Based on the latest forecasts from top industry analysts, the crypto market seems to be set for a wild ride over the next few months.

Crypto Volatility To Persist Through Q3

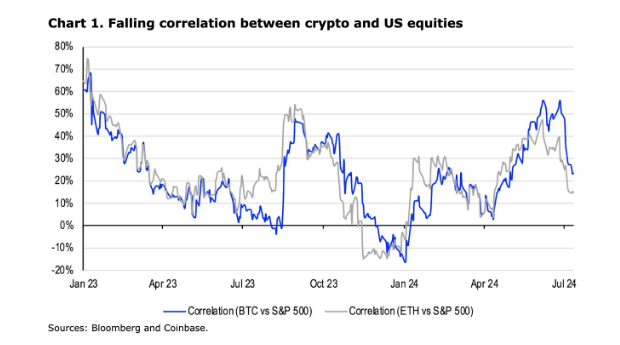

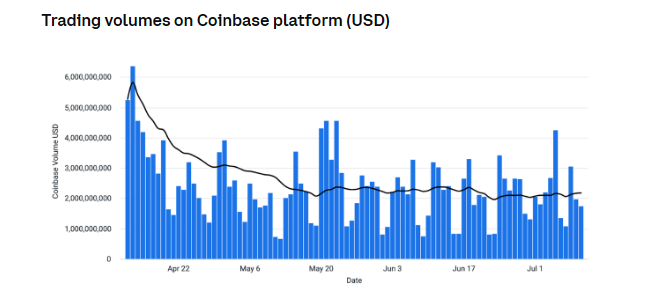

Driven by the expected introduction of spot Bitcoin ETFs, despite the positive trend of the crypto market earlier this year, the second and third quarters of 2024 have experienced notable headwinds. “The third quarter started on a sour note,” says Coinbase’s head of institutional research, David Duong.

The market has been much affected by supply overhangs created by indiscriminate Bitcoin selling from price-insensitive sources, notably the German government’s Bundeskriminalamt (BKA), the crypto exchange said.

As the market lacks compelling narratives, Duong and his colleague David Han, an analyst at Coinbase, predict the price movement to stay “choppy” throughout Q3 2024. “For now, we expect the price action to remain choppy in 3Q24, as crypto markets still lack strong narratives,” they said in a late Friday post.

As the analysts focus on the last quarter of the year, their perspective gets more optimistic.

Potential Q4 Rebound Driven By Macro Factors

Looking further to the fourth quarter, Duong observes, possible interest rate drops and the US election in November might have a major impact on the market. Although Coinbase cautions that if there are more general worries about an economic downturn, rate reduction may not always be positive; still, the analysts think that if the economy stays rather strong, the rate cuts could “unlock more liquidity and attract retail participation.”

Another wild card for the approaching US election in November is the possibility for fiscal expansion independent of the result. Regardless of the result of the election, fiscal expansion might help Bitcoin to be positioned as a solid buy at present levels, especially as an alternative to conventional finance, the experts propose.

JPMorgan Analysts Offer Similar Bullish Outlook

Though on a different timescale, experts at JPMorgan mirror Coinbase’s projection and also predict a possible comeback for the cryptocurrency market. Though with a different date, JPMorgan analysts had a similar optimistic view stating crypto markets may recover in August.

The Approval Of Spot ETFs Seen As A Positive

The latest legislative developments—the SEC allowing spot ETH ETFs and getting applications for SOL ETFs—offer one encouraging indication for the crypto sector. Although the experts are not sure about the whole effect on ETH prices, from a positioning standpoint they think the prognosis is unlikely to be bad.

This could leave room for surprise outperformance and offer ETH more support, even if the flows take time to materialize, the Coinbase analysts say.

Featured image from Norris Inc., chart from TradingView