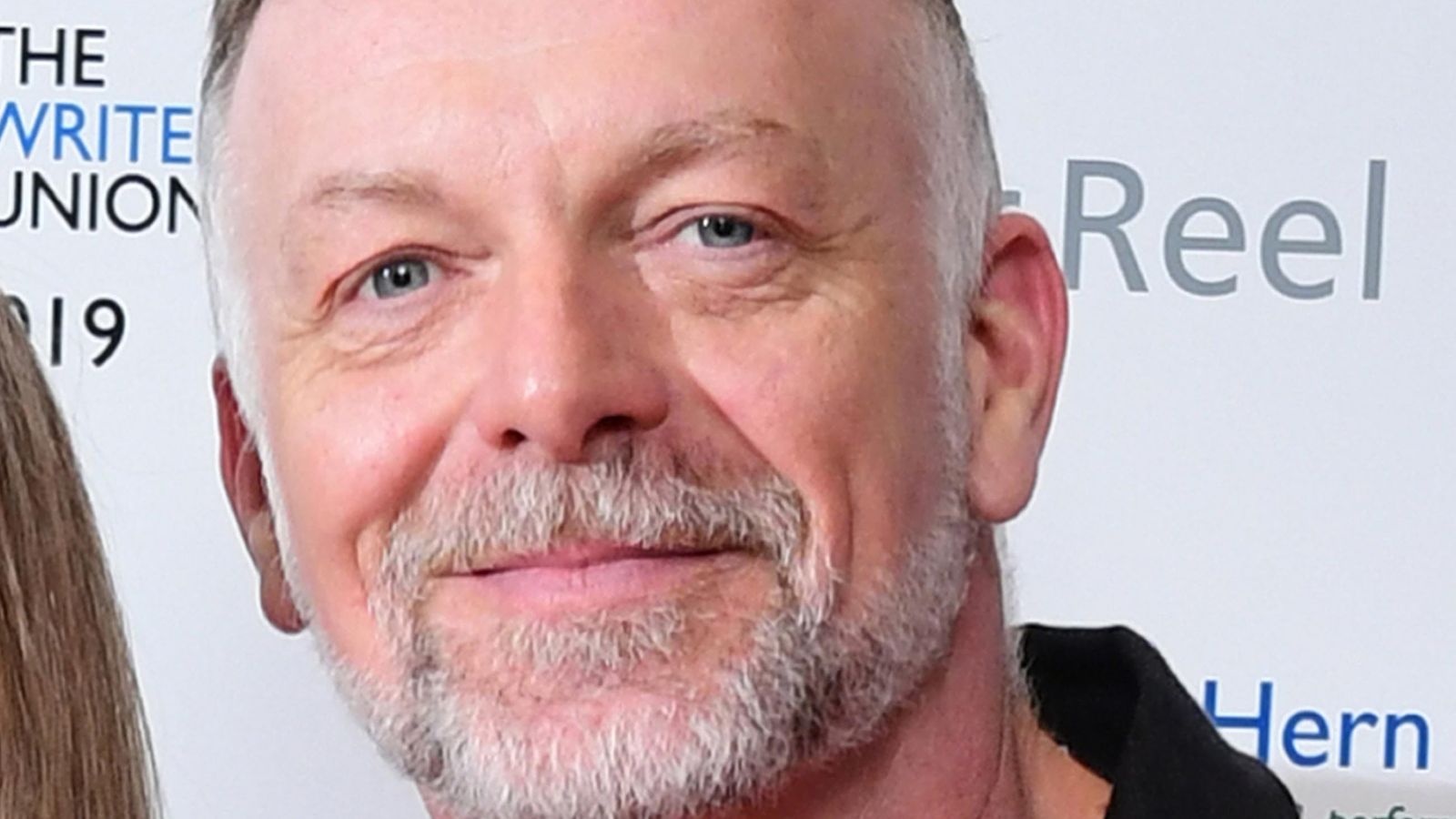

The founder of Solend, Rooter, revealed to CryptoSlate what happened behind the scenes while the crypto looked on as it voted to take control of a user’s account in order to liquidate its funds OTC. Ultimately, the decision was reversed, and Solend could work with the whale to reduce his position via other means.

In the following interview, Rooter spoke candidly about the “sleepless nights” and genuine fears that the Solana network could not handle the whale liquidation. We discussed how the decision was made to take over the whale’s account, its motivation, how the issue was created in the first place, and how Solend plans to make sure the situation never happens again.

Interestingly Rooter claimed that users with something to lose from the liquidation event were in support of the DAO proposal, and it was people with “nothing to lose’ that were most vocal. Those with nothing to lose were from the wider DeFi community, who viewed the DAOs proposal as going against the core tenants of decentralized finance.

However, Rooter pointed out that the liquidation bots that would handle the liquidation were not set up to handle such large DEX transactions. While the DAOs decision may not have been ideal, it could have been the only option available for a DeFi protocol missing the tools to stop a major issue on the horizon. Read the interview below to discover why Solend believed the liquidation event could have seriously affected the entire Solana network.

The post Solend founder reveals what happened behind the scenes during its whale liquidation event appeared first on CryptoSlate.