A prominent crypto analyst said that Bitcoin went through a significant event over the past few months as the coin’s open interest plummeted by nearly 20%, wiping out around $12 billion.

BTC’s open interest wipeout might appear to be detrimental to the coin, but CryptoQuant analyst DarkFost believes that the cleansing is essential for a “bullish continuation”, citing that it may provide opportunities for its investors in the near term if history repeats itself.

Bitcoin’s nearly $12 billion open interest shakeout earlier this month might be just the catalyst needed for the asset to regain its upward momentum, according to a crypto analyst.

A Catalyst

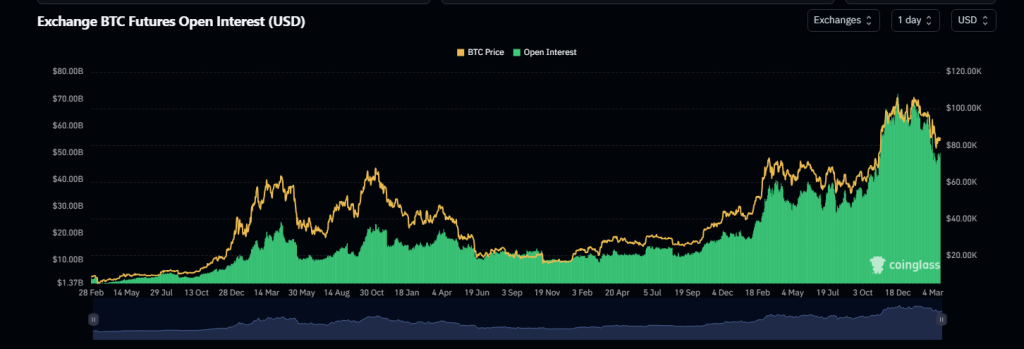

Data from CoinGlass shows that the firstborn crypto’s open interest dropped by 19%, from $61.42 billion to $49.71 billion, citing that the $12-billion shakeout might be a good thing for Bitcoin.

“Following the recent panic triggered by political instability linked to Trump’s decisions, we witnessed a massive liquidation of leveraged positions on Bitcoin,” DarkFost said.

The analyst said more than $10 billion in open interest has been erased in only two months, with an estimated $10 billion wiped out between February 20 and March 4.

DarkFost claimed that the wipeout experienced by BTC earlier this month could serve as the catalyst needed by the coin to regain the momentum that will allow the crypto to move upward.

“This can be considered as a natural market reset, an essential phase for sustaining a bullish continuation,” the analyst explained.

Good Opportunities

DarkFost suggested that the recent ordeal faced by Bitcoin might prove to be advantageous to the crypto in the next few months.

The analyst provided a chart that shows the reset phases by determining the moments when the 90-day open interest change turns negative, adding that the current 90-day change in Bitcoin futures open interest plummeted and is now sitting at -14%.

“Looking at historical trends, each past deleveraging like this has provided good opportunities for the short to medium term,” the analyst added.

Influence Of The Federal Reserve

Some experts said that the Federal Reserve’s actions might have an impact on what will happen next to Bitcoin.

Today’s meeting of the Federal Open Market Committee could add more volatility to the crypto if there is something unexpected in the monetary policy.

Bitget chief analyst Ryan Lee explained that Bitcoin is already hovering at the $80,000 level and more volatility might be expected in the coin’s price and open interest if the March 19 Federal Open Market Committee meeting delivers any surprises.

“The market largely expects the Fed to hold rates steady, but any unexpected hawkish signals could put pressure on Bitcoin and other risk assets,” Lee said.

As of press time, Bitcoin’s open interest stood at $49.02 billion, which is approximately a 6.5% increase over the past five days.

Featured image from The Independent, chart from TradingView