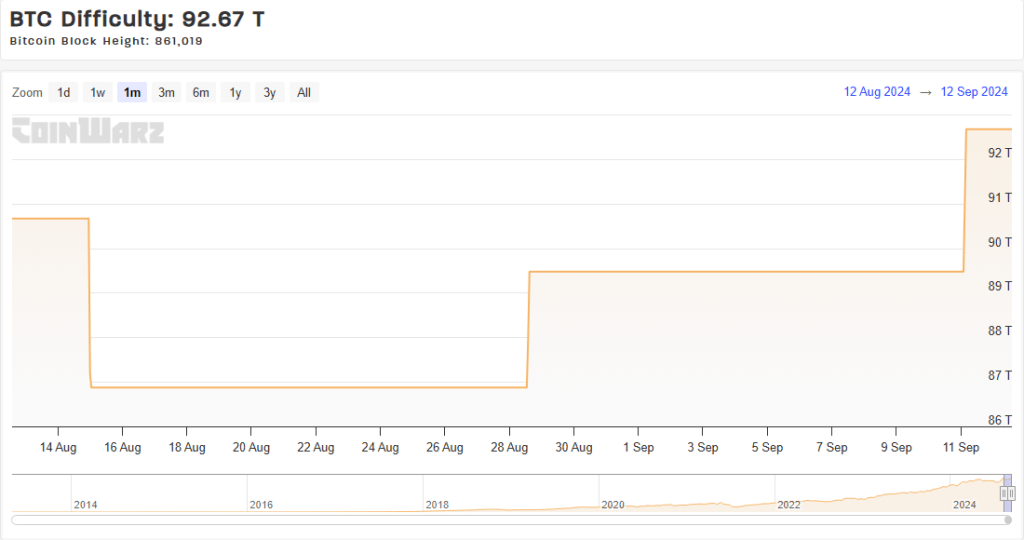

The difficulty in mining Bitcoin has surged to a new record level, hence squeezing profit margins. Reaching 92.67 trillion, the difficulty index exceeded the previous record peak of 90.67 trillion set in July this year.

This 3.6% rise represents the increased competitiveness resulting from record-breaking hashrate values. It emphasizes how resilient and secure the network is becoming since mining Bitcoin calls for more computational capability.

Miners Liquidating Their Bitcoin Holdings

Interestingly, since September 8, miners have sold almost 30,000 Bitcoin, worth around $1.71 billion. This significant sell-off points to possible problems with liquidity or worries about future price movements among miners.

The added difficulty comes at a trying time for miners, still adapting to the repercussions of April’s “halving,” a programmed decrease in mining rewards that has already halved possible profits since then, helping to explain a rough 10% decline in the price of Bitcoin.

Miner Secures Block Reward Alone

Despite the difficulties, a single miner obtained a block reward of around $180,000. This uncommon success underlines how much individual miners may still produce in spite of growing challenges.

NEWS: Solo #Bitcoin miner wins a $180K (3.169 $BTC) reward after successfully mining block 860749. pic.twitter.com/KrBDOw99ue

— CoinGecko (@coingecko) September 11, 2024

The growing difficulty hasn’t discouraged miners from improving their operations, either. September saw an all-time high in Bitcoin’s hashrate, which gauges the overall computing capacity sustaining the network. This implies that in the near future miners will be betting on a big price rise.

Effect On Miners Listed Publicly

The rise in mining complexity has heightened competitiveness and strained profit margins for publicly traded bitcoin miners. These difficulties have led major mining corporations to disclose notable declines in their stock prices and production rates.

This year, shares of Marathon Digital Inc. are off 31%, while Riot Platform’s fell 54%. The stock performances of a number of widely traded mining companies reflect the overall difficulties of the crypto mining industry.

The effects on Bitcoin’s price are yet unknown, with possible consequences for long-term network security as well as transient price swings. While some worry that the significant volume of BTC being sold by miners could set off selling pressure and a possible decline in Bitcoin’s price, others consider the rise in mining difficulty as a good indication for the security of the network and investor trust.

Therefore, every investor should track these developments to assist one in making a wise choice about financial strategy. Reflecting the uncertainties about the present market conditions, the optimistic attitudes of the Bitcoin community have also plummeted to 21% out of 51,341 respondents surveyed.

Featured image from Bankless, chart from TradingView