On-chain data shows the Chainlink exchange supply has observed a plummet, something that could turn out to be bullish for the asset’s price.

Chainlink Supply On Exchanges Has Registered A Drawdown Recently

According to data from the on-chain analytics firm Santiment, the LINK supply on exchanges could be forming a bullish divergence right now. The “supply on exchanges” here refers to the percentage of the total Chainlink circulating supply that’s currently being stored in the wallets of all centralized exchanges.

When the value of this metric rises, it means that the investors are depositing a net amount of their coins to these platforms currently. As one of the main reasons why they may transfer their coins to exchanges is for selling-related purposes, this kind of trend can have bearish effects on the cryptocurrency.

Related Reading: Bitcoin Cash Traders Back In Profit As BCH Surges 15%

On the contrary, the indicator’s value going down (that is, withdrawals taking place) could prove to be bullish for the price, as it can be a sign that the holders are accumulating.

Now, here is a chart that shows the trend in the Chainlink supply on exchanges over the past few years:

From the graph, it’s visible that the Chainlink supply on exchanges has registered a drop recently, meaning that a net number of coins has left these central entities.

In the chart, Santiment has also highlighted the pattern that the cryptocurrency’s price had followed when a similar trend in the supply on exchanges had formed in the last few years.

It would appear that whenever the supply on exchanges has declined into the green zone alongside decreases in the price, Chainlink has observed some uptrend soon after.

Since at the current value of about 15.5%, the indicator is inside this green territory, it’s possible that LINK could benefit from a rebound from this current bullish divergence.

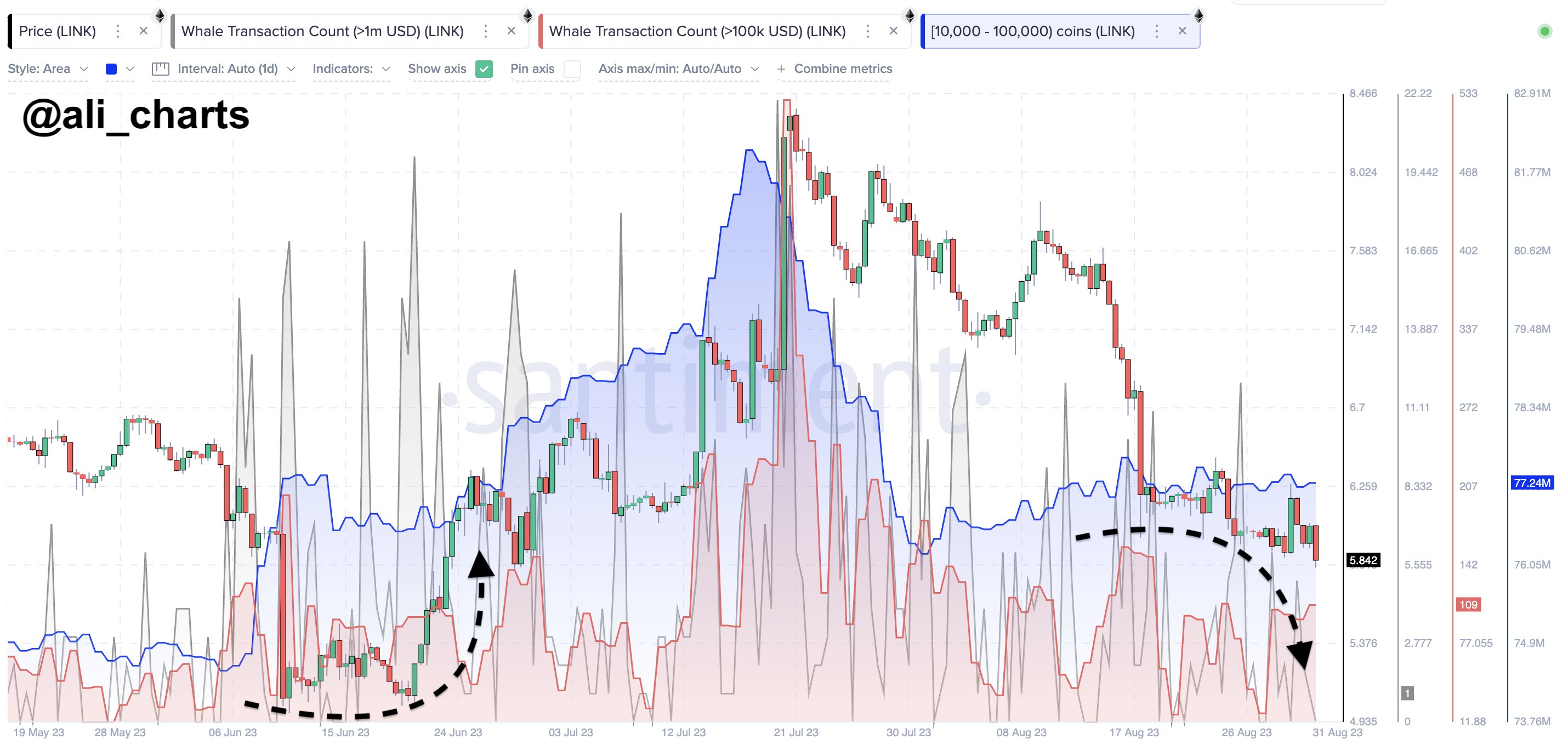

Not all signs are positive for Chainlink, however, as an analyst on X, Ali, has pointed out in a post that the whales have been behaving differently from the correction back in June.

The “whale transaction count,” which tells us about the number of transfers that these humongous investors are making, has declined since the latest drawdown in the asset, suggesting that this cohort has dropped its activity.

This is different from the trend that had followed after the price drop back in June, as these investors had ramped up their transfer activity then. The total holdings of the whales had also risen back then, as these investors had participated in accumulation, helping form the bottom and providing a platform for the eventual rebound.

The holdings of the Chainlink whales have continued to be flat this time, meaning that they aren’t interested in buying this dip. So while the supply on exchanges dropping is certainly bullish, support from the whales may also need to appear if the asset has to turn itself around.

LINK Price

Chainlink has been mostly moving sideways since the crash earlier in the month as its price continues to trade around the $6 level.