Chamath Palihapitiya, a well-known billionaire investor, has joined the dialogue about future Bitcoin Halving events and their implications for the asset in the long term.

According to the Billionaire, this notable event that occurs in the Bitcoin ecosystem every four years could propel Bitcoin’s value to as high as $500,000 in the upcoming years, and here’s how.

Post-Halving Price Movements: A Historical Insight

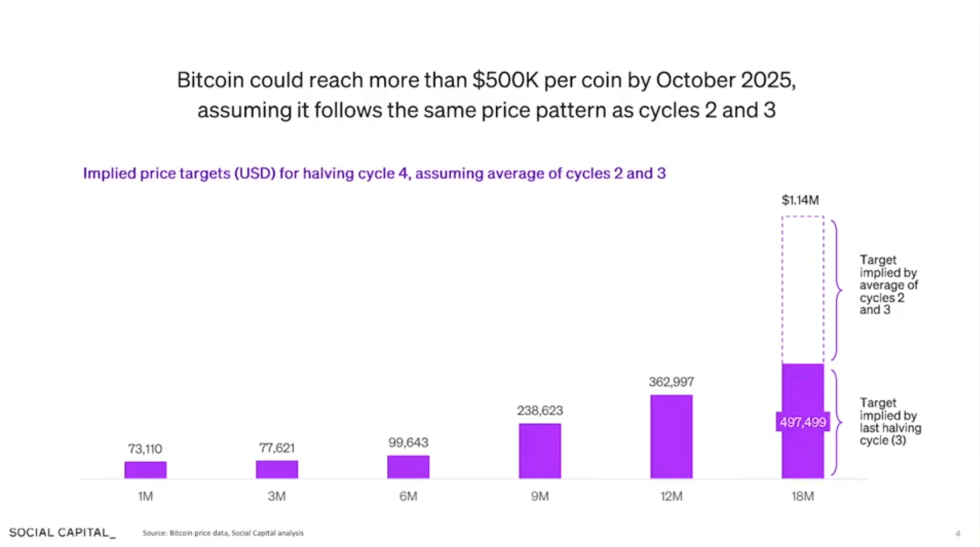

The premier cryptocurrency has historically shown significant price movements post-halving, with most substantial gains typically occurring 12 to 18 months after the event.

Palihapitiya points out that while the price tends to show modest increases initially, substantial surges have followed previous Halvings. For instance, the first Halving led to a more than tenfold increase six months later and 45.52x after 18 months.

Chamath Palihapitiya explains how 1 #BTC could reach OVER $500k per coin by October 2025 pic.twitter.com/jQ8avhWafb

— Altcoin Daily (@AltcoinDailyio) June 3, 2024

Subsequent cycles also saw significant but slightly more moderate gains. For context, after 18 months of the second Halving, the Bitcoin price saw a 27.92x increase, and the third Halving rose nearly 8x.

Bitcoin has been consolidating in the current cycle, which Palihapitiya interprets as part of its usual growth trajectory. He suggests that if Bitcoin follows the patterns observed in the second and third cycles, there could be an exponential rise, potentially reaching as high as $500,000 by October 2025.

Bitcoin’s Path to $500K And The Dual Currency Future

Elaborating on the potential of BTC hitting $500,000, Palihapitiya added that this cycle is distinct due to the “commercialization” of BTC, highlighted by the introduction of spot ETF products in the US, which could influence the cryptocurrency’s valuation significantly.

Palihapitiya states that these financial products allow “Bitcoin to cross the chasm” and have its “central key moment.” He further explains the evolving global financial landscape, predicting a future in which many countries will adopt a “dual currency” system.

According to the Billionaire, countries will increasingly recognize the need for their local currency for everyday transactions and BTC for acquiring substantial assets with enduring digital value.

Palihapitiya concluded, emphasizing the “transformative” potential of BTC:

I think that is a very powerful concept. If these things start to get to these levels of appreciation, it [BTC] is going to completely replace gold and start to become something that has transactional utility for hard assets. And I think if you marry that with the worry that some folks have for the dollar debasement, you start to see some really interesting opportunities.

Featured image created with DALL-E, Chart from TradingView