Quick Take

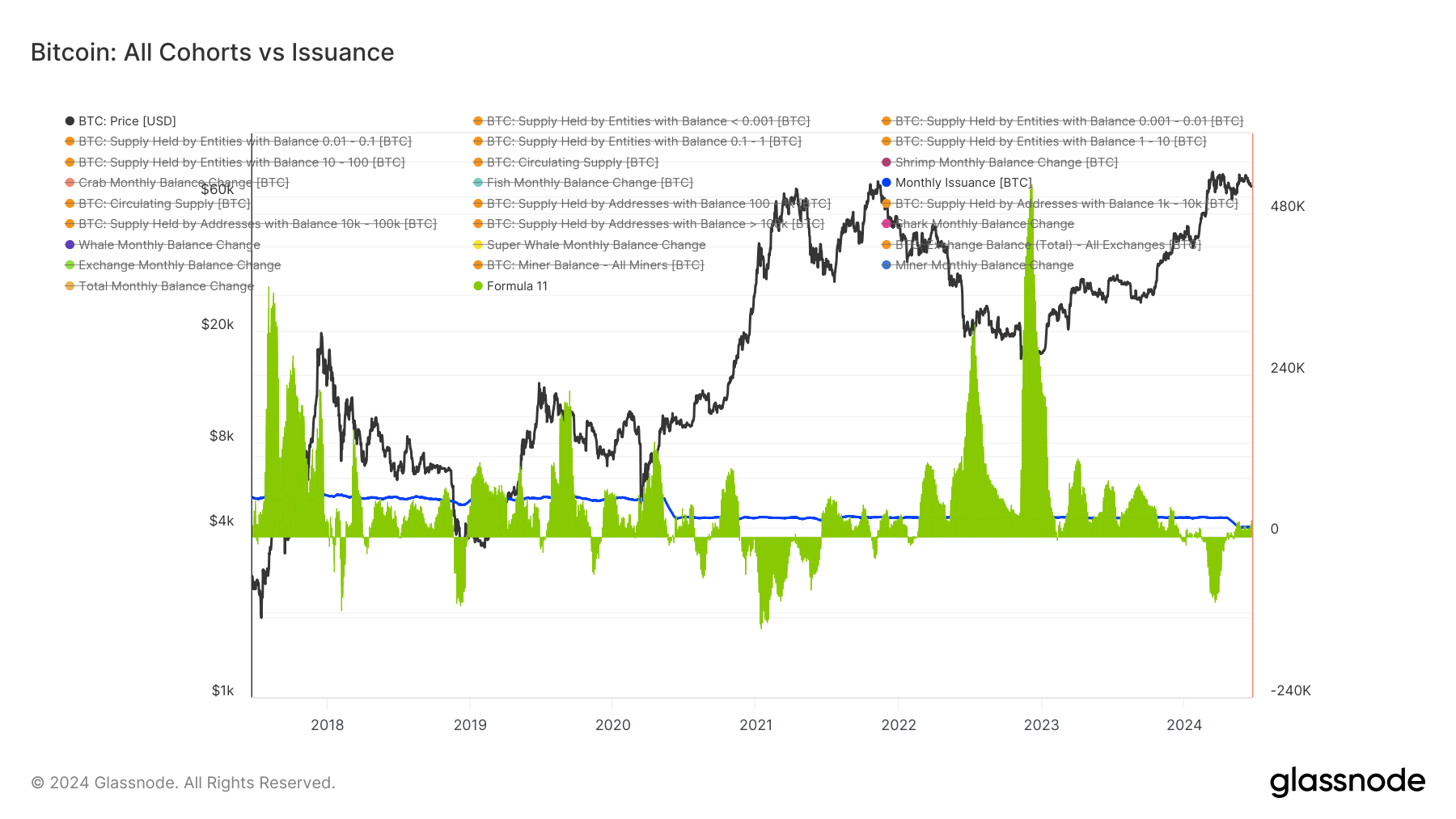

In investing and trading, retail investors are often perceived as the “dumb money,” while institutional investors are seen as the “smart money.” Historically, this perception has been evident in Bitcoin cycles. For example, during the 2017 cycle, retail investors, represented by “shrimps” (holding less than 1 BTC) and “crabs” (holding 1-10 BTC), were buying at the peak of the bull run. At that time, they accumulated approximately 360,000 BTC on a 30-day moving average, indicating they were buying at the top.

However, recent events have shown a shift in this dynamic. During major crises such as the COVID-19 crash in March 2020, the Luna collapse in June 2022, and the FTX collapse in November 2022, these retail cohorts accumulated significant amounts of Bitcoin at depressed prices. They accumulated roughly 135,000 BTC during the COVID-19 dip, 300,000 BTC during the Luna collapse, and 500,000 BTC during the FTX collapse.

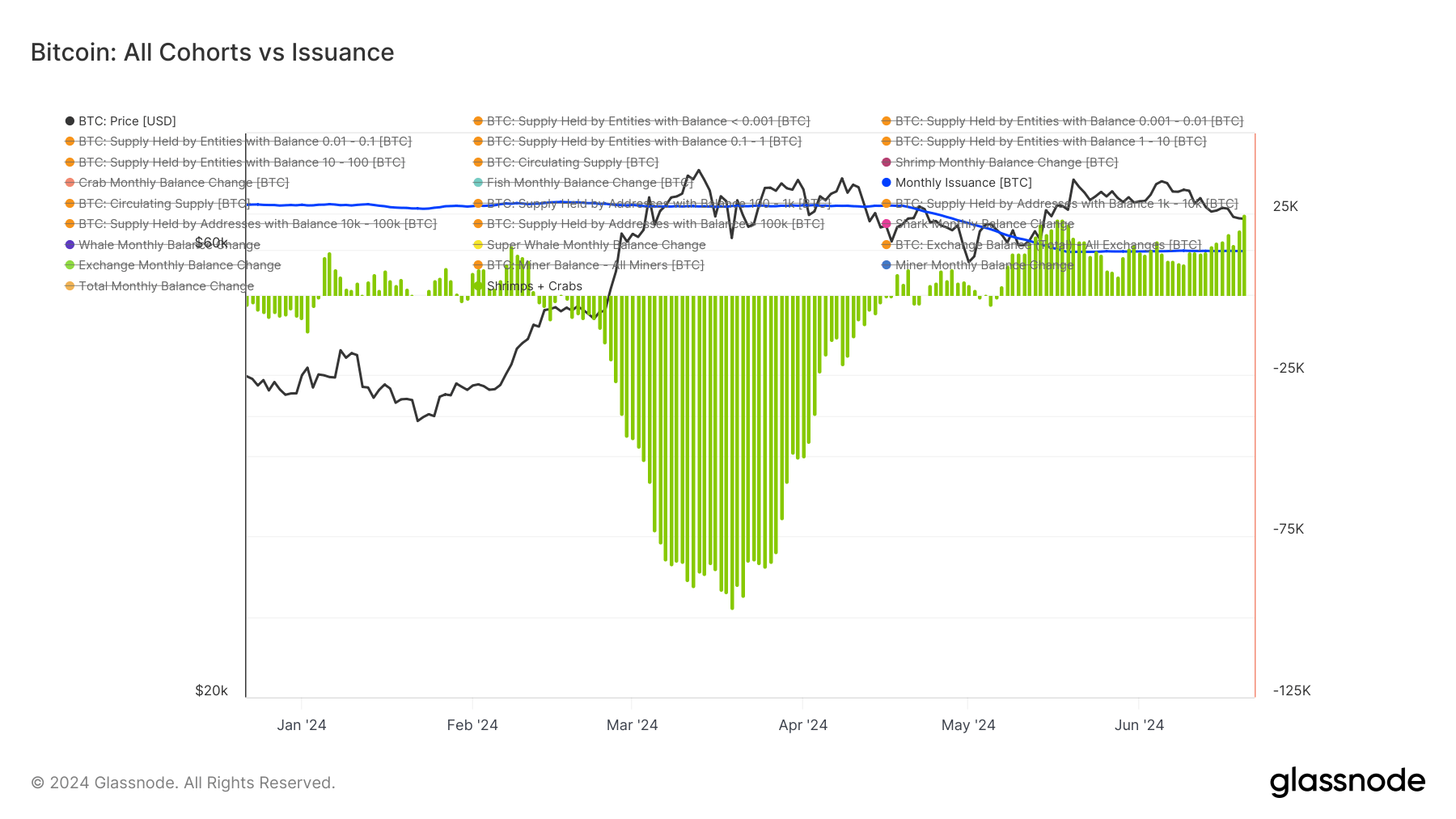

In 2024, this trend continued. Retail investors sold around 100,000 BTC at an all-time high in March, demonstrating strategic profit-taking. As Bitcoin has been consolidating for the past few months, they have been accumulating, indicating they see value in the current prices. This evolution from “dumb money” to “smart money” among retail investors is a promising indicator for the market.

The post Retail Bitcoin cohorts evolve from ‘dumb money’ to ‘smart money’ appeared first on CryptoSlate.