Quick Take

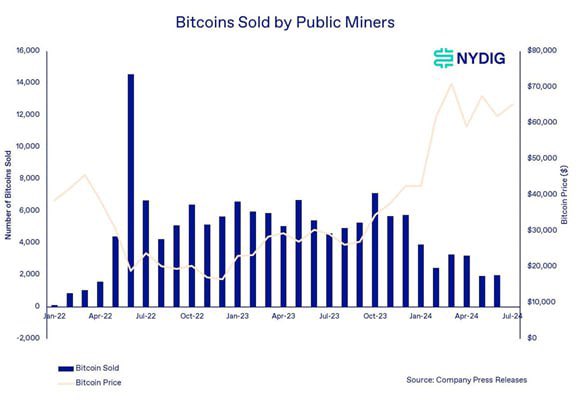

In a recent analysis shared by Kelly Greer, an analyst at Galaxy, data from NYDIG reveals a significant shift in the behavior of publicly traded Bitcoin miners over the past two years. The chart illustrates a notable decline in the amount of Bitcoin these miners sell, indicating a transition from net sellers to net buyers. According to Greer:

“Public BTC miners flipped from net sellers to net buyers in July,” highlighting a critical trend in the industry.

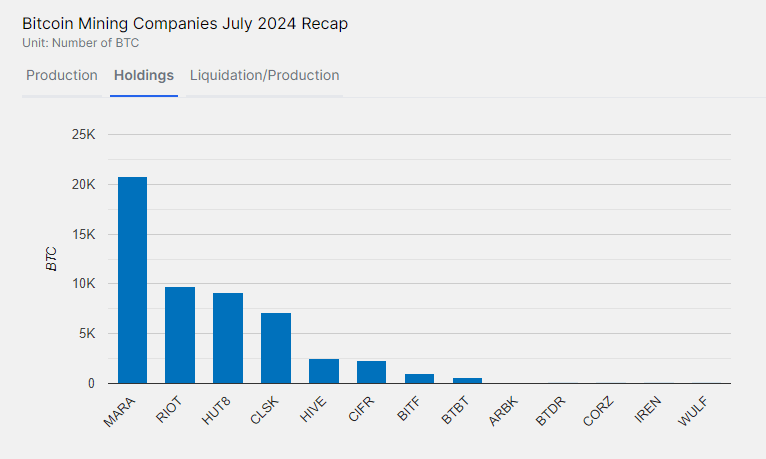

Companies like Marathon Digital Holdings (MARA) have notably increased their Bitcoin holdings, surpassing 20,000 BTC, according to the minermag.

Although public miners as a group may not yet be significant net buyers, the reduction in sell pressure is a positive development for the market. Publicly traded miners now control a substantial portion of the Bitcoin network’s hash rate, a trend expected to continue as larger players consolidate their dominance.

The potential for these miners to shift strategies suggests they should consider retaining more of their mined Bitcoin on their balance sheets, such as IREN. Such a move would further reduce market sell pressure, potentially supporting Bitcoin’s price stability in the long term.

The post Publicly traded Bitcoin miners decrease sell-offs appeared first on CryptoSlate.