The Australian Securities Exchange (ASX), the largest stock exchange in Australia, has recently approved the listing of its first spot Bitcoin exchange-traded fund (ETF).

The VanEck Bitcoin ETF (VBTC), which will begin trading on June 20, will be issued by asset management firm VanEck. This approval follows VanEck’s successful launch of the VanEck Bitcoin Trust (HODL), in the United States earlier this year.

Australia’s Bitcoin ETF Market Heats Up

VanEck’s CEO for the Asia-Pacific region, Arian Neiron, highlighted the increasing demand for Bitcoin exposure in Australia, particularly through regulated and transparent investment vehicles.

Recognizing Bitcoin as an emerging asset class, Neiron emphasized that VBTC would simplify advisers’ and investors’ access to Bitcoin by managing the complexities associated with acquiring, storing, and securing digital assets.

According to Bloomberg, aside from VanEck, other players in the Australian market are preparing to introduce their spot-Bitcoin and Ethereum (ETH) funds. Sydney-based BetaShares Holdings Pty and DigitalX Ltd. are reportedly working towards listing their offerings on the main Australian board.

In particular, BetaShares intends to launch spot Ethereum and Bitcoin ETF funds shortly to meet “the growing demand” for diversified digital asset investments.

While VBTC represents the first spot for Bitcoin ETF to receive approval from the ASX, it is not the first to launch in Australia. Two other Bitcoin ETFs have been introduced in the country in the past two years.

The Global X 21 Shares Bitcoin ETF (EBTC) debuted in April 2022, followed by the Monochrome Bitcoin ETF (IBTC), which began trading on the Cboe Australia exchange on June 4.

Shift From BTC To Altcoins

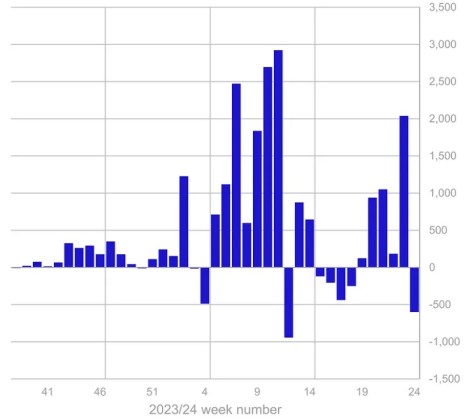

In the broader context of digital asset investment products, recent data from asset manager CoinShares reveals significant outflows of approximately US$600 million.

These outflows, the largest since March 22, coincided with a more hawkish than expected Federal Open Market Committee (FOMC) meeting, leading investors to reduce their exposure to fixed-income assets. As a result, total assets under management (AuM) fell from over $100 billion to $94 billion.

The outflows observed were primarily on Bitcoin, with approximately US$621 million withdrawn. However, several altcoins experienced inflows during this period.

Ethereum, Lido (LDO), and XRP were among the altcoins that received notable inflows of US$13 million, US$2 million, and US$1 million, respectively. This suggests that investors sought diversification beyond Bitcoin amidst the recent market volatility.

As of this writing, the largest cryptocurrency on the market is trading at $65,400, down 2% in the 24-hour time frame and nearly 6% in the past seven days, approaching the key $65,000 support level.

Featured image from DALL-E, chart from TradingView.com