Large investors seem to be upping their ante; at least, that’s the story of Bitcoin and its latest rebound to over $63,000 today. And market watchers have indeed taken notice. On the inside, however, is key on-chain data that suggests Bitcoin whale accumulation and the reactivation of dormant wallets may be signs for a super price spike ahead.

Ki Young Ju, founder of CryptoQuant, pointed to a rise in Bitcoin flowing into custody wallets, typically used by institutional players for safe, long-term storage. Such an increase indicates that big players position themselves to make what they believe could be another major price move.

Whales are accumulating #Bitcoin.

Six days of accumulation alerts in a row. Primarily from custody wallet inflows.

Nothing has changed for Bitcoin; we’re in the middle of the bull cycle. pic.twitter.com/DE0A1Khhus

— Ki Young Ju (@ki_young_ju) September 18, 2024

Dormant Wallets Spring Back To Life

The trend in past months has been the revival of dormant Bitcoin wallets. For instance, 203 BTC, valued at $12.18 million, were transferred from wallets that were inactive for more than a year to Binance, earning a whale $6.89 million in profit.

The second wallet has been unused for over a decade, with 146 BTC inside. That would total to $8.09 million today. In 2013, it would have only sold for $80,257, which is an astonishing 9,985% rise.

Whale Accumulation Signals Long-Term Optimism

The accumulation pattern follows the recent Bitcoin price rallies and fuels speculations that whales are waiting for the prices to scale even higher. Ju’s analytical insights raise the notion that institutional investors are not losing faith in Bitcoin’s future even with the volatility since March 2024.

The price of bitcoin has risen from a starting point in September at $58,909 to $59,530. Although it did fall briefly on Sept. 6 to the lowest level at $53,940, the strong pressure of whales and institutions buying it pushed the price up.

More Gains Expected: Technical Indicators

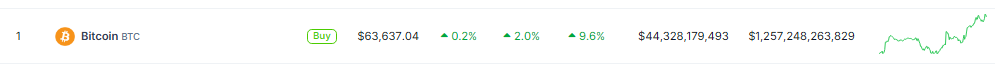

The price for Bitcoin to $63,637 has now indicated impressive potential to push upwards, backed by the technical factors. The near future crossover between the 50-day and the 200-day Exponential Moving Averages point to a more positive trajectory.

Also, the RSI currently stands at 46.79, which is still not over the overbought value, meaning that there is a good amount of room left for the price to rise without the market getting too extended.

Inactive Wallets Stir Market Volatility

A stabilization of Bitcoin’s price above the key 0.5 Fibonacci retracement level at $57,688.42 gives excellent support to the bullish sentiment.

Activation of dormant wallets could also stir the market’s volatility due to a reaction from the increased supply. Crypto asset management firm Ceffu transferred massive Bitcoins and Ethereums to Binance recently, generating speculations about long-term holders selling pressures.

Featured image from Pexels, chart from TradingView