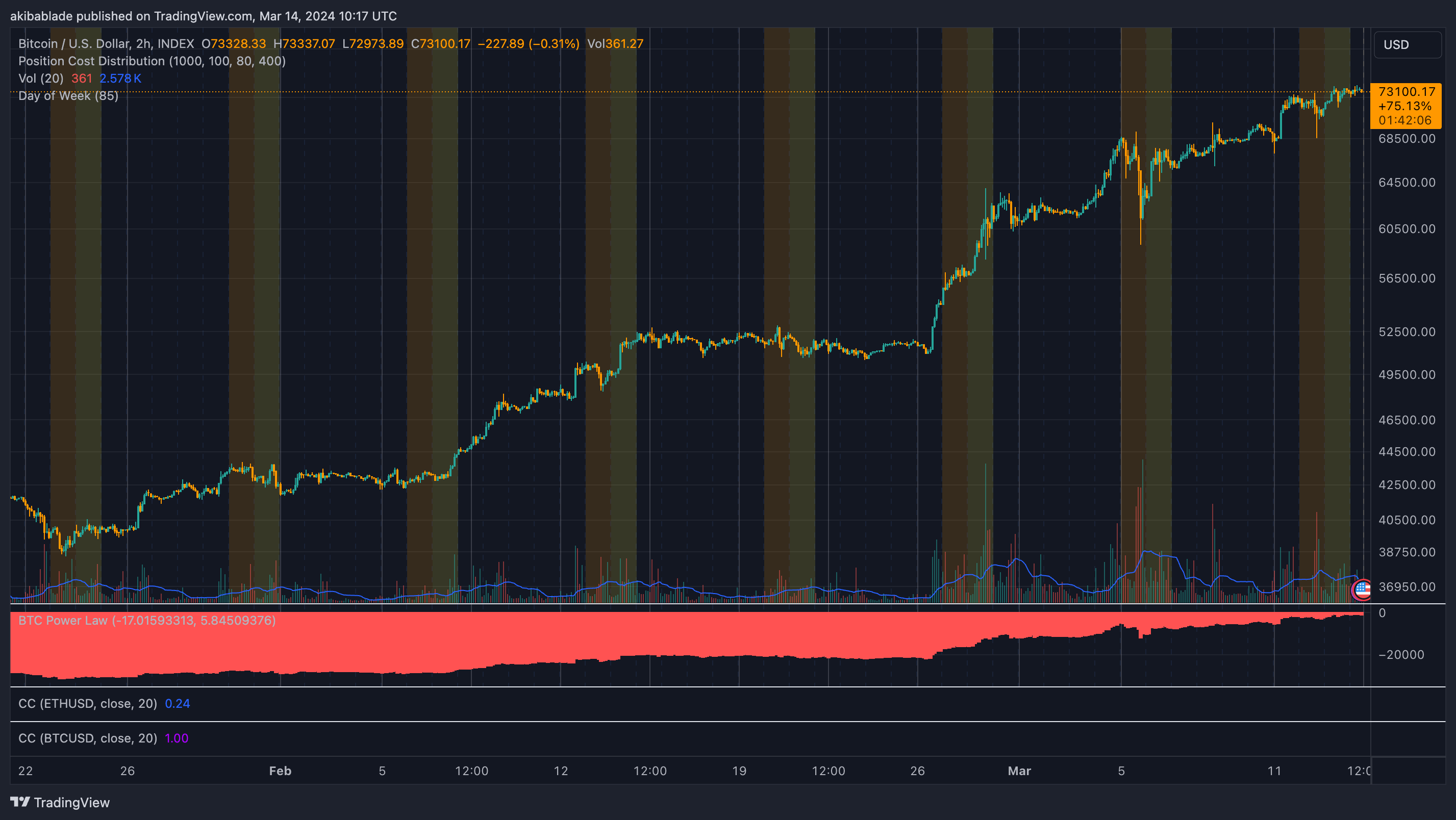

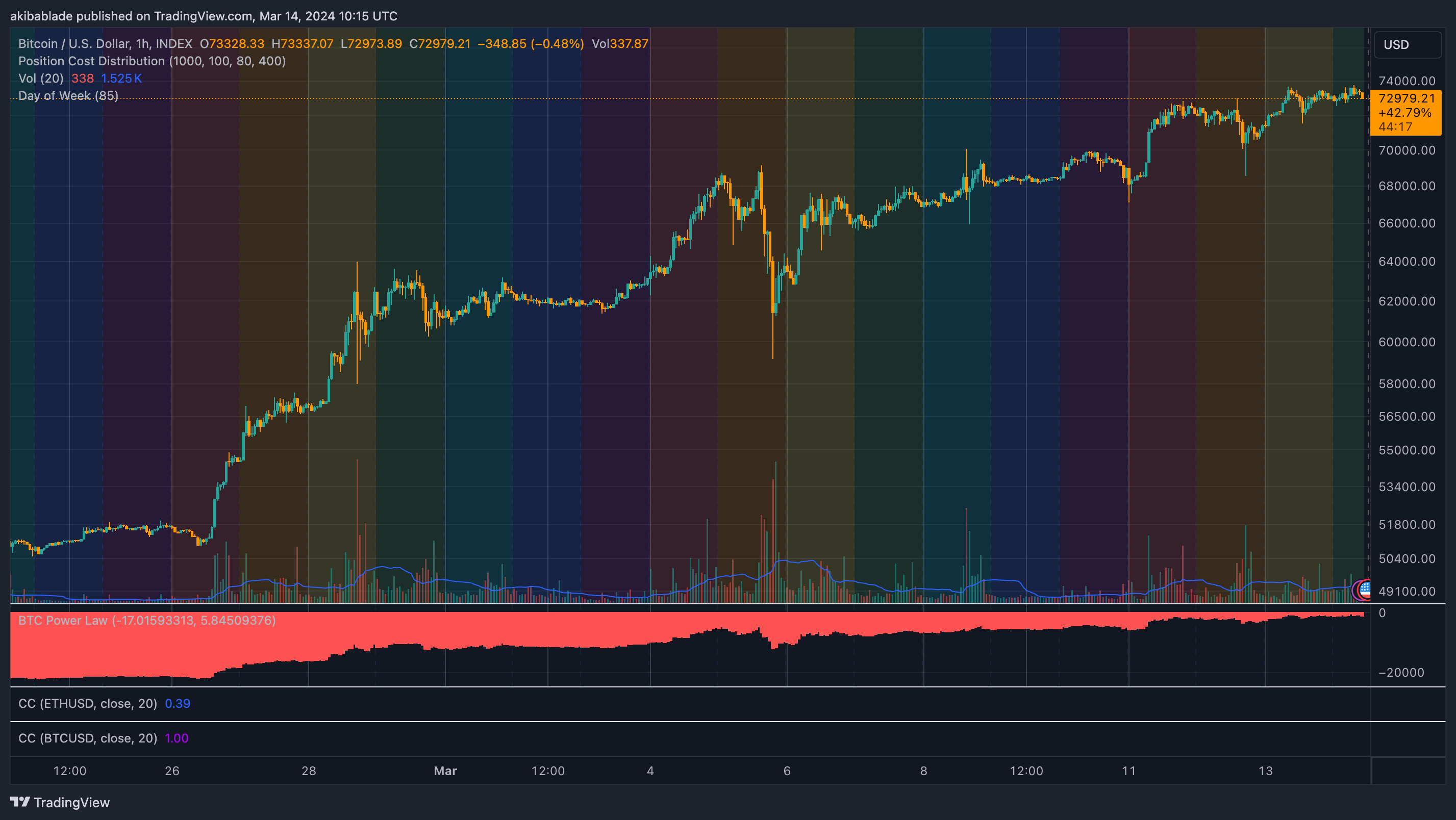

Bitcoin prices appear to have exhibited an intriguing pattern of higher volatility on Tuesdays and Wednesdays since the launch of Bitcoin ETFs on January 11, 2024, per CryptoSlate analysis. While prices have tended to rise on Mondays, Tuesdays, and Wednesdays, there have been wilder intraday swings, with several V-shaped recoveries.

Over the past three weeks, Mondays saw price increases of 10%, 9%, and 6.5% respectively. However, the following Tuesdays had significant price movements in both directions – a 5% gain followed by a 7% loss on March 5 (a 14% intraday swing) and a more modest 6% swing this past Tuesday, March 12. Wednesdays have also been volatile, with a 9% swing on February 29. Most Thursdays and Fridays have seen around a 2% intraday price swing.

One theory is that the introduction of Bitcoin ETFs has led to prices being more stable on weekends when traditional markets are closed, with the early week becoming the prime time for heavier trading volumes. The dramatic swings on Tuesdays and Wednesdays may have flushed out leveraged positions and could be related to activity by ETF-authorized participants or market makers absorbing large orders.

Bitcoin investors and traders may want to brace for more turbulence early in the week, with relatively calmer weekend times if this pattern continues. However, given Bitcoin’s historical unpredictability, only time will tell if this new apparent trend persists as the market adapts to the presence of ETF vehicles. As always, market participants should exercise caution and risk management with trades or investments.

The post Bitcoin volatility becoming more focused at start of Wall Street trading week appeared first on CryptoSlate.