The Japanese financial regulator is preparing to review cryptocurrency regulations, potentially lowering crypto taxes and paving the way for a digital assets exchange-traded fund (ETF).

Crypto Review In Japan The Need Of The Hour

Speaking with Bloomberg on the condition of anonymity, an official at Japan’s Financial Services Agency (FSA) said that in the coming months, the agency will conduct a comprehensive review of existing crypto regulations.

The review’s primary focus will be to determine whether the current method of regulating digital assets under the Payments Act is adequate.

Specifically, the FSA will assess if the act provides sufficient investor protection. The source added that digital assets are used primarily for investing and speculation rather than as a medium of exchange.

One potential option is reclassifying tokens as financial instruments under Japan’s investment law. Commenting on this development, Yuya Hasegawa, a market analyst at the crypto exchange bitbank Inc., said:

Reclassifying digital assets via the Financial Instruments and Exchange Act would strengthen investor safeguards and usher in other dramatic changes.

Referring to these “dramatic changes,” Hasegawa added that such a regulatory shift could reduce tax rates on crypto gains from 55% to 20% – aligning them with taxes on assets such as stocks and other similar financial instruments.

Additionally, this reclassification could clear the path for launching token-based ETFs, further integrating digital assets into Japan’s financial economy.

Japan Keen On Regulating Crypto Despite Past Challenges

Japan’s cautious approach to regulating digital currencies is not surprising, given its history involving Mt. Gox, a now-defunct Tokyo-based crypto exchange hacked in 2014. In May 2024, Japanese exchange DMM Bitcoin fell victim to a similar hack, losing $305 million worth of digital assets.

Despite these mishaps, the Japanese regulator has made it abundantly clear over the years that it does not intend to “excessively” regulate cryptocurrencies – a starkly contrasting approach from neighboring China’s strict crypto laws.

A recent survey found that most institutional investors in Japan are ready to venture into the digital assets space within the next three years. However, crypto executives see further room for less stringent laws that would help reduce operational costs and boost growth.

Earlier this year, the Japanese government implemented a policy change allowing venture capital and other investment firms to hold digital assets directly.

Crypto trading in Japan is witnessing a resurgence after a prolonged decline since 2022. Average monthly volumes through August 2024 in Japanese centralized exchanges have jumped to almost $10 billion, compared to $6.2 billion in 2023.

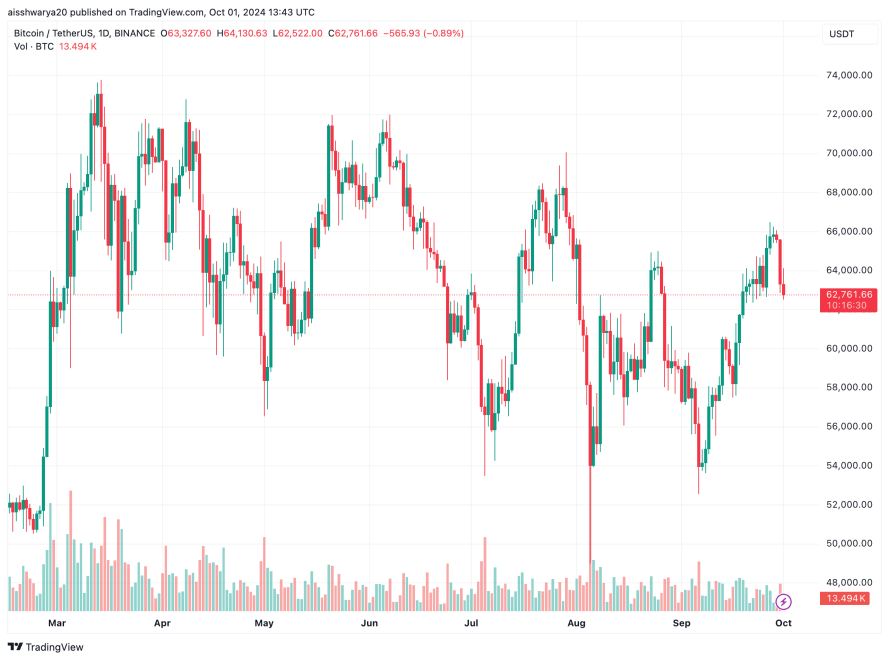

Most recently, Japanese publicly traded company Metaplanet Inc. made headlines when it disclosed that it had added Bitcoin (BTC) to its balance sheet. BTC trades at $62,761 at press time, down 2.1% in the past 24 hours.