A new clearing bank which launched just two years ago is among the suitors this weekend weighing bids to salvage the British arm of Silicon Valley Bank (SVB).

Sky News has learnt that The Bank of London (TBOL), which recently raised funds at a valuation of over $1bn, is considering making an offer for SVB UK.

News of its interest comes hours after the Bank of England said it planned to use a bank insolvency procedure to take control of the British operation, which counts thousands of UK start-ups among its clients.

It was unclear this weekend how credible an offer might be from The Bank of London given its own fledgling status.

One source said it had appointed the investment bank Perella Weinberg Partners to advise it on its interest in SVB UK.

The Bank of London’s new finance chief, Gavin Hewitt, was previously at SVB UK, which could offer an advantage in any attempt to acquire the business rapidly.

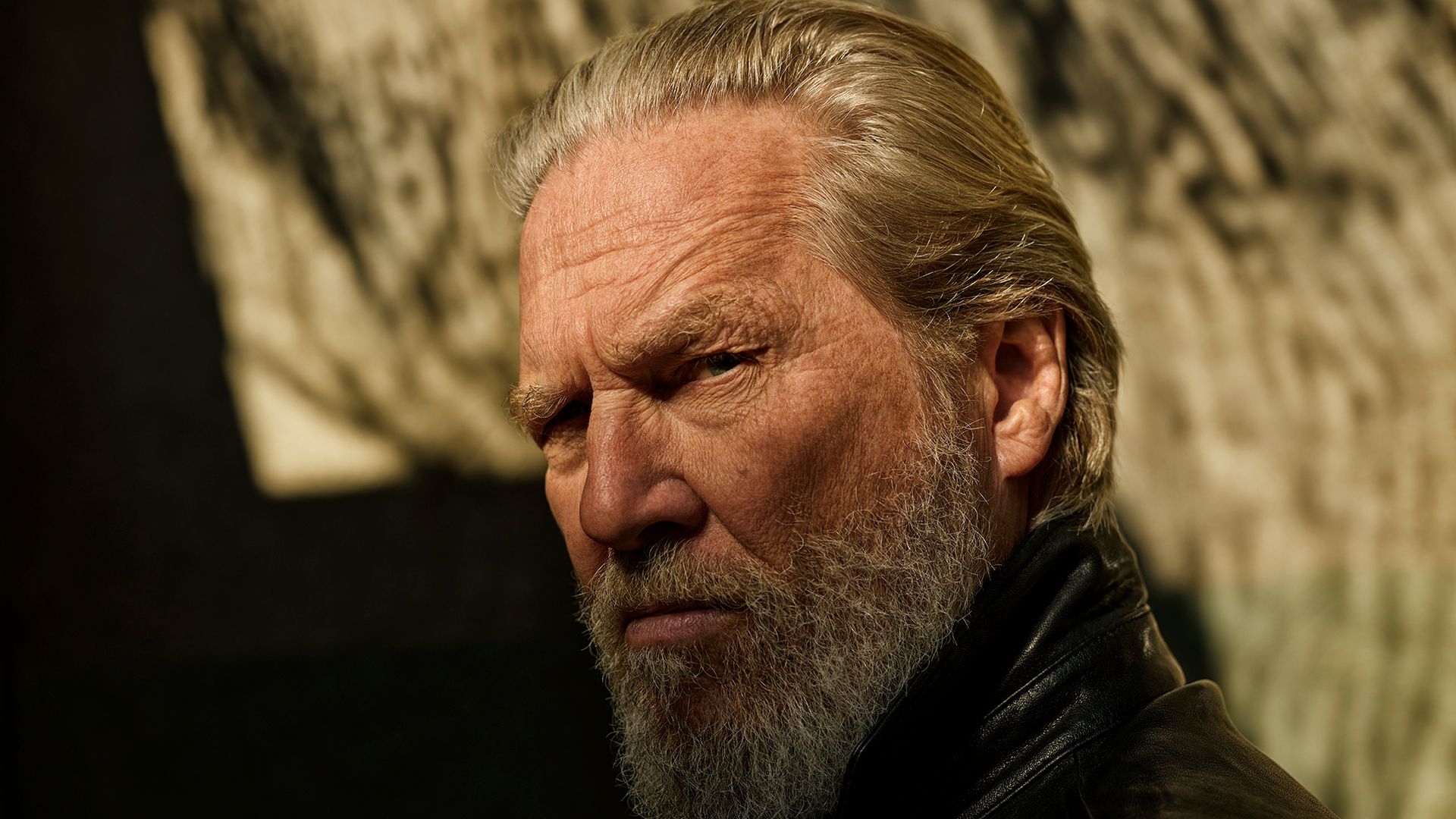

The Bank of London is chaired by Harvey Schwartz, the new chief executive of Carlyle Group, the giant American private equity firm, and City insiders speculated that Carlyle could also become involved in an offer.

Thames Water braced for crunch talks over £14bn debt-pile

Growth pains: Ahead of Jeremy Hunt’s first budget, we ask what’s holding the British economy back?

Grant Thornton UK partners to vote on Indian investment

Sources close to Carlyle, however, sought to play down any suggestion that it would be interested in participating in a takeover of SVB UK.

The implosion of SVB’s US-listed parent company, which has been taken into government control, represents one of the biggest banking collapses since the financial crisis of 2008.

UK depositors stand to receive up to £85,000 as part of the resolution of the British arm of SVB, sparking fears about the fate of substantial amounts of funding in the start-up community.

On Saturday, dozens of early-stage companies were writing to Jeremy Hunt, the chancellor, to warn of “an existential threat to the UK tech sector”.

In a draft letter seen by Sky News, founders including those from Adzuna, Signal AI, JustPark and Thriva called on Mr Hunt to intervene.

“The majority of the most exciting and dynamic tech businesses bank with SVB and have no or limited diversity in where their deposits are held,” the draft letter said.

“This weekend the majority of us as tech founders are running numbers to see if we are potentially technically insolvent.

“The impact of this is far greater than our individual businesses.

“The Bank of England’s assessment that SVB going into administration would have limited impact on the UK economy displays a dangerous lack of understanding of the sector and the role it plays in the wider economy, both today and in the future.”

The founders warned Mr Hunt, who will deliver his Budget statement on Wednesday, that the collapse of SVB UK would “cripple the sector and set the ecosystem back 20 years”.

“Many businesses will be sent into involuntary liquidation overnight,” they wrote.

“Many other businesses, both in the tech sector and the wider economy – the customers and suppliers of these businesses – will be negatively impacted by these businesses going bankrupt.”

Mr Hunt and Treasury officials were being kept informed on Saturday about the preparations for SVB UK’s resolution.

Interpath Advisory is being lined up to handle the insolvency process in the UK.

A spokesman for The Bank of London said on Saturday: “The Bank of London does not comment on market speculation.”