Last month, the NFT market saw a spike in trading volume on April 5th, followed by a significant 50% drop by the end of the month. The number of NFT sellers exceeds the number of buyers, indicating a potential oversupply in the market.

As these markets evolve and grow, investors and traders must stay abreast of the latest developments and trends. By examining the key factors driving the cryptocurrency and NFT markets, we can better understand the opportunities and risks associated with these emerging trends.

Data from this report was obtained from Footprint’s NFT research page. An easy-to-use dashboard containing the most vital stats and metrics to understand the NFT industry, updated in real-time, you can find all the latest about trades, projects, fundings, and more by clicking here.

Key Findings

Crypto Macro Overview

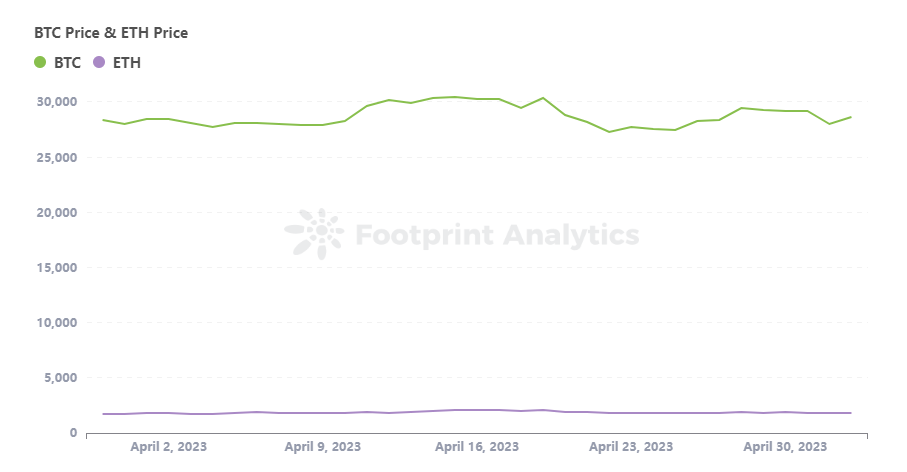

- The cryptocurrency market experienced ups and downs in April, with Bitcoin rising to $30,506 and Ethereum breaking through $2,100 on positive economic data.

- Despite some volatility, the cryptocurrency market stabilized towards the end of April, with Bitcoin pushing back towards $30,000 and positive sentiment prevailing.

NFT Market Overview

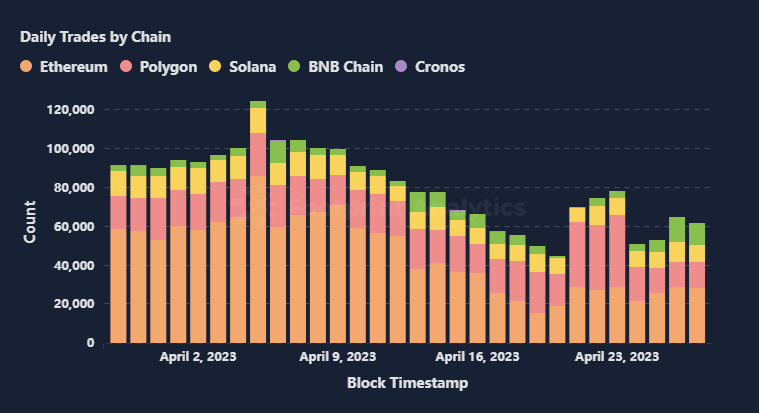

- The NFT market saw a spike in trading volume on April 5th but experienced a significant 50% drop by the end of the month.

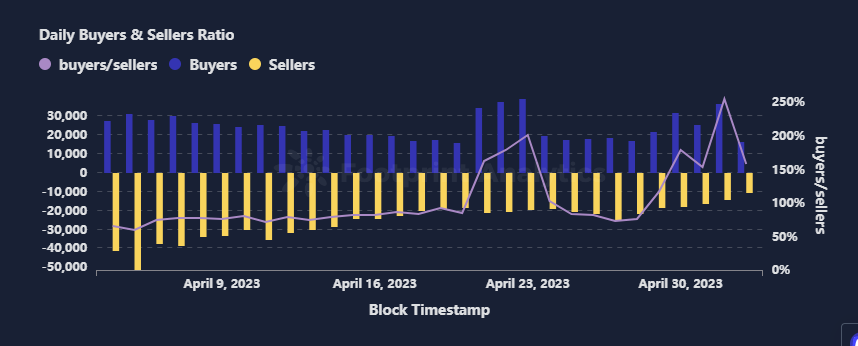

- The number of NFT sellers exceeds the number of buyers, indicating a potential oversupply in the market.

Chains & Marketplaces for NFTs

- Ethereum dominates the NFT market volume, but network congestion and fees may drive users to alternatives such as Polygon.

- Blur and OpenSea cater to high-end and retail traders, but both encroach on each other’s territory and may integrate.

NFT Investment & Funding

- Despite a slight increase in the number of NFT projects, the decrease in funding indicates investors’ caution about investing.

- Platform building and scalability solutions are essential for NFTs, as demonstrated by Flow’s $3 million seed funding of its NFT marketplace.

Hot Topics of the Month

- Integrating AI and NFT technology emphasizes the importance of NFT provenance for copyright protection and the value of human creativity in artistic expression to strike a balance for sustainable development.

Crypto Macro Overview

In April, the cryptocurrency market experienced some ups and downs. On April 14th, most cryptocurrencies traded higher due to better-than-expected U.S. economic data, with Bitcoin rising to $30,506, while ETH broke through $2,100 on April 16th.

On the macro front, official inflation rose to 5% in March, slightly below the consensus of 5.1%. However, investor focus has shifted to potential recessionary risks after the banking crisis exposed the fragility of the market’s financial system. Recent data also points to a macroeconomic slowdown, as the ISM Purchasing Managers’ Index fell to its lowest since May 2020.

Despite the volatility, bitcoin pushed back to 30,000 in late April, with positive sentiment across the crypto market.

NFT Market Overview

The NFT market attracted much attention at the beginning of 2021 as numerous projects launched their own NFT collections. However, the NFT market has shown signs of weakness this year.

According to Footprint Analytics, the NFT market peaked in trading numbers on April 5, but daily trades had dropped by 50% by the end of the month. This decline in trading activity suggests a growing sense of caution among investors as the initial enthusiasm for the NFT market appears to be fading.

In addition, according to Footprint Analytics, the number of NFT sellers in the market continues to exceed the number of buyers, suggesting that there may be insufficient underlying demand.

The initial hype around the NFT market was driven by the cryptocurrency market and celebrity endorsements, leading to a rush of people entering the market. However, the number of people who understand NFTs is relatively small, leading to oversupply. It remains to be seen whether the fundamentals of NFTs can eventually support market growth and open up new opportunities.

Chains & Marketplaces for NFTs

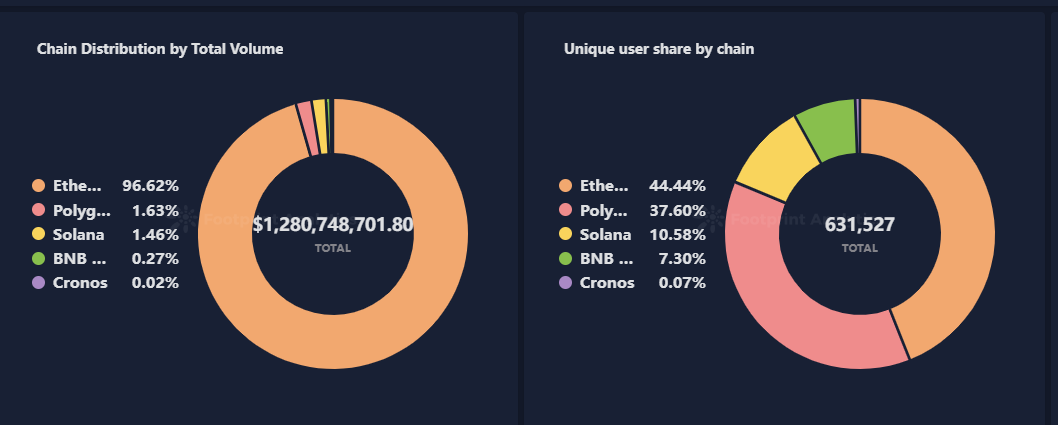

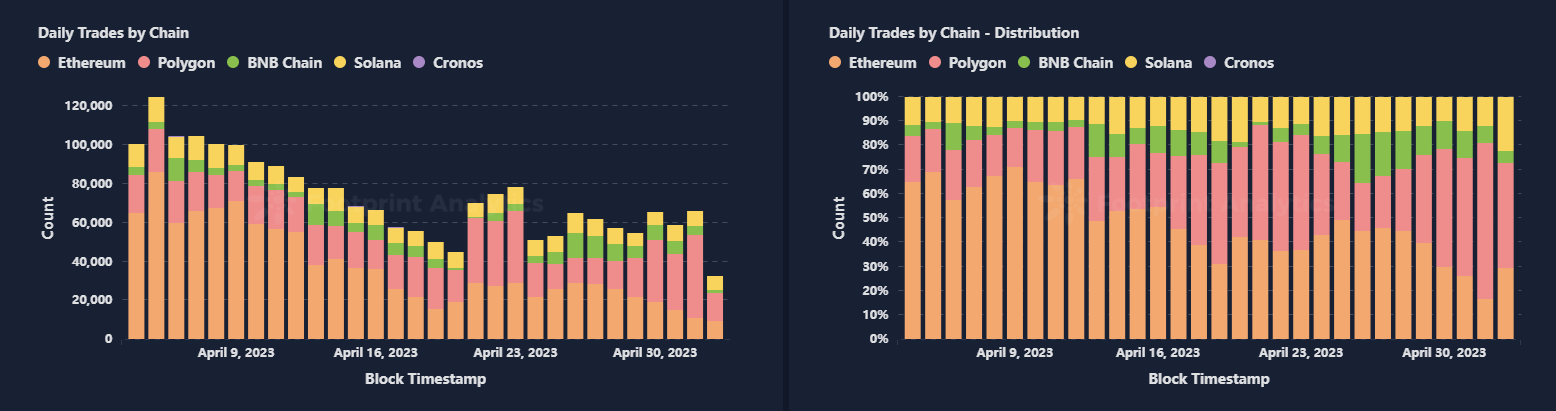

According to Footprint Analytics, Ethereum holds the lion’s share of NFT transaction volume, with a massive 96% market share. However, when it comes to active users, Ethereum only accounts for 44%, while Polygon’s active user base is close behind at 37%.

While Ethereum remains the platform of choice for most mainstream NFT projects, its network congestion and high transaction fees may drive some users to alternative platforms. As a result, Ethereum may face challenges in maintaining its dominant position in the NFT market.

Polygon’s daily trades are catching up with Ethereum, with transaction volume not high. Still, the number of trades is comparable, indicating that it’s more suitable for small traders due to lower barriers to entry. Polygon’s low barriers to entry make it more suitable for small transactions and asset exchanges, meaning that its market may be more decentralized and multi-domain. However, gathering high-value and high-quality NFT projects and assets is also more difficult. Therefore, it takes longer to build a good ecosystem and accumulate assets.

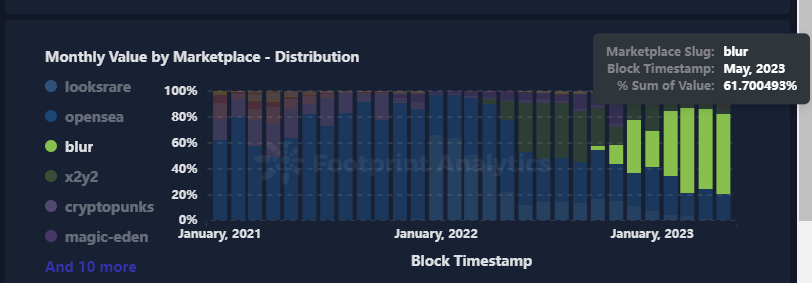

From a marketplace perspective, Blur still has an absolute advantage regarding transaction volume. However, in terms of the number of transactions, OpenSea still has the upper hand. Blur’s dominant position suggests it’s more suitable for high-value assets and professional users with larger transaction sizes. On the other hand, OpenSea’s transactions are looser and more dispersed, with smaller transaction sizes, making it more suitable for retail users and small daily transactions.

Blur and OpenSea represent high-end and small traders, respectively. However, with the market’s overall development, both are encroaching on each other’s territory, and the competition is becoming more intense. The future trend may be further integrating high-end and small markets, creating a certain synergy effect. Continued monitoring of the performance of both platforms will be necessary to predict their future development.

NFT Investment & Funding

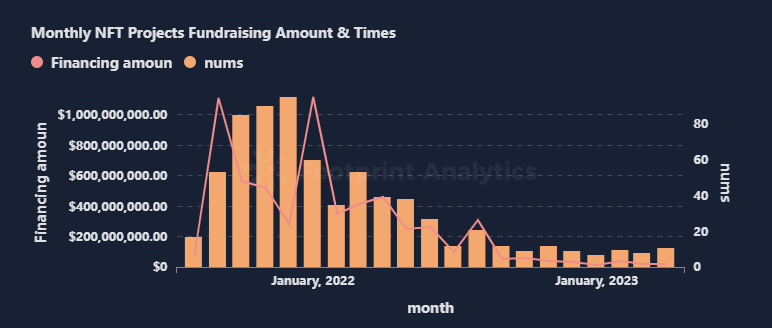

While the number of NFT funding projects slightly increased from 8 to 11 compared to last month, the amount of funding has decreased, indicating a more cautious approach by investors.

Many builders are working on the NFT marketplace. Flow, which secured $3 million in seed funding to build a rollup-centric NFT ecosystem, highlights the growing need for layer 2 and scalability solutions to address Ethereum network issues. Also, the entry of large companies such as Amazon into the NFT market is expected to increase market visibility and size but also increase industry risks.

In addition, the music and entertainment industries are exploring NFT, as evidenced by Muverse and Daniel Allan Entertainment, which received funding this month, opening up new opportunities for NFT applications.

Hot Topics of the Month

As Chatgpt became famous, people started talking about integrating AI and NFT, as NFT is a great example of a creative economy in the crypto world.

KOL 6529 provided a representative discussion on this topic. On the one hand, as the amount of AI-generated content increases, the importance of NFT provenance technology is further highlighted. NFT provenance can help distinguish the source and ownership of content and protect the copyright of content creators.

Conversely, the proliferation of AI-generated content makes original human content more valuable. The uniqueness of human creation is difficult to completely replace by AI, making original works more scarce and valuable. Therefore, the ability of creators to build their reputations is especially important in an era of digital content overload. Only by allowing more people to understand and recognize their work can creators stand out in the fierce competition for content.

Commercial content creation is more easily replaced by AI, while artistic creation is difficult to replace. Commercial content is usually completed around a certain demand and can be efficiently generated by AI technology, making it more easily replaced by machines. In contrast, the value of artwork lies in the author’s thoughts and emotional expression, which is difficult for AI to achieve and requires the unique perspective and creativity of human artists.

Although AI creation is increasing, human creativity remains irreplaceable in the form of artistic expression. Striking a balance between copyright protection, creative tools, and human expression is key to the sustainable development of NFT and encryption technologies.

Closing Thoughts

The world of NFTs is rapidly evolving, with new trends and developments emerging monthly. April was no exception, as the market for these digital assets experienced significant fluctuations and new developments. While the spike in trading volume at the beginning of the month followed a drop towards the end, the NFT market remains a dynamic and promising sector.

As the NFT market grows and matures, staying abreast of the latest trends and developments is important. By understanding the opportunities and risks associated with this emerging technology, investors and traders can make informed decisions and capitalize on the potential of NFTs.

This piece is contributed by Footprint Analytics community,

We’re thrilled to invite institutions and projects to build out your custom research pages like this. With our help, you can easily own your data website for research without any coding experience or technical input. Simply fill in this form to apply for the waitlist and get started today.

The Footprint Community is where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling blockchain world. Here you’ll find active, diverse voices supporting each other and driving the community forward.

The post April Monthly NFT Report: Navigating the volatile NFT market appeared first on CryptoSlate.