Ethereum managed to surpass the $1,800 price level initially, but it has been experiencing a period of consolidation recently. In the past 24 hours, there has not been much progress in the price movement. Similarly, the weekly chart shows that Ethereum has not made significant price advancements during this timeframe.

The technical outlook for ETH is bearish, with indications of falling demand and accumulation. This suggests a lack of enthusiasm from buyers since Ethereum started trading sideways. The altcoin has been consolidating below an important resistance level, which, if successfully surpassed, could pave the way for a potential recovery.

Furthermore, ETH has formed a pattern that suggests the possibility of a bullish breakout in the near future. However, it’s important to note that for Ethereum to reverse its declining price trend, it will require broader market support.

The market capitalization of Ethereum has declined, indicating an increasing dominance of sellers. This suggests that selling pressure has been mounting.

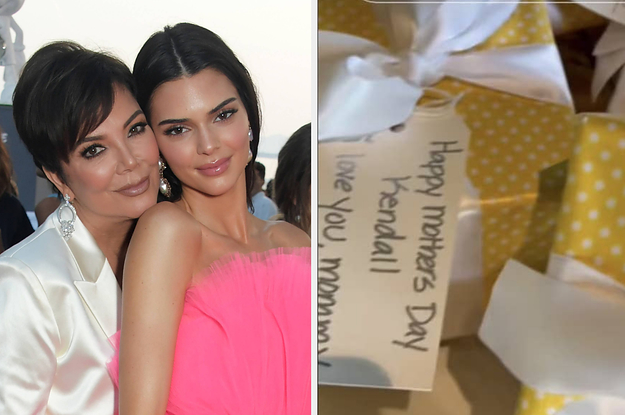

Ethereum Price Analysis: One-Day Chart

At the time of writing, Ethereum (ETH) was priced at $1,819. After surpassing the resistance level at $1,800, Ethereum has struggled to maintain a clear price direction. The next significant resistance for the coin is at $1,822, and if this level is surpassed, there is a possibility of Ethereum attempting to breach $1,840.

Currently, ETH is displaying a downward wedge pattern, which is considered a bullish formation and suggests a potential price reversal in the future. However, if ETH falls from its current level, it could reach $1,800 and potentially even dip below $1,790.

The trading volume of Ethereum in the last session has also declined, indicating a decrease in buying strength. But this could also point toward fatigue among sellers.

Technical Analysis

The recent price decline has placed ETH buyers in a negative zone. The Relative Strength Index (RSI) indicates that sellers currently outnumber buyers, as it is below the half-line.

Furthermore, ETH has dropped below the 20-Simple Moving Average line, suggesting a lack of demand and indicating that sellers are driving the market’s price momentum.

However, if there is a slight increase in demand, it could enable ETH to surpass the next resistance level, which would strengthen the position of buyers in the market.

ETH price movement remains negative, consistent with other technical indicators. The Directional Movement Index shows a negative trend, with the -DI line (orange) positioned above the +DI line (blue).

The Average Directional Index (Red) is below the 20-mark, indicating a weak price direction. However, there is a potential hint of recovery suggested by the Chaikin Money Flow indicator. It has moved above the half-line, indicating that capital inflows are surpassing capital outflows.