According to analysts at Bitfinex, Bitcoin and its recent activity on exchanges reflects a pattern reminiscent of December 2020, hinting at a possible growth phase.

The exchange’s latest report highlights a significant decline in the supply of Bitcoin held by long-term investors on centralized exchanges, reaching its lowest levels in 18 months.

This trend, coupled with the forthcoming halving event, suggests a scenario conducive to further price appreciation, as stated by the analysts.

Potential Growth On The Horizon

The Bitfinex Alpha report underscores the diminishing inactive supply of Bitcoin, particularly those assets stagnant for over a year. This reduction implies that long-term holders either reduce their positions or transfer their assets off exchanges.

Such actions are fundamental to understanding Bitcoin’s price dynamics, especially as the halving event approaches.

With an increasing number of BTC leaving centralized exchanges and a decrease in inactive supply, the market is primed for “potential growth,” according to Bitfinex analysts. They add that this mirrors the conditions observed before the significant market surge in December 2020.

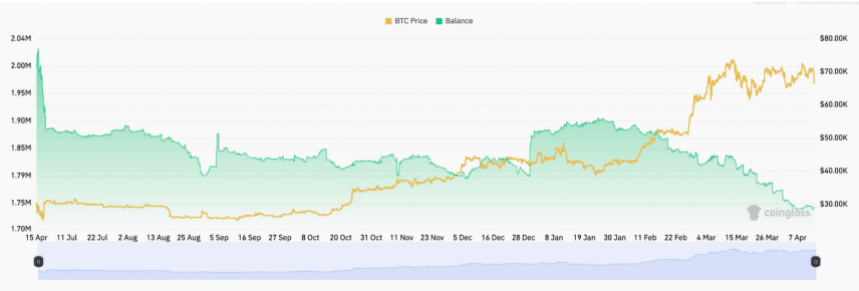

On a broader scale, data from CryptoQuant corroborates Bitfinex’s observations, indicating a continuous decline in Bitcoin exchange reserves since July 2021. This decline, which has seen reserves plummet from 2.8 million to approximately 1.94 million, suggests a sustained trend of Bitcoin leaving exchange wallets.

Bitcoin Latest Price Action

Meanwhile, Bitcoin’s price performance has taken a downturn, notably beginning late last week Friday and continuing throughout the weekend. The top crypto witnessed a significant decline, plummeting from above $70,000 to as low as $62,000.

Notably, this downward trend has persisted over the past 24 hours, with the asset experiencing a decrease of 4.6% during this period and over 10% in the past week, leading to its current trading price of $62,034 at the time of writing.

Amidst these price movements, signs of panic have emerged within the Bitcoin market. Recent data from Whale Alert sheds light on a significant transfer involving 7,690 BTC, valued at $483 million, to Coinbase, the largest cryptocurrency exchange in the United States.

7,690 #BTC (483,425,557 USD) transferred from unknown wallet to Coinbase Institutionalhttps://t.co/olrmzaQdHx

— Whale Alert (@whale_alert) April 16, 2024

While details about the origin of the address, “1Eob1,” remain undisclosed, it’s important to recognize that such transfers to exchanges often signal potential intentions to liquidate holdings. This occurrence typically suggests a readiness to sell off assets within the crypto sphere.

Furthermore, should the entity responsible for this transfer decide to sell off the entirety of the deposited BTC, it could potentially exert a notable influence on the broader Bitcoin market.

Featured image from Unsplash, Chart from TradingView