The total number of Ethereum locked on liquid staking derivatives (LSD) protocols reached 10 million on June 29, according to data from DeFillama.

Liquid staking protocols allow users to earn staking rewards while providing liquidity for other crypto-based activities, such as Lido (LDO) and Rocket Pool (RPL).

Lido dominates LSDs

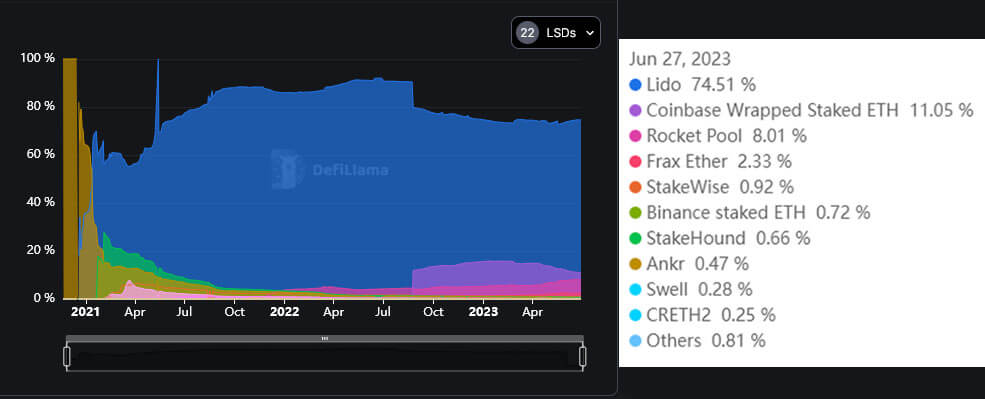

DeFillama data tracks 22 liquid staking protocols, with the total value of assets locked on these protocols at $18.55 billion as of press time.

Lido is the dominant player in the space, controlling 74.5% of the market. This is ahead of competitors, including liquid staking services provided by major centralized exchanges like Coinbase and Binance, which control roughly 12% of the market combined.

Since Ethereum enabled staked Beacon Chain ETH withdrawals, LSD platforms have enjoyed heightened interest as several institutions like Celsius have been restaking their ETH holdings.

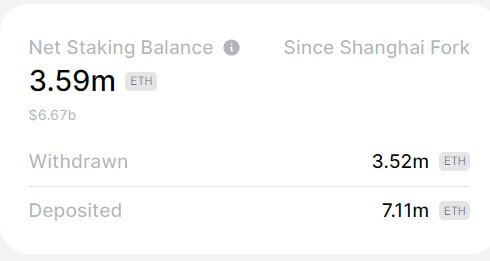

For context, the Token Unlocks dashboard shows that over 7 million ETH tokens have been deposited in the Beacon Chain since withdrawals were enabled. At the same time, 3.52 million ETH were withdrawn during the same period.

This heightened interest has seen the total amount of staked ETH exceed the ETH balance on centralized exchanges, including Coinbase and Binance.

LSD tokens struggle

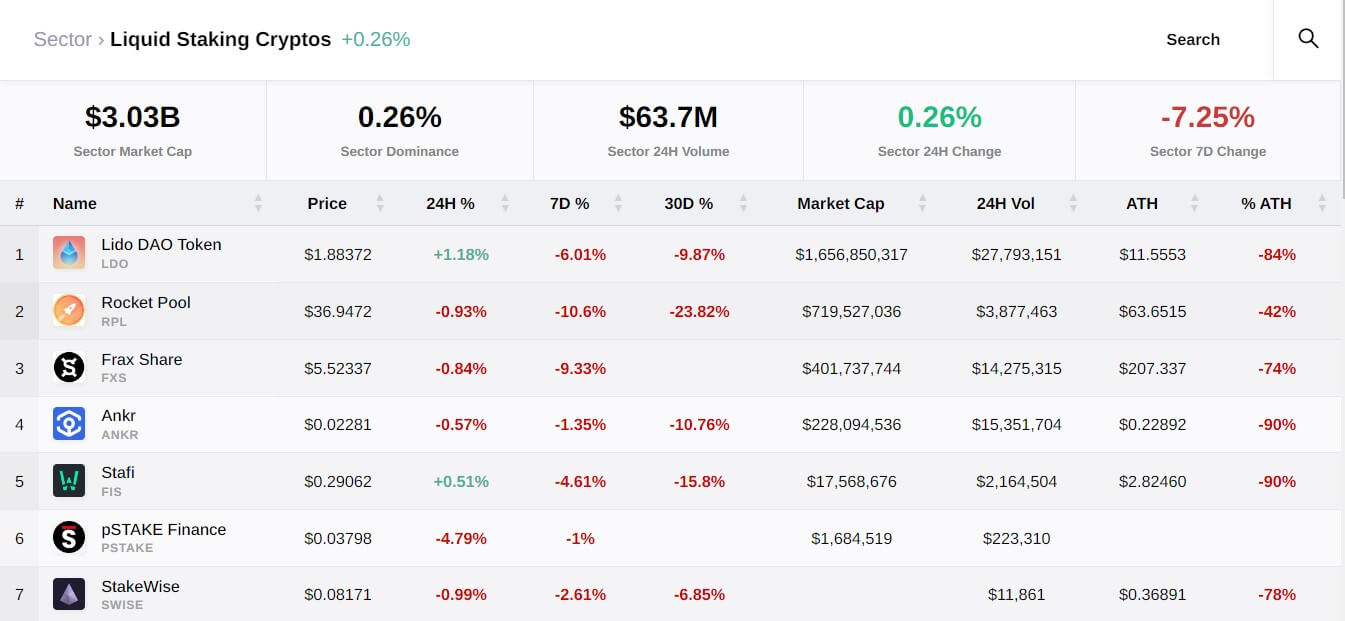

Despite the milestone, tokens in the liquid staking sector have struggled in the last 24 hours, rising by just 0.26%, according to CryptoSlate data.

According to the data, only Lido’s LDO and Stafi’s FIS saw their value rise by 1.18% and 0.51%, respectively, during the reporting period.

Others like Rocket Pool, Frax Share (FXS), Ankr, pSTAKE Finance (PSTAKE), and StakeWise (SWISE) recorded slight losses.

CryptoSlate data further shows that all of the assets in the sector declined by 7.25% in the last seven days.

Overall, the market cap of the crypto tokens in this sector sits at $3.03 billion as of press time.

The post Lido leads as Ethereum locked as liquid staking derivatives hits 10 million appeared first on CryptoSlate.