Bitcoin investors are currently experiencing a déjà vu. As has happened several times in the past, the recent Tether FUD has once again marked the local bottom for the BTC price. At the same time, euphoria and greed have returned to the market. And there are several good reasons for this.

BlackRock has applied for a spot ETF and has an insane track record, Fidelity, Citadel & Schwab are launching a crypto exchange, Invesco and WisdomTree have both renewed their Bitcoin ETF applications and Germany’s largest asset manager Deutsche Bank has applied for a crypto custody license. Big money is definitely making its way into the crypto market after the hard crackdown aka Operation Choke Point 2.0 in the US to grab the largest piece of the pie possible.

What Triggered The Bitcoin And Crypto Price Spike?

One of the driving factors behind the price rise in the crypto market is undoubtedly the bullish news surrounding Bitcoin and the potential wave of new institutional investors. Bitcoin is once again setting the trend for the broader crypto market, which can also be seen in the fact that Bitcoin dominance, the share of BTC’s market capitalization in the entire crypto market, continues to rise.

The metric rose to its highest level since mid-April 2021 today and currently stands at 51.08%. Yet, the Bitcoin rally has also breathed new life into several altcoins. Among others, FLOW, CFX and BCH are up 22% in the last 24 hours, followed by STX with 18%, OP with 17% and INJ with 15%. ETH is up 4.8%.

However, it is important to note that the current price rally is not mainly due to speculation by futures traders. As we reported yesterday, in recent weeks BTC whales with assets of 1,000 to 10,000 BTC have accumulated a total of 131,6000 BTC worth around $3.5 billion from the spot market. And this trend continues. CryptoQuant CEO Ki Young-Ju wrote via Twitter:

This is not a short squeeze, but someone(s) is just buying $BTC a lot.

I repeat.

This is not a short squeeze, but someone(s) is just buying $BTC a lot.

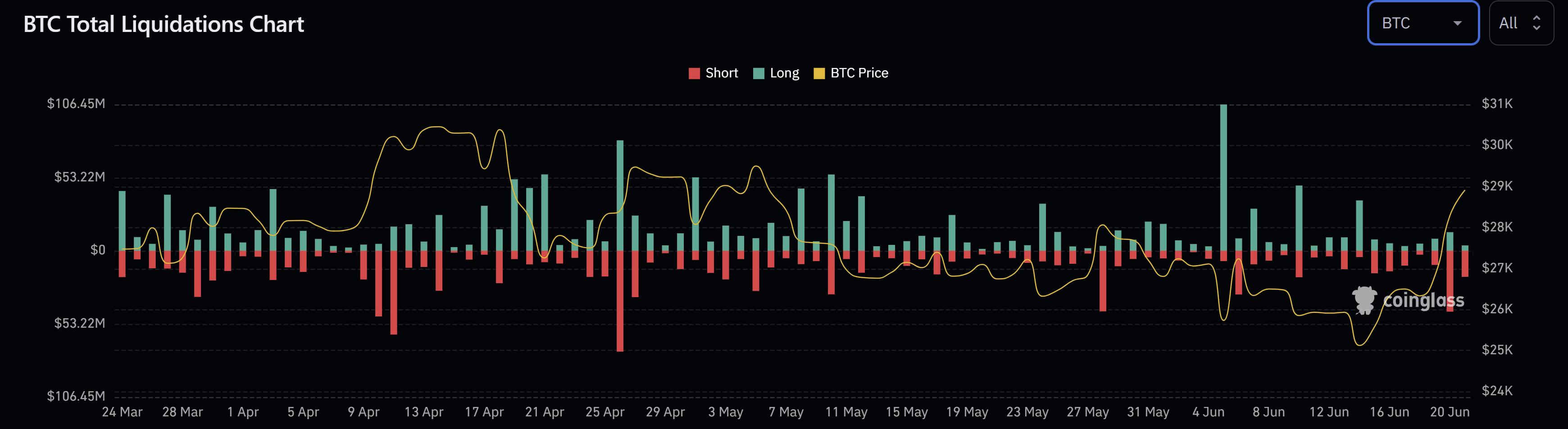

The analyst is referring to the hourly short squeeze ratio indicator. As the chart below shows, the metric has remained relatively flat compared to previous price spikes, indicating that there is more upside potential if short positions are squeezed (once again).

This also implies that the spot market had a major influence on the movement. In general, the rise can therefore be seen as more sustainable.

Nevertheless, it should be noted that there was a certain degree of short squeeze. Coinglass data shows that about $44 millions in shorts were liquidated. The level is similar to that seen on May 28 this year, when $44 million in BTC shorts were liquidated and the Bitcoin price rose by 4.4%.

Vetle Lunde, senior analyst at K33 Research, also made another bullish observation regarding the CME futures. “Very bullish action on the CME,” says Lunde, who explained that CME’s basis pushed to yearly highs after seeing the largest relative daily growth in OI since November 9, 2022. “Allocations to the futures ETFs did not cause the growth, as the active market participation share increased from 42% to 51% yesterday,” remarked the analyst.

At press time, Bitcoin was displaying an extremely bullish price action. BTC bounced off the 200-day EMA and broke through the downward trend that persisted since mid-April this year.