Polygon’s MATIC token experienced fleeting 24-hour gains that offered a momentary glimmer of hope for its investors. However, this uptick was juxtaposed against lingering weaknesses in the bullish sentiment, prompting questions about the potential for further downside.

In the last five days, MATIC embarked on a trajectory marked by a relatively narrow price range, predominantly oscillating between $0.537 and $0.56. This phase of consolidation led to a visible reduction in market volatility, consequentially resulting in a discernible drop in the open interest metric throughout the week.

This deceleration in market activity not only hinted at speculators’ ambivalence towards predicting the token’s next trajectory but also suggested that traders might need to exercise caution and patience as the market seeks clearer signals.

Analyzing MATIC’s Current Climate

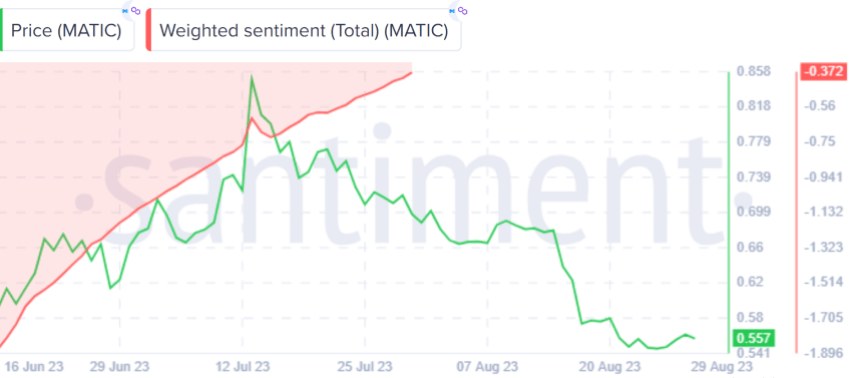

Beneath the surface of these price fluctuations and speculative hesitations, a series of interesting developments unfolded. The sentiment prevailing in social discussions around MATIC’s price exhibited a noteworthy shift towards negativity.

Insights gleaned from Santiment data revealed a gradual decline in MATIC’s Weighted Sentiment that commenced around August 25, ultimately settling at a current value of -0.37 as of today.

Additionally, subtle indicators hinted at underlying accumulation dynamics taking shape. The average coin age exhibited an upward trajectory, indicative of the gradual accumulation of MATIC tokens across the network. Coinciding with this trend, the volume of supply held on exchanges witnessed a decline over the past week, once again underscoring the narrative of token withdrawal and strategic accumulation.

MATIC Current Valuation And Outlook

Despite the drop in the token’s social sentiment rating, MATIC still registered a 1.5% surge over the past 24 hours, and trading at $0.559, according to crypto market tracker CoinGecko. Over a broader time frame of seven days, the token’s incremental gain stands at a modest 0.6%.

Meanwhile, in a timely and pivotal announcement, Polygon’s Co-Founder Sandeep Nailwal unveiled insights into the forthcoming migration of MATIC to a new POL Token. Of notable significance in this update was the assurance extended to users – a seamless transition to POL was promised without the risk of forfeiting rewards earned from ongoing MATIC staking activities.

Ideally, as a user you should get 1/2 click upgrade to staked POL from staked MATIC. I think once the upgrade is approved by the governance, only then we all would have more info about the mechanism. Some basic info regarding how the mechanism would look like was shared in the…

— Sandeep Nailwal | sandeep. polygon

(@sandeepnailwal) August 28, 2023

This announcement takes on added significance after months of uncertainty that followed Polygon’s 2.0 tokenomics revelation in July 2023. Nailwal’s transparent communication could potentially inject a dose of confidence into the investor community and stimulate heightened engagement within the network over the ensuing days.

While MATIC showcased marginal gains over a 24-hour period, an air of fragility hung over the bullish narrative. The tight price range, waning social sentiment, and intricate indicators called for a measured approach from traders.

Nevertheless, the impending shift to POL Token, as detailed by the Polygon’s co-founder, could potentially emerge as a stabilizing influence, rekindling investor trust and invigorating participation within the network.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from G2 Learning Hub