Quick Take

On May 28, the London Stock Exchange opened trading for crypto exchange-traded notes (ETNs), but access was restricted to regulated financial investors, excluding retail traders. This development raises questions about the demand for these ETNs, especially since European investors have already had access to digital asset ETFs for some time now.

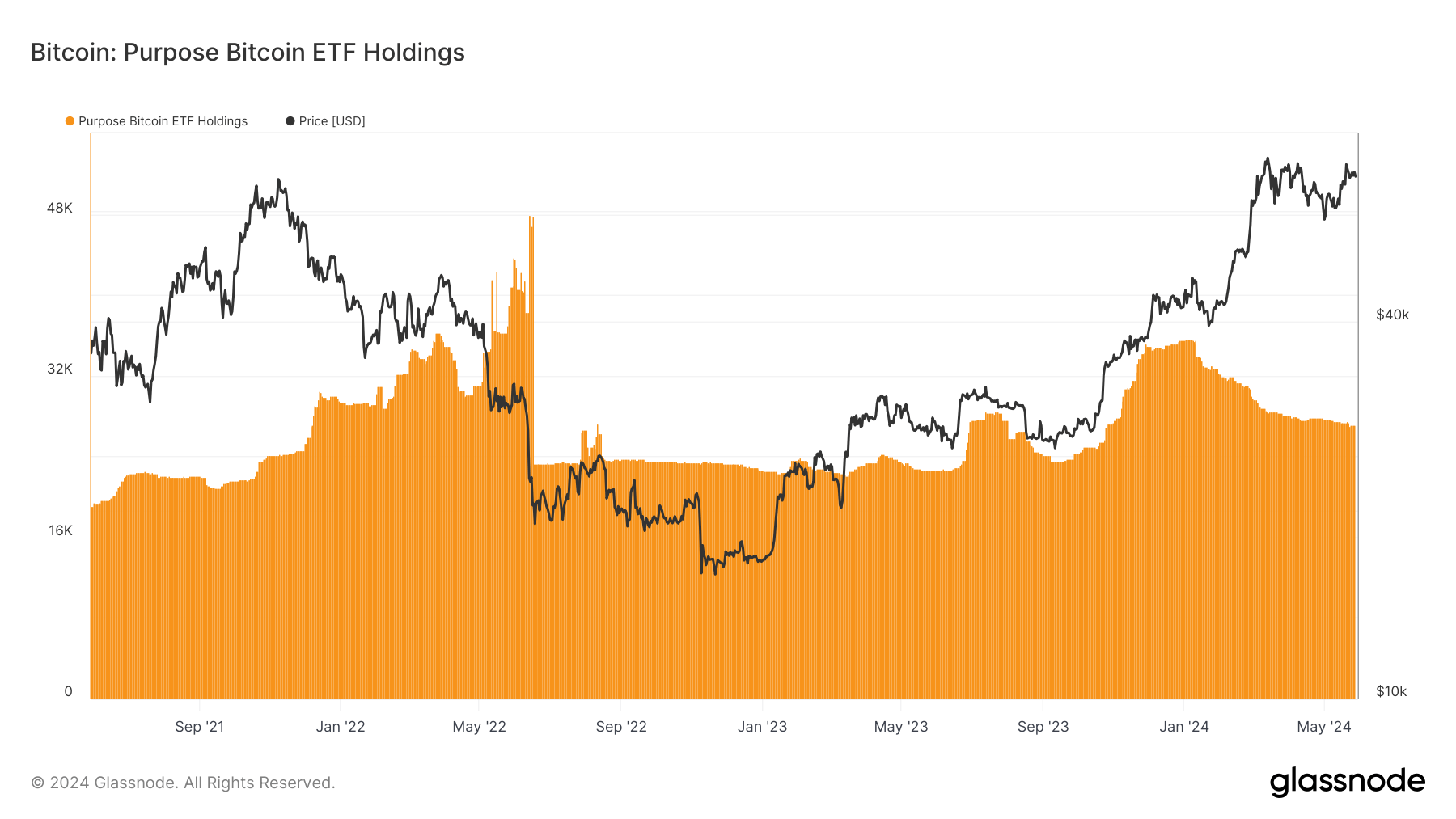

The poor start of the UK ETNs reflects broader trends, as evidenced by the limited success of the Canadian Purpose spot bitcoin ETF, which currently holds around 27,000 BTC, down from its peak of nearly 50,000 BTC, and the minimal traction seen with Hong Kong ETFs. However, the US has seen tremendous success, most notably BlackRock IBIT.

Charlie Morris, who heads up ByteTree, highlighted a poor start for these Bitcoin ETNs, with just 200 shares traded from 21Shares. Morris said:

“Towards the close, 21Shares had the tickets,”

Morris hopes this step will eventually lead to retail approval, although he finds the situation peculiar due to the lack of prior announcement or public relations efforts.

“This is a very odd situation. No warning or PR. No point except that’s it’s hopefully a starter before retail approval. But these aren’t funds, they are just new share classes of existing German and Swiss Bitcoin ETFs that have been around for quite a long time”.

The post London Stock Exchange’s new crypto ETNs see sluggish start, only 200 shares traded appeared first on CryptoSlate.