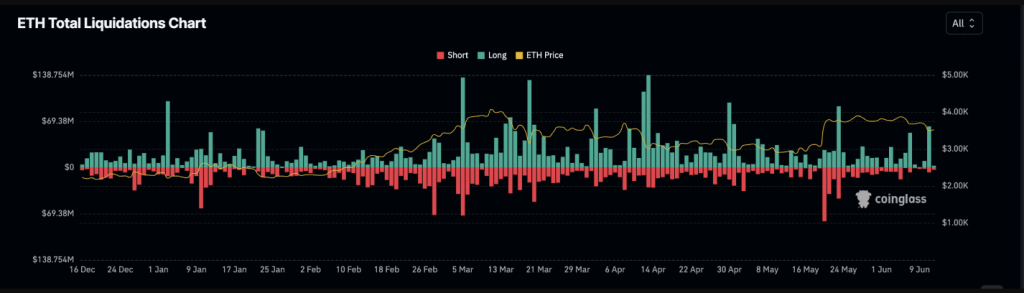

Ethereum (ETH) bulls got a taste of fire on June 11th as the altcoin’s derivatives market witnessed a dramatic surge in long liquidations. According to data from Coinglass, this event marked the highest level of long liquidations since May 23rd, signifying a significant correction for traders who bet on rising prices.

Crimson Chart: Long Positions Liquidated

Overconfident investors piled into long positions, essentially placing a wager that Ethereum’s price would climb. However, the market had other plans. An unexpected price drop sent shivers down the spines of these bulls, triggering a wave of liquidations.

As the price dipped below a certain threshold set by the exchange (known as the margin requirement), these positions were forcefully closed to prevent further losses for the unfortunate traders. The result? A collective sigh of relief for some exchanges, but a hefty bill for liquidated bulls, totaling over $60 million on that fateful day.

Positive Funding Rate Offers A Glimmer Of Hope

While the market correction sent shockwaves through the Ethereum derivatives landscape, a silver lining emerged in the form of a positive Funding Rate. This metric essentially reflects the fees paid by traders holding short positions (betting on a price decline) to those holding long positions.

In simpler terms, a positive Funding Rate indicates a stronger demand for long positions, suggesting that even amidst the carnage, some investors remain optimistic about Ethereum’s long-term prospects. This positivity is further bolstered by the fact that ETH’s Funding Rate hasn’t dipped into negative territory since May 3rd.

A Temporary Hiccup?

The jury’s still out on whether this event represents a fleeting blip or a more concerning trend. While the positive Funding Rate offers a glimmer of hope, the significant drop in derivatives activity paints a different picture.

The past 24 hours have seen a worrying decline in both options trading volume (down 50%) and Open Interest (total outstanding contracts, down 2%). This suggests a potential flight from the market, with fewer participants actively trading options contracts or holding open positions.

Ether Price Forecast

Meanwhile, the current Ethereum price prediction by CoinCodex suggests a 2.46% rise to $3,636 by July 13, 2024. Despite this positive outlook, the market sentiment remains bearish. The Fear & Greed Index stands at 70 (Greed), indicating strong investor interest.

Over the last 30 days, Ethereum has shown significant volatility, with positive gains on 53% of the days and an overall price fluctuation of 8.63%. While the short-term forecast is optimistic, the mixed signals highlight the need for cautious investment given the current market unpredictability.

Featured image from SignatureCare Emergency Center, chart from TradingView