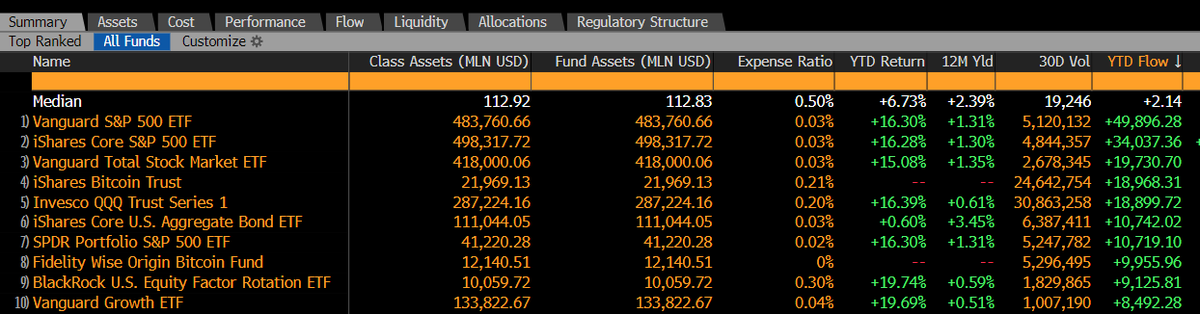

The recent performance of the iShares Bitcoin Trust (IBIT) has surpassed the Invesco QQQ Trust Series 1 (QQQ) in year-to-date net flows despite a significant difference in total assets.

Spencer Hakimian, Founder of Tolou Capital Management, shared data showing how IBIT has attracted $18,968.31 million in YTD flows, compared to QQQ’s $18,899.72 million. This is despite IBIT’s total assets of $21,969.13 million being dwarfed by QQQ’s $287,224.16 million.

The Invesco QQQ tracks the Nasdaq-100 Index, which comprises the 100 largest non-financial companies listed on the Nasdaq stock exchange based on market capitalization.

IBIT is now fourth in terms of ETF inflows this year, with Fidelity’s spot Bitcoin ETF (FBTC) in eighth place.

The trend highlights the intense demand for Bitcoin exposure through regulated ETF products. IBIT’s inflows are rapidly approaching those of the Vanguard Total Stock Market ETF, which has seen $19,730.70 million in YTD flows. The scale of IBIT’s inflows relative to its asset size is particularly noteworthy, marking an unprecedented level of investor interest in gaining Bitcoin exposure through traditional financial instruments.

The post BlackRock Bitcoin ETF surpasses Invesco QQQ Nasdaq fund in 2024 inflows appeared first on CryptoSlate.