Solana (SOL) is facing serious selling pressure after a 35% correction from local highs set last Saturday. Following weeks of massive volatility and corrections, SOL is now trading above a crucial support level—a monthly liquidity zone that could be key to its future price action. If this support holds, it could send SOL toward new all-time highs, offering a potential reversal in the current bearish trend.

Analysts and investors are closely watching price movements, with many noting that the next few days will be crucial in determining Solana’s direction. The market’s response to this support level will likely dictate SOL’s performance in the short term, making it a pivotal moment for traders and investors alike.

Solana Testing Monthly Demand For Support

Solana (SOL) is currently trading above a crucial support level around $128. This support is particularly significant as SOL has demonstrated resilience by holding above it despite recent volatility and market uncertainty. In contrast to the pervasive negative sentiment surrounding other altcoins, the sentiment around Solana remains relatively positive among traders and investors.

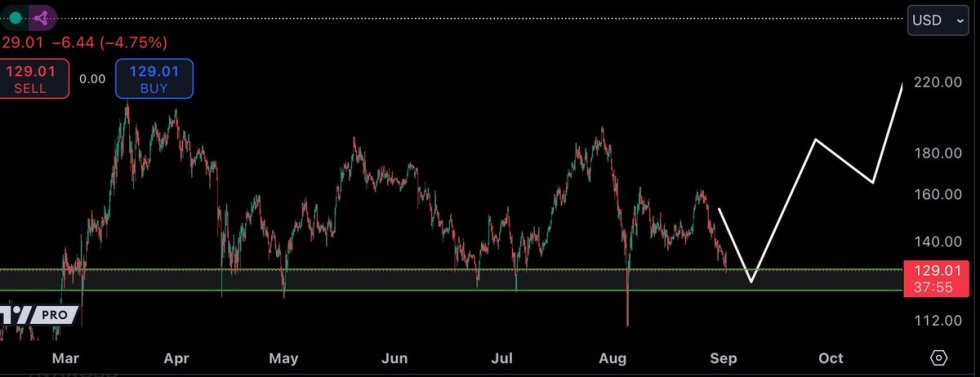

Notably, top analyst and trader Kaleo has provided a technical analysis on X, forecasting a potential decline from last week’s local high to the $120-$128 range before a possible surge to new all-time highs.

This analysis aligns well with recent price action, as SOL tested the $127 support and managed to stay above it, indicating strength in the face of market turbulence.

As the broader market seeks direction and begins to consolidate, investor interest in Solana is increasing. Market participants should closely monitor Solana’s price movements around this key support level. Maintaining this support could set the stage for a significant rally if SOL can leverage this technical base to push toward new highs. With the market’s sentiment bifurcated, Solana’s ability to hold above the $128 support while other altcoins struggle highlights its potential for growth in the coming days.

SOL Price Action

Solana (SOL) is currently trading at $131.95 after a brief dip below $130. For a short-term recovery, SOL needs to reclaim the $140 level. Achieving this would allow it to target the 4-hour 200 exponential moving average (EMA) at $147.78. Reclaiming and holding above this EMA could provide a solid foundation to shift the negative price action and drive SOL to higher levels, potentially setting the stage for a more substantial upward move.

Conversely, if SOL fails to maintain the $127 support level, the next significant liquidity level to watch would be around $110. This would represent a 16% correction from current prices, highlighting a potential downside risk. Losing this support could trigger a more substantial decline, emphasizing the need for SOL to hold above the $127 level to avoid further losses.

As the market fluctuates, investors should keep a close eye on these key price levels. Monitoring how SOL interacts with the $127 support and the $140 resistance will be crucial in determining the short-term trajectory of the price. This careful observation will help gauge whether SOL can reverse its current trend or face further challenges.

Featured image from Dall-E, chart from TradingView