Nine spot Ethereum ETFs commenced trading on the US stock market on Tuesday, marking a pivotal moment for the crypto industry following the Securities and Exchange Commission’s (SEC) green light on Monday.

Ethereum ETFs See $1B In Trading Volume On Debut

James Seyffart, a senior ETF analyst at Bloomberg, described the Monday ETF launch as a “pretty big success,” according to a Fortune report. However, the initial enthusiasm was tempered by a stark comparison to Bitcoin’s ETF debut earlier this year, which garnered $655 million in inflows on its first trading day.

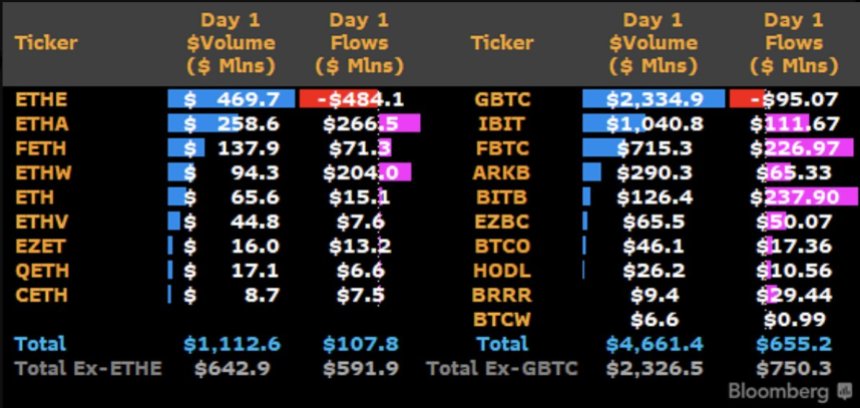

Diving into the specifics, the Ethereum ETFs collectively amassed $10.2 billion in assets, with trading volumes surpassing $1.1 billion on day one. Grayscale’s Ethereum Trust (ETHE) led the volume race with $469.7 million.

Among the key players, BlackRock led the charge with $266 million in inflows, followed closely by Bitwise with $204 million and Fidelity with $71 million.

Despite these figures, the ETFs collectively witnessed net inflows of $107 million, overshadowed by Grayscale’s Ethereum Trust’s outflows of $484 million, as per Bloomberg data.

However, the market response to the ETFs did not translate into a noticeable impact on Ethereum’s price, which experienced a marginal 0.8% decline since trading commenced.

Currently, the second largest cryptocurrency on the market is trading at $3,420, with a 27% decrease in trading volume in this area, amounting to $16 billion in the last 24 hours, and no significant changes to Tuesday’s price value per coin.

Bright Future Despite Challenges

Given that Ethereum’s market cap is a fraction of Bitcoin’s, the comparatively smaller inflows were somewhat to be expected. In addition, the Fortune report noted that the lack of a staking feature in the ETFs, which is prohibited by the SEC, also drove some investors to buy Ethereum directly, bypassing the new Ethereum ETFs mechanism.

Another strong reason for the outflows on the first day of the ETHE fund is Grayscale’s 2.5% fee compared to competitors charging 0.25% or less, a factor that is believed to have influenced investor behavior and contributed to ETHE’s outflows.

Despite the lack of market response, Seyffart remains optimistic about the reception of the Ethereum ETFs, citing the strong performance of “smaller players” such as 21 Shares’ Core Ethereum ETF, which attracted $8.7 million in inflows. Seyffart said to Fortune:

Very successful launch day by any standard ETF’s first day of trading. On top of this, the volume numbers were very strong.

Adding to the optimistic outlook for the Ethereum ETFs, it is noteworthy that Bitcoin (BTC) surged to an all-time high of $73,700 on March 14, just two months after the approved ETFs started trading.

Although ETFs investing in ETH’s price may not attract as much inflow and trading volume as BTC, this could lead to a sustained increase in ETH’s price in the long term.

Featured image from DALL-E, chart from TradingView.com