Global venture capital firms are pouring money into the semiconductor startups developing the next generation of chips. Semiconductors, which have become a valued asset, are used in virtually almost every industry, including 5G networks, automation, the internet of things, financials, smart homes, smart cities, virtual reality (VR), augmented reality, and self-driving cars.

Sunghyun Park, a former quant developer at Morgan Stanley in New York, launched artificial intelligence semiconductor startup Rebellions with four co-founders to enter this red-hot industry in 2020. Today, the South Korea-based company that builds chips designed for artificial intelligence applications, announced it has raised a $50 million (62 billion KRW) Series A from investors including Temasek’s Pavilion Capital, Korean Development Bank, SV Investment, Mirae Asset Capital, Mirae Asset Ventures, IMM Investment, KB Investment and KT Investment.

Its existing backers Kakao Ventures, GU Equity Partners, and Seoul Techno Holdings, also participated in the round, Park told TechCrunch.

The Series A, which was oversubscribed – the firm initially targeted around $40 million – and wrapped up in less than three months, brings Rebellions’ total funding raised to about $80 million (100 billion KRW) at an estimated valuation of $283 million (325 billion KRW), CEO of Rebellions Park said in an interview with TechCrunch.

The startup will use the capital to mass-produce its second AI chip prototype, called ATOM, which will be used in enterprise servers, Park said. Additionally, the funding will be used to double its headcount to 100 employees, and set up an office in the U.S. by the end of this year, Park continued.

Rebellions is in talks with potential customers to get its first AI Chip, called ION, into the market. The company’s ION customers could include global investment banks, and its second chip ATOM targets large companies in the cloud sector and data centers, Park added. It has lined up Taiwan Semiconductor Manufacturing Company (TSMC) to begin manufacturing the ION chips as early as next year.

The company claims that its first chip ION, released in November 2021, improves trading speeds and reduces latencies and is two times faster than Intel Habana Labs’ AI Chip Goya in terms of execution. That means Rebellions’ ION enables faster data execution, so that lead orders can be processed more quickly and profitably than traders with slower execution speeds. High-frequency trading (HFT), or systematic trading, is an automated trading platform used by large investment banks, hedge funds and institutional investors to transact a large number of orders.

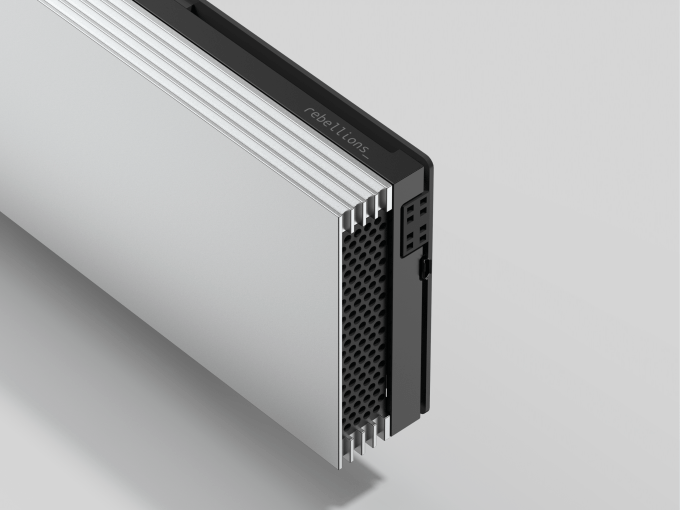

Image Credits: Rebellions’ AI chip ION

Park had previously helped design a Starlink ASICs chip at Space X, and worked as an engineer at Intel Labs and Samsung Electronics.

There are more than 50 AI chip makers in the world including Samba Nova, Graphcore, Groq and Cerebras looking to challenge AI processors from Nvidia, Intel and Qualcomm, according to Gartner analyst Alan Priestley. Intel acquired Israeli AI chipmaker Habana Labs for about $2 billion in 2019 while Qualcomm picked up Nuvia for approximately $1.4 billion in early 2021. The AI chip market is projected to be worth over $83.2 billion by 2027, up from $56 billion in 2018, per a 2019 report by Insight Partners.

Venture capital funding for global chip startups more than tripled year over year in 2021, with $9.9 billion invested across 170 deals, per PitchBook.