Institutional investors have been buying the dip following Bitcoin’s recent downtrend. This is evident in the increased demand for the Spot Bitcoin ETFs, which recorded their best weekly outing in a long while.

Spot Bitcoin ETFs Record Best Inflows In Over A Month

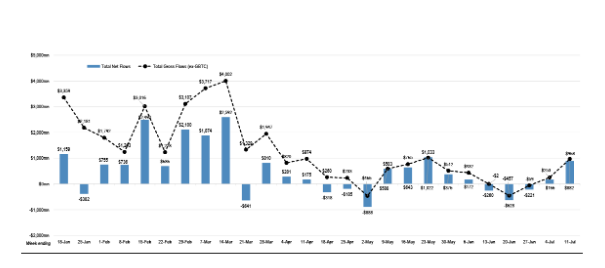

According to data from JPMorgan, the Spot Bitcoin ETFs witnessed their best inflows in over a month, with $882 million flowing into these funds in the week that ended July 11. This represents their best weekly inflow since May 23, when they recorded weekly net inflows of $1,022.

Interestingly, an addition of the $310.1 million net inflows that these Spot Bitcoin ETFs witnessed on June 12, according to data from Farside Investors, shows that this was their best weekly outing since March. The Friday tally means these funds took in almost $1.05 million this week.

Meanwhile, Friday’s total net flows of $310.1 million represent the best daily outing for these Spot Bitcoin ETFs since June 5. BlackRock’s IBIT and Fidelity’s FBTC accounted for most of the flows recorded on the day, with $120 million and $115.1 million flowing into these funds, respectively.

Bitwise’s BITB, Grayscale’s GBTC, Ark Invest’s ARKB, and VanEck’s HODL also recorded inflows of $28.4 million, $23 million, $13 million, and $6.6 million respectively. The other Spot Bitcoin ETFs failed to register any inflow on July 12.

According to data from Soso Value, these funds have now taken in total net inflows of $15.81 million since they were approved in January. This includes the $18.64 billion net outflows that Grayscale’s GBTC has recorded during this period. The net inflows that BlackRock’s IBIT ($18.26 billion) has taken in during this period have been able to plug the Grayscale bleed.

The other Spot Bitcoin ETF issuers have also played their part, with all these funds boasting net inflows. Fidelity’s FBTC is second behind IBIT, with total net outflows of $9.72 billion since launch. ARKB and BITB are third and fourth, with total net inflows of $2.5 billion and $2.13 billion, respectively.

Worst Is Almost Over For The Crypto Market

The crypto market has been in the red these past weeks thanks to the German government’s Bitcoin selling spree, which began last month. However, the worst looks to be almost over, as data from the on-chain analytics platform Arkham Intelligence shows that the German government has no Bitcoin left in its reserves.

Based on this and with the aid of the Spot Bitcoin ETFs, Bitcoin looks primed to recover and reclaim the $60,000 support. The Spot Ethereum ETFs are also expected to launch soon, with market experts like Bloomberg analyst James Seyffart predicting they could begin trading next week. This will provide more bullish momentum for Bitcoin and the broader crypto market.

Featured image from Pexels, chart from TradingView