The momentum in the market has completely turned since BlackRock filed for a Bitcoin spot ETF. Currently, the applications are piling up at the US Securities and Exchange Commission (SEC). In addition to BlackRock, Invesco (4th largest ETF issuer), WisdomTree (top 10 issuer), Bitwise and Valkyrie have submitted their Bitcoin spot ETF filings (again), while the BTC price knows only one direction at the moment: Up only!

According to renowned figures from the crypto space, this is for a good reason. In an interview with Brian Sullivan for CNBC’s “Last Call”, Anthony Pompliano theorized that the “Great Accumulation Race” for Bitcoin has begun.

As “Pomp” discussed, everyone has heard of the space race, where a number of countries competed to get into space first. Something similar is now happening in the Bitcoin space, triggered by the spot ETF application from BlackRock, which called the race.

According to Pompliano, the current rise in Bitcoin’s price is triggered by institutions and individuals all trying to get their share of the 21 million BTC that will ever exist. Retail investors have had a head start over the past 15 years and have amassed all the Bitcoin.

As the expert notes, 68% of all in circulation have not moved in over a year. This means that when Wall Street giants such as BlackRock, Invesco and WisdomTree want to buy Bitcoin, they will encounter a highly illiquid asset. Pomp added:

And these Bitcoiners don’t want to sell to Wall Street. So, the only thing that can move for a fixed supply asset that is highly illiquid, and there’s a bunch of demand coming into the market, is the price has to go up. How long that takes is anyone’s guess. But I think this is the big story here, the great accumulation race is underway.

The most obvious and best trade of this decade? #Bitcoin https://t.co/uqgbusfsxu

— Jake Simmons (@realJakeSimmons) June 22, 2023

Cameron Winklevoss, co-founder of the cryptocurrency exchange Gemini, also supports this theory. Via Twitter, the Winklevoss twin wrote that the Great Accumulation of Bitcoin has begun.

“Anyone watching the flurry of ETF filings understands the window to purchase pre-IPO Bitcoin before ETFs go live and open the floodgates is closing fast. If Bitcoin was the most obvious and best investment of the previous decade, this will likely be the most obvious and best trade of this decade,” Winklevoss said.

Bitcoin Data Supports The Theory

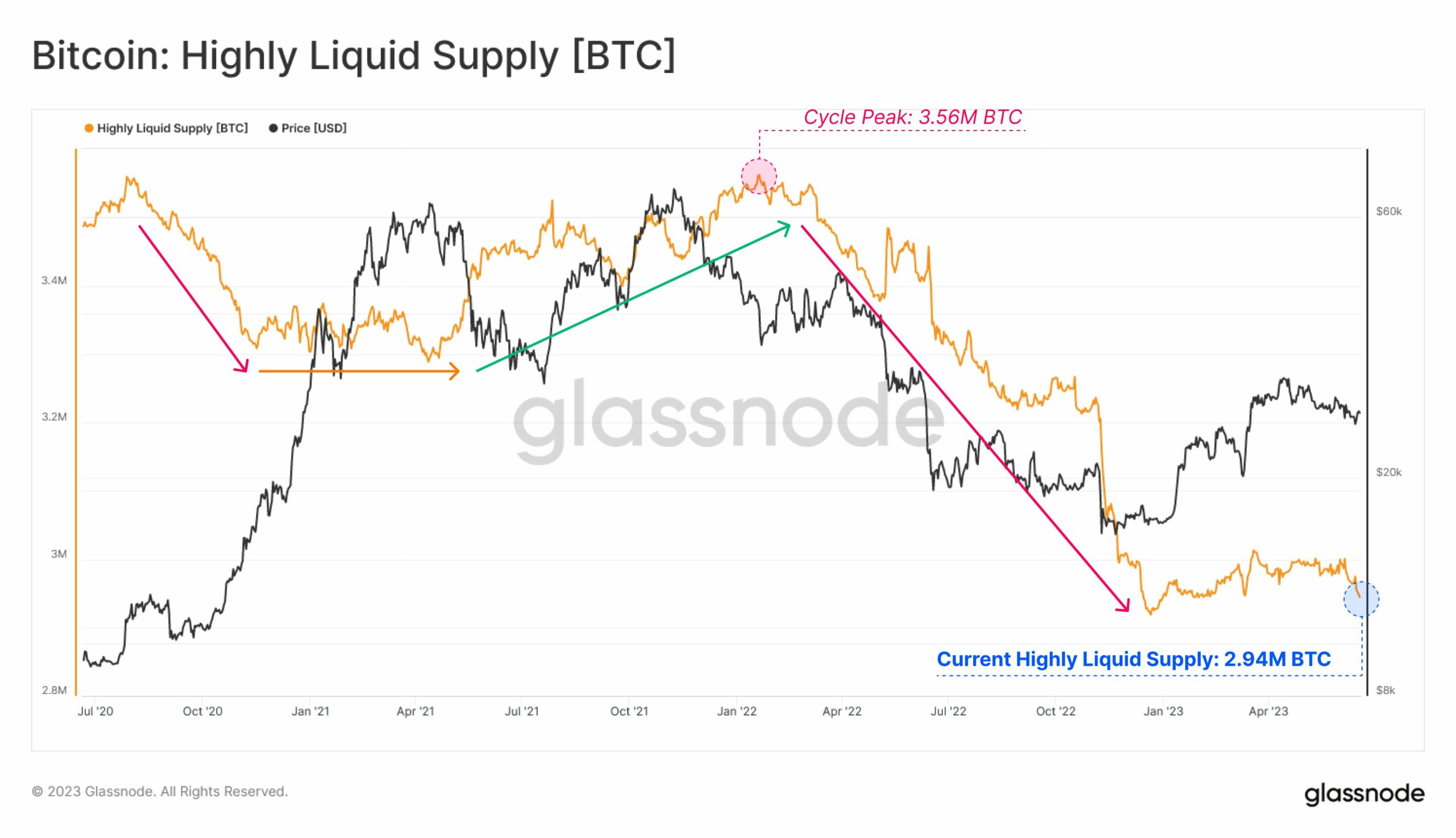

As Glassnode recently noted, highly liquid BTC supply has declined sharply this cycle and is currently near a cycle low of 2.94 million BTC, a decline of 620,000 BTC since January 2022. This indicates a significant contraction in actively tradable supply, according to Glassnode, leading to both a decline in liquidity and a constrained supply side.

The statistic mentioned by Pompliano also shows how illiquid the market is. Actually 69% of all BTC in circulation have not moved for more than a year, which is a new all-time high. Long-term investors are not interested in selling, many are accumulating more. Remarkably, this is a similarity to the end of 2015 when the all-time high ushered in the new bull market.

At press time, the BTC price stood at $30,133. If BTC breaks the yearly high at $30,972, the price could move towards the area above $32,000 (red area).