Quick Take

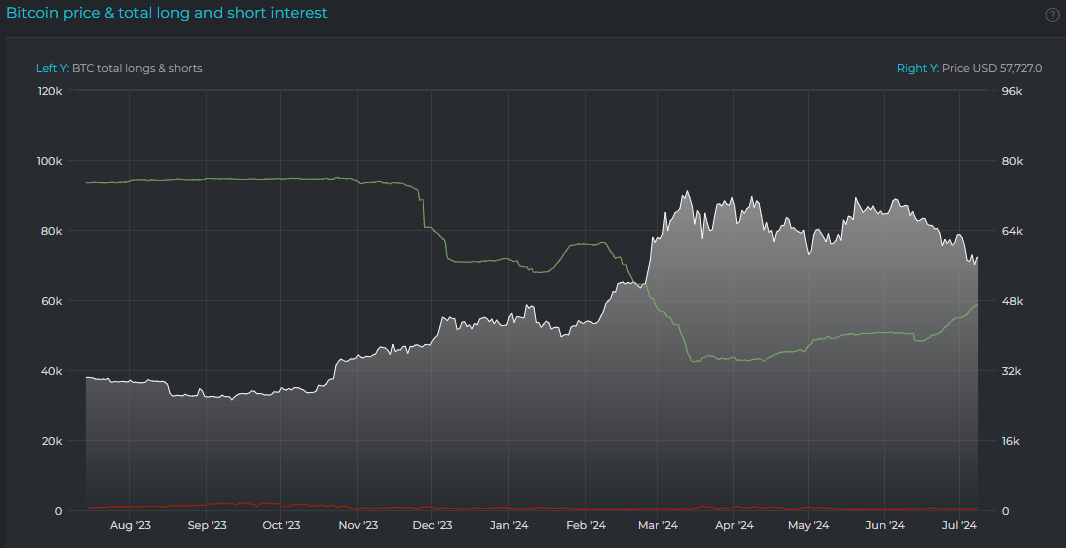

Bitcoin is still going through its consolidation phase of the cycle, stabilizing around the $57,000 mark. Notably, Bitfinex whales have significantly increased their long-margin positions, now holding 58,595 BTC. This marks an increase of 10,000 BTC since the low of 48,455 BTC on June 13, when Bitcoin’s price was $66,000. This level of long-margin holdings was last seen on March 1, when Bitcoin was climbing to its all-time high, and whales were strategically offloading BTC at the peak.

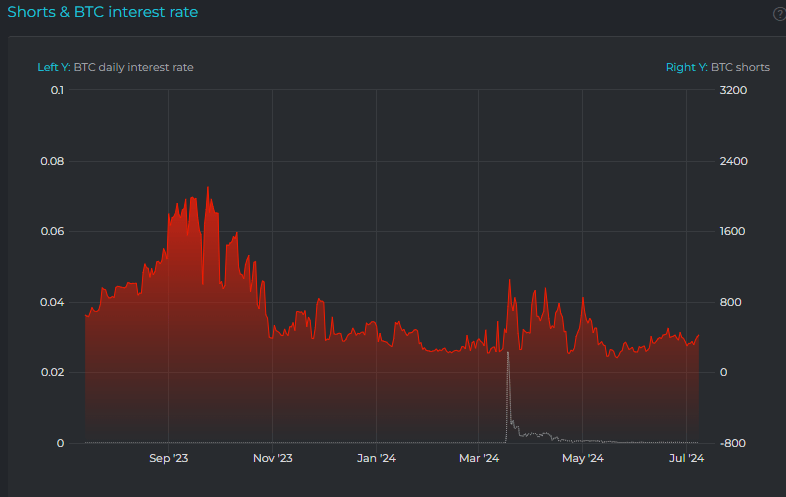

Meanwhile, short interest has slightly increased since the correction began on June 7. As of July 8, there are approximately 423 BTC on short interest margin, compared to 250 BTC on June 7. This slight increase in short interest suggests a cautious market sentiment, with traders still considering betting against Bitcoin during this correction phase.

Overall, the increase in long positions by Bitfinex whales suggests optimism about a potential rebound, while the slight rise in short interest margin indicates some traders are preparing for further downward pressure.

The post Bitfinex whales boost long positions by 10,000 BTC during Bitcoin correction appeared first on CryptoSlate.