Quick Take

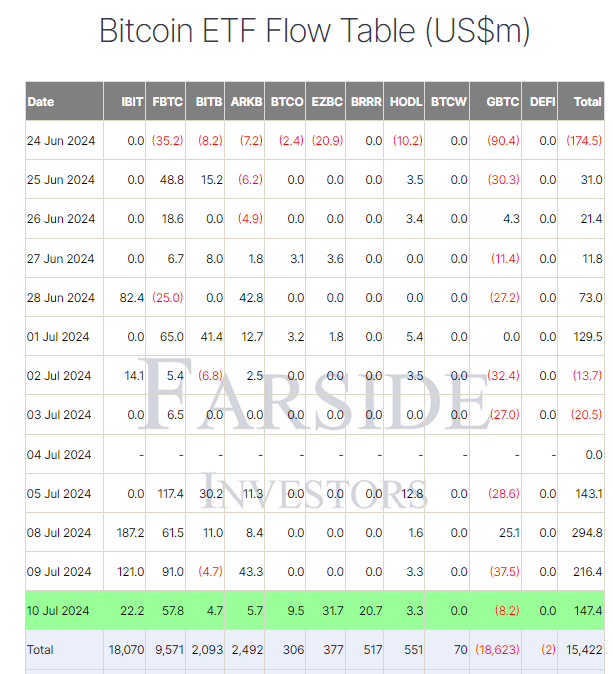

Bitcoin Exchange Traded Funds (ETFs) have continued their upward momentum, marking the fourth consecutive trading day of inflows. On July 10, these funds saw an inflow of $147.4 million, according to Farside data. This trend is noteworthy due to the broad participation, with eight out of ten ETF issuers experiencing inflows.

Farside data shows that leading the charge was Fidelity’s FBTC, which recorded a $57.8 million inflow, pushing its total net inflows to an impressive $9.6 billion. Following closely, Franklin Templeton’s EZBC ETF experienced its largest inflow since May 3, with $31.7 million, raising its total net inflows to $377 million. BlackRock’s IBIT also saw a healthy addition of $22.2 million, bringing its total net inflows to a staggering $18.1 billion. Meanwhile, the Valkyrie Bitcoin Fund BRRR received $20.7 million, taking its total net inflows to $517 million. Overall, the total inflow into Bitcoin ETFs now stands at $15.4 billion.

The post Bitcoin ETFs see strong inflows as eight out of ten issuers report gains appeared first on CryptoSlate.