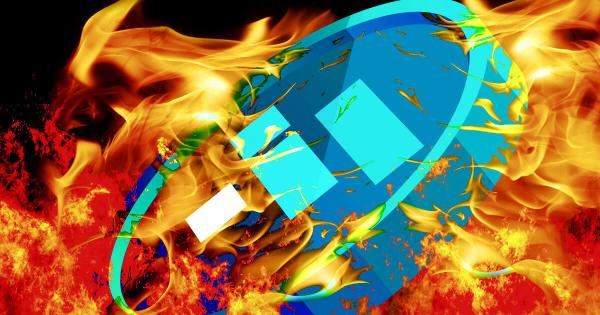

Crypto exchange Huobi said DebtDAO would burn 18 million FTX User Debt (FUD) tokens later today because it rallied to a much higher value than the recommended price, according to a Feb. 7 statement.

Debt DAO previously issued 20 million FUD tokens valued at $1 each, representing around $100 million owed to FTX creditors.

However, the token surged to around $115 on Feb. 5, forcing the DAO to consider burning the majority of the token’s supply to bring the debt valuation to its “fair value.”

The token has declined by over 10% and was trading for $69.80 as of press time, according to CoinMarketCap data.

Huobi said:

“After the destruction, the total issue will become 2 million FUDs and change from the initial 1 FUD=1 USD equivalent claim to 1 FUD=10 USD equivalent claim with an additional early bird airdrop value, and the recommended price of FUD will fluctuate between 0<1 FUD≤50 USDT after the destruction.”

The exchange added that “holders of the FUD token do not do not need to do anything, and the value of tokens holding FUD will appreciate ten times.”

DebtDAO previously said it would create more tokens that would be distributed through airdrops to FUD holders when FTX confirms the actual debt.

Meanwhile, the crypto community remains wary of the high-flying crypto token. DebtDAO has no website, and its official Twitter account was created earlier this month. Community members have also pointed out that the Tron-based token has no connection to the bankrupt crypto exchange FTX.

The post FTX User Debt (FUD) tokens decline 10% as 18M burn becomes imminent appeared first on CryptoSlate.