Quick Take

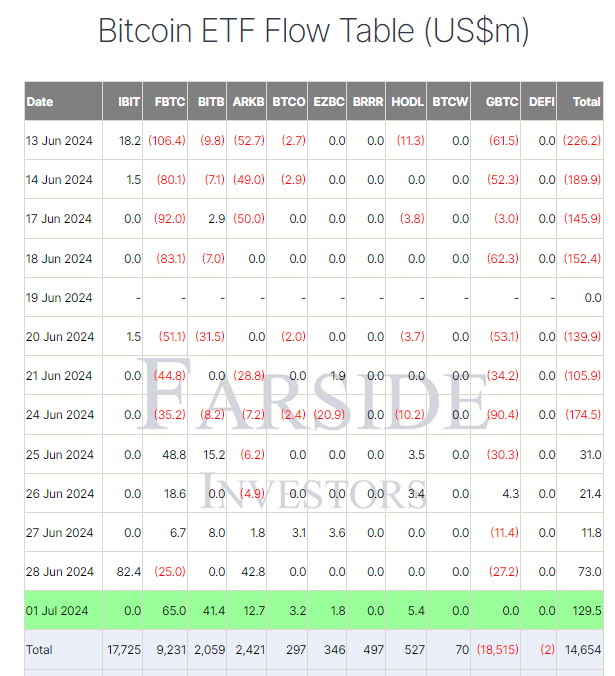

Farside data shows that on July 1, Bitcoin (BTC) exchange-traded funds (ETFs) experienced a significant influx of $129.5 million, marking the largest inflow since June 7. This surge represents the fifth consecutive trading day of positive inflows, coinciding with Bitcoin’s price consolidation above the $60,000 mark.

Among the ETF issuers, Fidelity’s FBTC led the day with a $65.0 million inflow, bringing its total net inflow to $9.2 billion. Bitwise’s BITB was followed by a $41.4 million inflow, raising its total to $2.1 billion. ARK’s ARKB saw a $12.7 million inflow, pushing its total to $2.4 billion. Grayscale’s GBTC remained unchanged, with no inflows or outflows. Overall, total inflows into Bitcoin ETFs now stand at $14.7 billion, according to Farside data.

Notably, BlackRock’s IBIT ETF saw a substantial inflow of $82.4 million on June 28, ending a streak of five trading days with no inflows or outflows. This inflow brought BlackRock’s total net inflow to $17.7 billion.

The post Bitcoin ETFs see largest inflow since June 7 with Fidelity leading at $65 million appeared first on CryptoSlate.