The post POPCAT Rally at Risk, Will Price drops to $1.4? appeared first on Coinpedia Fintech News

With impressive performance, the popular Solana-based meme coin, Popcat (POPCAT) has been making waves in the cryptocurrency industry. However, despite its strong performance over the past 30 days, the current price action appears bearish and indicates a potential price reversal.

POPCAT Technical Analysis and Upcoming Levels

According to expert technical analysis, POPCAT has been moving within a bullish channel pattern while making higher highs and higher lows. Following the recent price rally, the meme coin has reached the upper boundary of the channel, where it has historically experienced price reversals.

Since the beginning of October 2024, POPCAT has reached this level multiple times, experiencing notable selling pressure and price declines each time. A similar price action has emerged again.

Based on historical price momentum, if the POPCAT price remains below the $1.755 level, there is a strong possibility that it could decline by 18%, reaching the $1.4 level in the coming days.

The thesis of POPCAT’s price decline will hold only if its price remains below the $1.755 level, otherwise, it may fail.

Bullish On-Chain Metrics

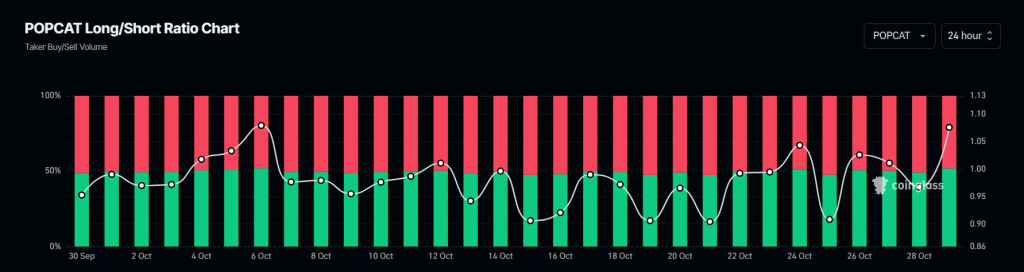

Despite the negative price action, POPCAT’s on-chain metrics indicate a bullish outlook. According to the on-chain analytics firm Coinglass, POPCAT’s Long/Short ratio currently stands at 1.076, reflecting strong bullish sentiment among traders.

Furthermore, its open interest has surged by 23% over the past 24 hours, signaling growing trader interest and the buildup of new positions.

Traders and investors often view rising open interest and a Long/Short ratio above 1 as favorable when building long positions. Currently, 52% of top traders hold long positions, while 48% hold short positions.

Current Price Momentum

At press time, POPCAT is trading near $1.72 and has experienced a price surge of over 14% in the past 24 hours. During the same period, its trading volume jumped by 26%, indicating heightened participation from traders and investors amid bullish market sentiment.