On-chain data suggests the $28,700 mark, which Bitcoin has yet to hit since the LUNA collapse, could be the next major obstacle to clear for the asset.

Bitcoin Has Been Under The $28,700 Level For 310 Days Now

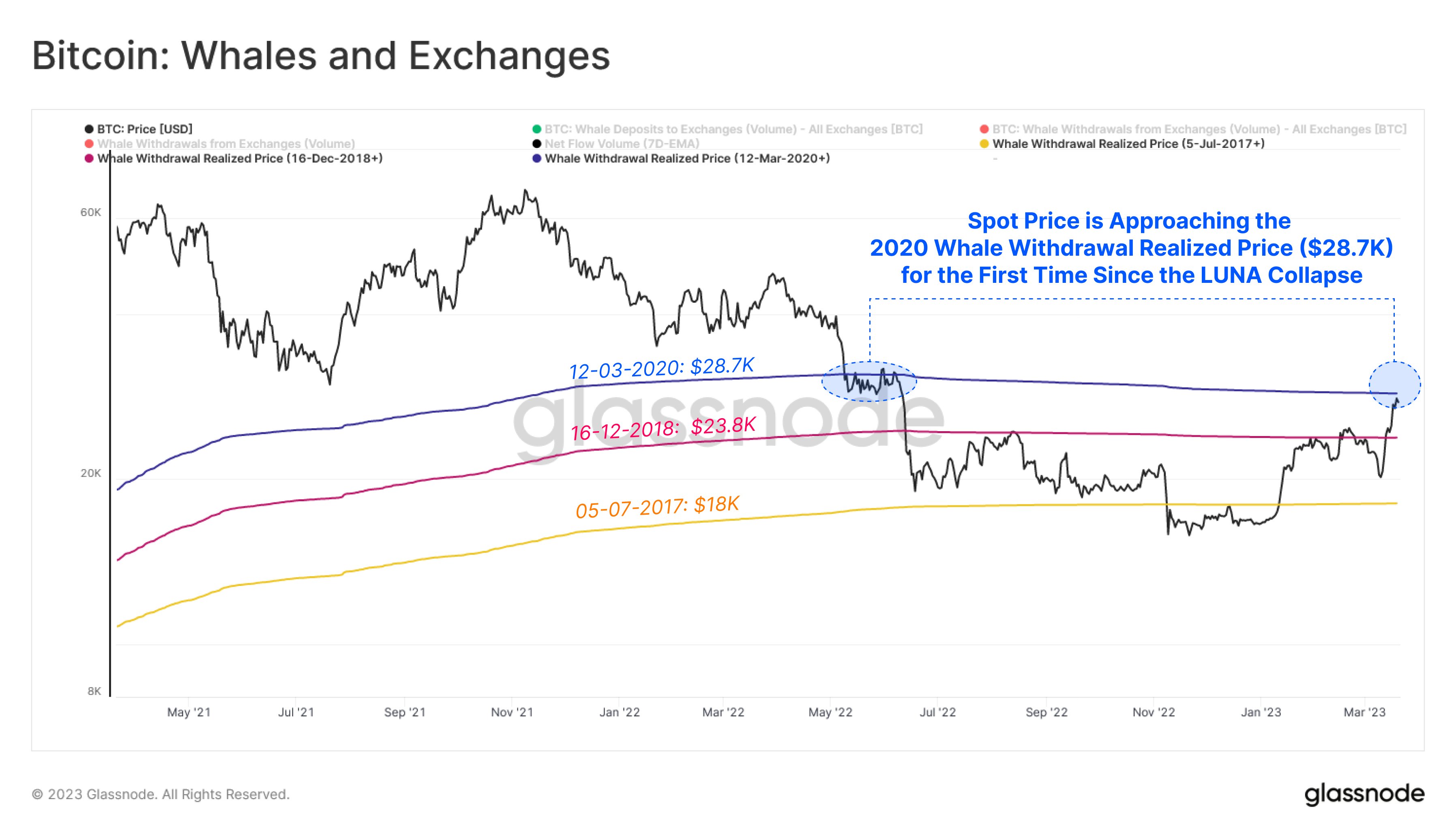

According to data from the on-chain analytics firm Glassnode, the $28,700 is the cost basis (that is, the acquisition price) of a specific whale group in the BTC market. The relevant indicator here is the “realized price,” a value derived from the realized cap, a capitalization model for Bitcoin.

Instead of taking the value of each coin in the circulating BTC supply the same as the current asset price, the realized cap assumes that the “actual” value of any coin is the price at which it was last transacted on the chain.

The realized price is obtained when this metric is divided by the total number of coins in circulation. As the realized cap accounted for the price at which holders bought their coins, that is to say, their cost basis, what the realized price signifies is the cost basis of the average investor in the market.

In the context of the current topic, the realized price has been applied to three whale cohorts to find their average acquisition prices. To better identify the price at which these whales first bought their coins, Glassnode has used their exchange withdrawal transactions as the point at which they acquired their Bitcoin (as exchanges are what holders generally use for buying purposes).

Now, here is a chart that shows the trend in the Bitcoin realized price of these whale groups over the last couple of years:

Whales have been put into these three groups based on the period they bought their coins. For example, the 12 March 2020 cohort includes all whales that have acquired their coins between now and then.

As shown in the above graph, the 5 July 2017 whale group has the lowest cost basis at $18,000, below which BTC was stuck during the lows after the FTX collapse. Sometime later, the coin attempted to put together a rise and get above this level, but it found rejection.

However, with the rally this year, BTC finally broke through this level. The rise continued until the cryptocurrency tested the 16 December 2018 whales’ cost basis of $23,800 and found resistance.

From the chart, it’s apparent that the asset struggled around this mark for a while until the sharp price surge of the past week took place, and the asset managed to clear this level.

Now, Bitcoin’s price is above the $28,000 mark, and the coin is fast approaching the cost basis of the final cohort, the 12 March 2020 whales. Given that the other two whale groups provided resistance to the price, it’s possible that the $28,700 cost basis of the last group could also cause trouble to the asset.

BTC Price

At the time of writing, Bitcoin is trading around $28,000, up 9% in the last week.