In a significant development for Ethereum, the average gas fee on the network has dropped to 6.8 Gwei, marking the lowest level since January 2020, as shown by YCharts.

This decrease in gas fees has made all on-chain operations, including asset swaps, cross-chain bridging, and non-fungible token (NFT) minting, considerably more affordable for users.

Dencun Upgrade Lowers Ethereum Fees

The plunge in transaction fees has impacted several operations on the Ethereum network. For instance, according to data from Etherscan, asset swaps can now be executed for just $7.32, bridging at $2.35, and borrowing at $6.21, while NFT minting is priced at roughly $12.37.

This reduction in fees follows the post-Dencun upgrade, which introduced blobs and optimized network usage. This upgrade sparked curiosity among developers about the potential increase in gas prices should market activity surge.

The Dencun upgrade has notably decoupled Ethereum’s transaction fees from network activity, maintaining low fees even during periods of high usage.

This change benefits users and adjusts the deflationary mechanism set by previous upgrades like EIP-1559 and The Merge.

With this new fee structure, the anticipated pressure from ETH’s burning mechanism has lessened, indicating a shift towards a more inflationary trend in the short term, as lower transaction fees mean less ETH is burned.

Impact on Ethereum’s Market Dynamics And Future Projections

Martin Koppelmann, the co-founder of GnosisDAO, highlighted the current fee dynamics on Ethereum, questioning whether the low base fee and unexplored price discovery of blob fees are the new normal or if the network will experience spikes to over 100 Gwei again.

Ethereum base fee is at record lows. The blob fee still has not even entered price discovery (with a very short exception) and thus is at absolutely 0.

Is this the new normal or will we see periods of +100 GWEI again and by what demand will they be driven?— Martin Köppelmann

(@koeppelmann) May 10, 2024

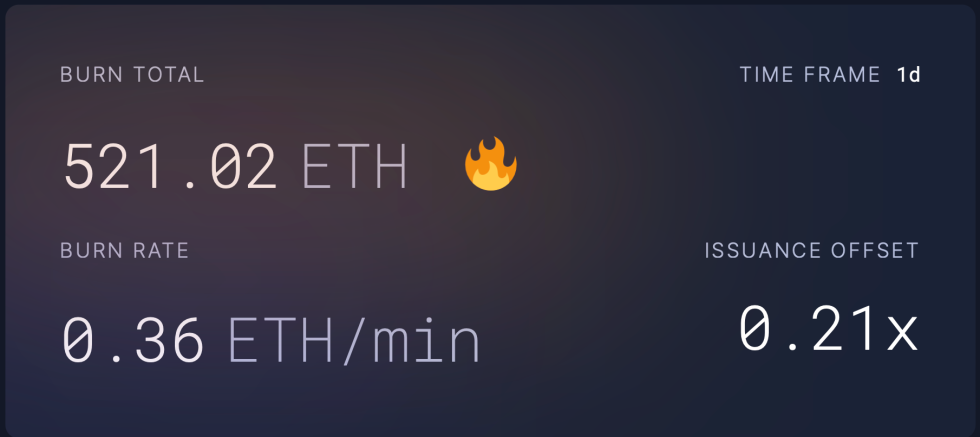

This uncertainty underscores the challenges in predicting network demand and its implications on fees. Meanwhile, Ultrasoundmoney’s data shows a significant decrease in the burn rate of ETH, with only 521.02 ETH burned in the past day, further evidence of the softened deflationary impact post-Dencun.

The broader market reactions to these developments are mixed. ETH’s price has shown volatility, with an early increase of about 2% to a high of $3,058, followed by a downturn to $2,920, marking a 16% decline over the past 30 days.

As noted by crypto analyst Shin Forex, this price behavior is partly influenced by liquidity dynamics. His ETH/BTC chart analysis suggests that liquidity is moving towards Bitcoin rather than altcoins like Ethereum, leading to a potential decrease in investor interest in Ethereum.

The analyst also observed that the ETH/BTC pair has broken below its support level of 0.05, a pattern that historically precedes a price crash. He predicts Ethereum could spiral to around $2,500 if the ETH/BTC pair falls below 0.04.

Featured image from Unsplash, Chart from TradingView