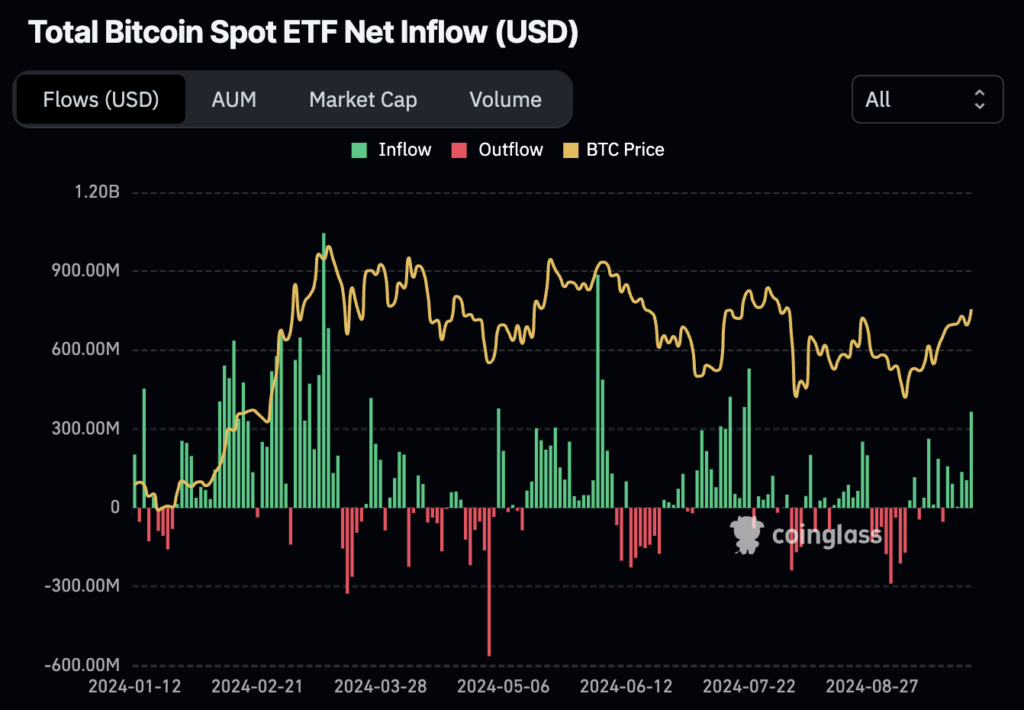

On Sept. 26, Bitcoin ETFs recorded substantial inflows totaling $365.7 million, marking the highest single-day inflow since July 22, when $530 million entered the market.

According to Farside data, Ark’s ARKB ETF led with $113.8 million, marking a significant shift after recent outflows seen earlier this month. BlackRock’s IBIT ETF added $93.4 million, while Fidelity’s FBTC ETF reported inflows of $74 million. Bitwise’s BITB ETF also saw strong participation with $50.4 million, and VanEck’s HODL ETF contributed $22.1 million. Invesco’s BTCO and Franklin’s EZBC reported smaller additions of $6.5 million and $5.7 million, respectively. Grayscale’s GBTC continued its trend of outflows, losing $7.7 million, while its smaller BTC ETF gained $2.9 million.

Ethereum ETFs experienced net outflows of $0.1 million, continuing the recent trend of mixed investor sentiment in the Ethereum space. Grayscale’s ETHE fund saw the most significant movement with outflows of $36 million, contrasting with BlackRock’s ETHA and Fidelity’s FETH, which brought in $15.3 million and $15.9 million, respectively. Inflows were also recorded for Bitwise’s ETHW, Invesco’s QETH, and 21Shares’ CETH, albeit in smaller amounts. Other funds, including those from VanEck and Franklin, remained relatively flat.

The contrasting flows highlight evolving trends. Bitcoin ETFs attract substantial inflows across major funds, mainly driven by Ark and BlackRock, while Ethereum ETFs face continued outflows, primarily from Grayscale. The flows coincided with Bitcoin also breaking $65k for the first time since August.

The post Spot Bitcoin ETFs record best day since July with $365 million inflow appeared first on CryptoSlate.