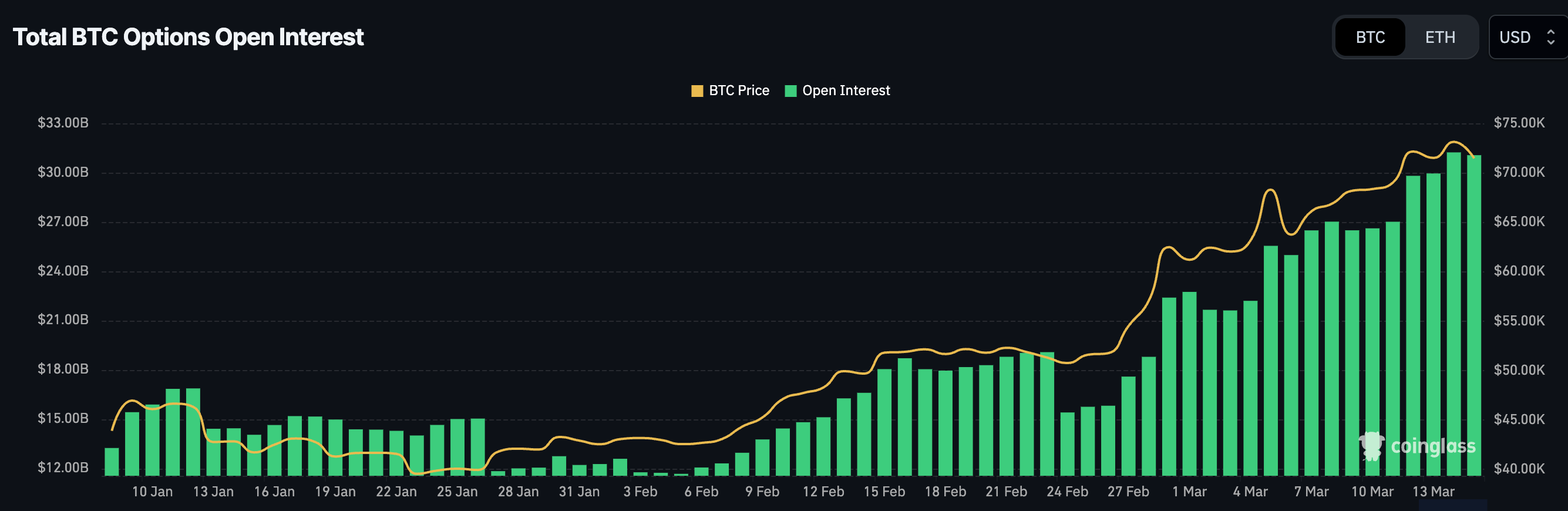

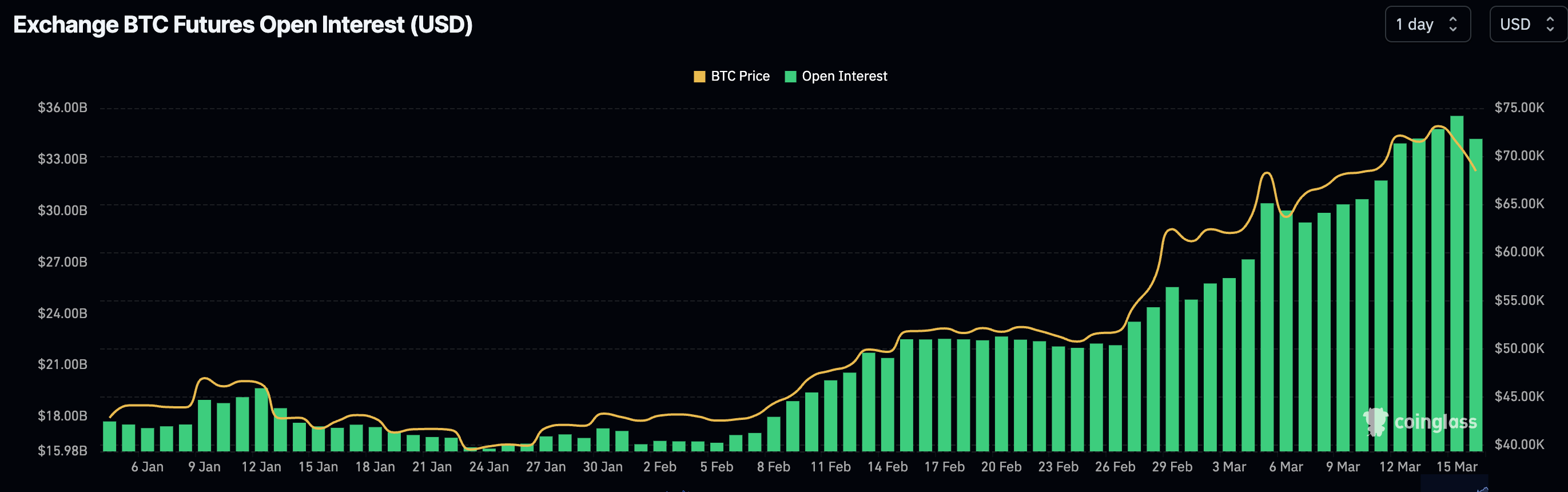

The notional total of leveraged long Bitcoin derivatives traders still surpasses $40 billion even after the recent swathe of liquidations, according to data from Coinglass. Shorts are primarily above $71,000 and amount to around $12 billion in notional value. Total open interest in futures contracts comes to $35 billion, while options contracts hold $31 billion as of press time.

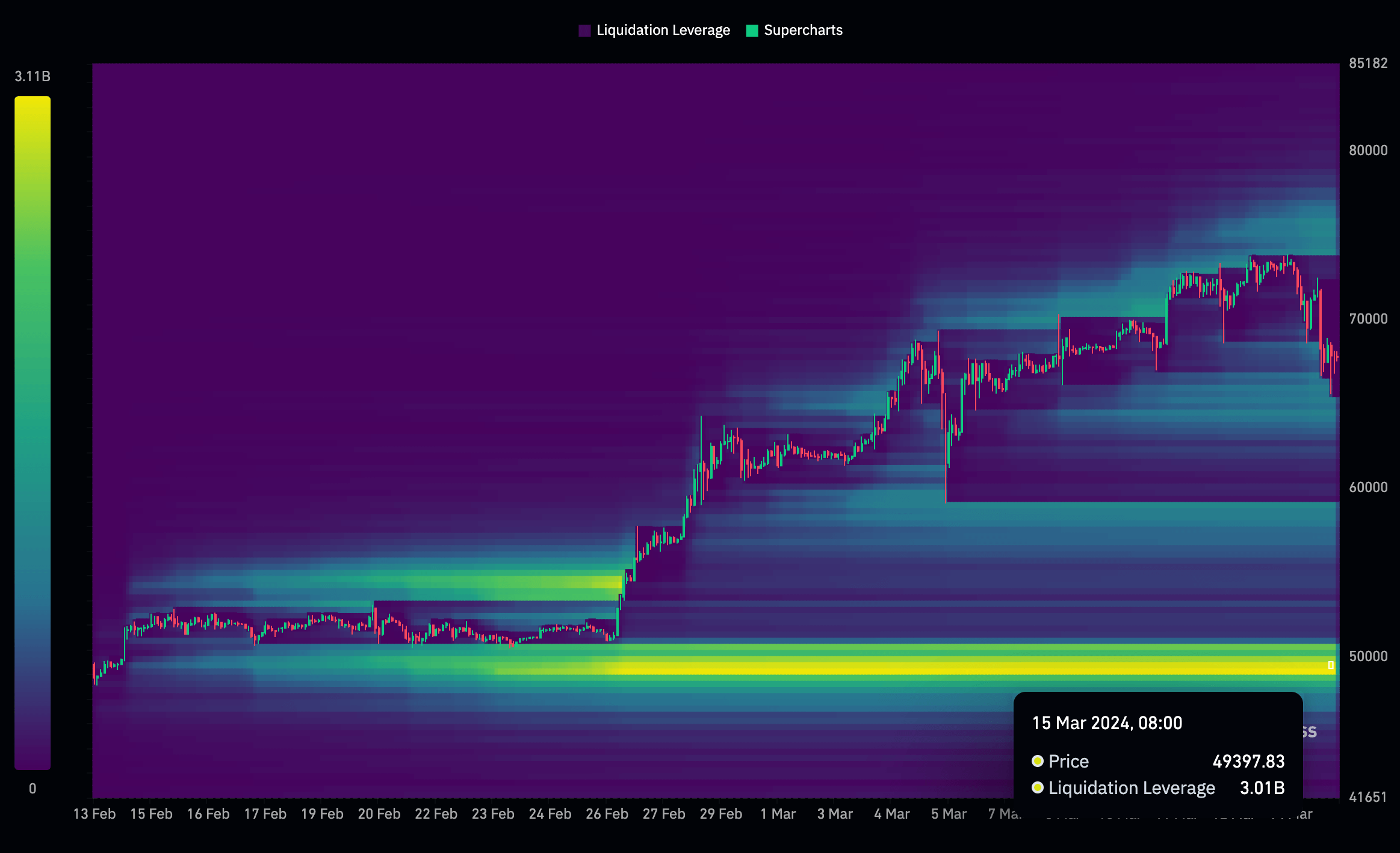

The Coinglass Liquidation Heatmap below shows a color band representing a range of prices at which a certain amount of notional value is at risk of liquidation. As the colors progress from purple to yellow, they indicate increasing notional value and, thus, higher positions that would be liquidated if the price moves through those ranges.

Suppose the price of Bitcoin reaches the levels indicated by warmer colors (like yellow). In that case, it suggests that there will be a higher amount of forced sell (in case of long positions) or buy (in case of short positions) orders to cover leveraged positions, which could lead to significant price volatility. Traders use this information to identify potential support and resistance zones and estimate the market sentiment and possible price directions.

At $35 billion, Bitcoin’s future open interest remains at an all-time high. However, unlike 2021, CME futures comprise over 30% of the market, leading to fewer over-leveraged positions. CME does not offer leverage on the same scale as Binance or OKX, where traders place bets at 100x leverage.

The post Bitcoin long traders still leveraged at over $40 billion notional value above $50k appeared first on CryptoSlate.