Shiba Inu (SHIB) has faced a significant challenge in the form of the December 2022 low. This crucial level has proved a formidable barrier for SHIB bulls, thwarting their attempts to increase prices.

Despite recent upside movements, the resistance at this level has proven to be persistent, creating a precarious situation for the cryptocurrency.

As the price of SHIB hovers in this area, the question arises: Will the selling pressure overpower the bulls’ determination and cause a reversal in the price action?

Shiba Inu Faces Bearish Order Block And Potential Liquidity Hunt

SHIB faces a significant challenge as its December 2022 low coincides with a bearish order block (OB) ranging from $0.00000785 to $0.00000824. This particular range, as highlighted in a recent SHIB price report, could serve as a stronghold for bearish sentiment in the market.

Consequently, the possibility of a liquidity hunt in this region cannot be disregarded, potentially leading sellers to extend their gains toward the immediate support level at $0.00000711.

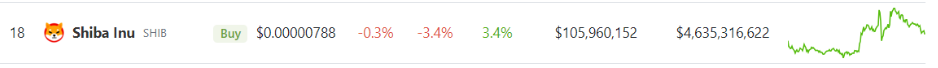

Amid recent market fluctuations, SHIB is currently trading at $0.00000788, based on data by crypto market tracker Coingecko. This reflects a decline of 3.4% over the past 24 hours.

However, despite this short-term setback, SHIB has also notched a seven-day rally of 3.4%, showcasing its inherent resilience and potential for recovery in the long run.

Decrease In SHIB Token Burns: Implications For Supply, Demand

Meanwhile, Shibburn reported a notable decline in the number of tokens burned within the past 24 hours. A mere 1,233,806 SHIB tokens were burned in a single transaction, representing a sharp 91.59% decrease in the daily burn rate and in contrast, the previous week witnessed the burning of nearly 1 billion SHIB tokens.

In the last 7 days, there have been a total of 915,371,832 $SHIB tokens burned and 139 transactions. #shib

— Shibburn (@shibburn) July 16, 2023

This decline in token burns carries several implications for the SHIB ecosystem. Firstly, burning tokens plays a crucial role in reducing the overall supply of SHIB, potentially exerting upward pressure on its price.

However, with the significant decrease in the daily burn rate, the rate at which new tokens are being removed from circulation has slowed down considerably. This could impact the potential scarcity and perceived value of SHIB in the market.

Moreover, the reduced token burns may suggest a shift in market sentiment and investor behavior. It could indicate a decreased demand for burning tokens or a temporary lull in activity within the SHIB community.

Market participants and SHIB token holders will closely monitor the implications of this decline in burns on future price movements and the overall supply-demand dynamics of the cryptocurrency.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Bodybuilding.com