Ahead of Apple’s Worldwide Developer Conference next week, the company is offering an update on its app ecosystem with the release of a new report detailing app earnings over the course of last year. In the analysis, released today, Apple says its App Store ecosystem generated $1.1 trillion in developer billings and sales in 2022, 90% of which was commission-free — a metric it likes to tout to downplay the growing complaints about the high cost of doing business on a marketplace that generally takes a 15% to 30% commission on in-app purchases and paid downloads, with some exceptions.

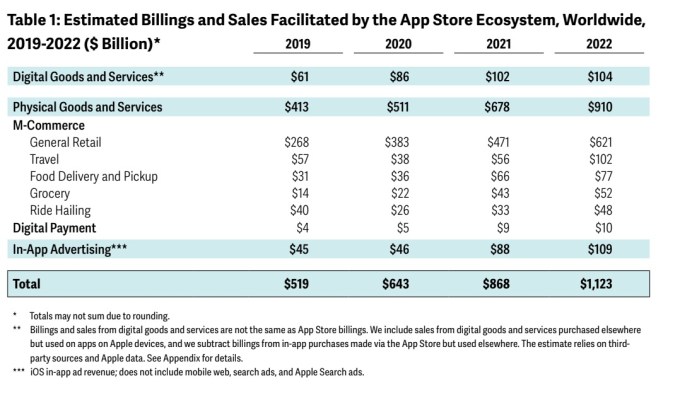

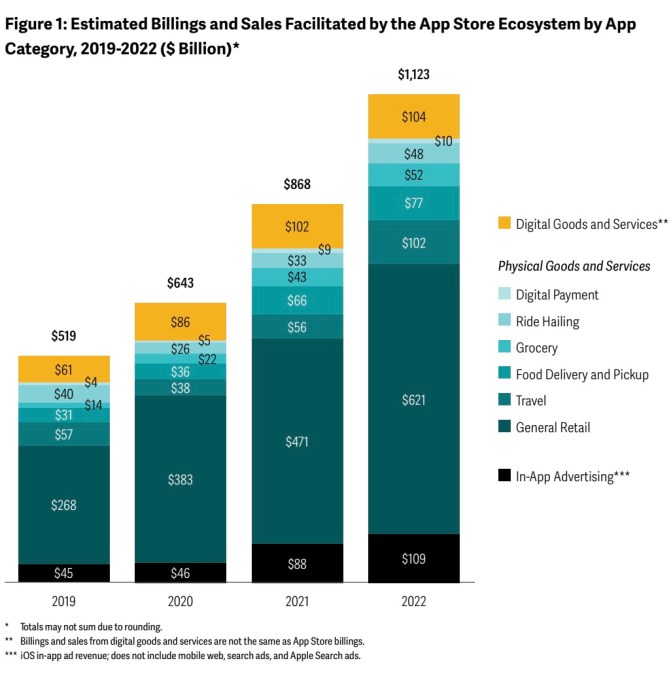

This $1.1 trillion breaks down as $910 billion in total billings and sales from the sale of physical goods and services, $109 billion from in-app advertising, and $104 billion for digital goods and services.

The figures are a sizable increase from 2019 data, when Apple said the App Store had facilitated $519 billion in commerce, with then “just” $61 billion coming from digital goods and services.

Image Credits: Apple

Apple also said iOS app developers have earned more than $320 billion on the App Store from 2008 to 2022, a jump from the $260 billion reported in 2021.

Today’s new study comes from the Analysis Group, the same analyst group that Apple first began working with starting in 2020 to crunch its App Store data — and to shine a light on the sizable commerce taking place on Apple’s app marketplace as regulators began working on new rules to dismantle’s the tech giant’s grip on the iOS app ecosystem.

While the broad totals by category are the main draw in today’s report, Apple shared other figures related to the App Store’s growth, as well. This included a slight uptick in the growth of developer billings and sales between 2021 and 2022, at 29%, when the prior two years saw 27% growth. Small developers’ earnings growth, in particular, grew 71% between 2020 and 2022, outpacing large app developers, Apple noted. (However, that figure is much more of a vanity metric as smaller developers are often pulling in smaller revenues, which are much easier to double or triple compared with larger developers’ revenues.)

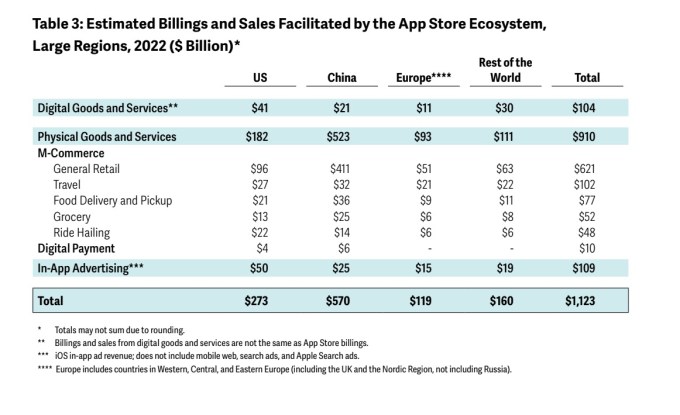

The company further broke down billings and sales by geography, noting U.S. developers’ billings and sales increased by more than 80% since 2019, while in Europe, that figure was 116%. Notably, Europe has been the center of new regulations that will impose strict new requirements on how the App Store operates. With the EU’s Digital Market Act (DMA), which comes into effect in 2024, big tech companies will have to allow alternative app stores on their platforms. A recent Bloomberg report suggested Apple was already building the groundwork to enable this functionality, in fact.

Image Credits:

In addition, the new report offered an analysis of app billings and sales growth across various categories, including things like food and grocery, travel, ride-hailing, and others. The analysts found that post-Covid recovery helped travel and ride-hailing app rebound, as the categories saw an 82% increase and 45% increases in sales, respectively, in 2022. Food delivery and pickup sales also more than doubled since 2019 and grocery sales more than tripled.

Image Credits: Apple

Enterprise apps also were one of the “fastest-growing” categories, the report said, adding that business apps represented 5 out of the top 25 most-downloaded apps in the U.S., for example. Plus, entertainment apps saw the “highest growth” in digital goods and services, thanks to trends like the creator economy. The latter reflects a trend already spotted by third-party app intelligence provider data.ai, which cited entertainment and social apps as the top global app subgenres in 2022.

The report included a look at iOS downloads, too, confirming that users have downloaded apps more than 370 billion times from 2008 to 2022. The App Store has nearly 1.8 million apps, or 123 times the figure it had at the end of 2008. (Of note, that “nearly 1.8 million” figure appears to represent a slight drop, as Apple said a year ago it had “more than” 1.8 million.)

Apple’s first-party data, while useful, only offers a window into the wider app economy. Though Apple’s numbers always paint a picture of a vibrant, rosy app ecosystem, the reality is that some developers have grown frustrated with commission prices and strict rules — many even sitting down with DoJ lawyers to complain as the U.S. builds an antitrust case. Many of the apps now generating sizable revenues are also what could be dubbed “fleeceware” — that is, apps that try to trick consumers into high-priced subscriptions for minimal functionality. One 2021 report even estimated these apps had generated over $400 million across the App Store and Google Play, which is a sizable chunk of the app economy. The Washington Post also that year reported nearly 2% of the top-grossing App Store apps were scams, and had cost consumers $48 million.

Meanwhile, the app ecosystem — including Android app stores — saw its first-ever slowdown in 2022, with a 2% drop in consumer spending, data.ai revealed in its “State of Mobile” annual report.

Apple’s full report offers more data on its ecosystem, including further regional and category breakdowns, historical analysis, and additional information about trust and safety measures, like app rejections, which were also recently detailed in a separate report released earlier this month.

Apple touts $1.1 trillion in App Store commerce in 2022, with $104B in digital sales by Sarah Perez originally published on TechCrunch