Bitcoin (BTC) investors witnessed a lucrative month in May, as the world’s most renowned cryptocurrency showcased its resilience and delivered robust returns. However, in the face of the changing market sentiment, a looming legal battle threatens to cast a shadow over these gains.

The ongoing Binance lawsuit has sparked concerns among crypto enthusiasts, raising questions about the potential impact it may have on their investments and the overall crypto market.

As investors weigh the significance of this legal battle, the fate of their hard-earned gains hangs in the balance, making it crucial to understand the potential ramifications and devise a strategic approach to navigate the evolving landscape of Bitcoin investment.

Goldman Sachs Report Reveals Bitcoin Market Dynamics

A recent report from Goldman Sachs provides a comprehensive analysis of BTC on-chain statistics and market dynamics. The study focused on the spent output profit ratio (SOPR) for Bitcoin, a metric that gauges the degree of realized profit.

Notably, the SOPR exhibited significant fluctuations throughout the month of May, reaching levels unseen since December 2020. This indicated a surge in profit-taking activities among investors in the spot markets.

According to the report, the spikes in SOPR reflected instances where Bitcoin holders took advantage of the gains they had accrued and sold their holdings. This profit realization trend was particularly prominent during May.

Investors capitalized on the positive market sentiment and chose to convert their Bitcoin investments into fiat currencies or other assets, reaping the benefits of their profitable positions.

However, the report shed light on another intriguing development: a notable decline in the number of Bitcoin addresses holding over 100,000 BTC. This decline amounted to a significant 31% decrease in such addresses over the course of a single month.

Impact Of Binance Lawsuit

Despite statistically significant outflows, the balance of #Bitcoin held across Binance exchange addresses remains robust at 694K BTC, just -10.5K BTC shy off of its ATH of 704.5K BTC.

Thus, we can conclude the recent flurry of outflows has only marginally affected the balance… pic.twitter.com/OMAcT1mYTm

— glassnode (@glassnode) June 6, 2023

Following the filing of the lawsuit, the cryptocurrency exchange experienced a notable surge in outflows, resulting in a net outflow of 10.5K BTC. Consequently, the price of BTC plummeted to a low point of $25,445, reflecting the market’s immediate response to the legal proceedings.

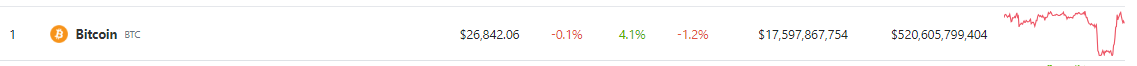

However, the cryptocurrency has since rebounded, with CoinGecko reporting its current price as $26,842, showcasing a 4.1% rally within the past 24 hours. Although there was a minor seven-day slump of 1.2%, the overall recovery suggests a degree of resilience in the Bitcoin market.

This recovery comes at a critical time for Bitcoin holders, who may anticipate a decrease in the profits they would have otherwise accumulated throughout this month. The impact of the lawsuit and subsequent market turbulence is likely to influence the profitability of Bitcoin investments in the short term.

As the month of June unfolds, Bitcoin’s performance will carry heightened significance, particularly as it marks the end of the second quarter of 2023.

Featured image from Shamsul Haque Ripon/The Business Post