Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Ripple has expanded its blockchain portfolio by acquiring a Nevada-based chartered trust company. Former CEO of Turkish crypto exchange Thodex, Faruk Fatih Özer, has been sentenced to 11,196 years in prison by a Turkish court after being convicted of fraud, money laundering and other charges. Meanwhile, in an unexpected move, crypto firm LBRY has filed a new notice of appeal against the United States Securities and Exchange Commission over a July 11 court judgment.

Ripple acquires Nevada-based chartered trust company

Enterprise blockchain firm Ripple has acquired Fortress Trust, a Nevada-based chartered trust company, for an undisclosed amount, according to a Sept. 8 announcement.

The acquisition expands Ripple’s portfolio of licensed companies in the United States, bolstering its status as a money transmitter. The company currently has over 30 licenses, along with a BitLicense in New York state.

Today, we are announcing intent to acquire Fortress Trust, part of the @Fortress_io suite of companies. Fortress Trust’s financial and regulatory infrastructure complements and expands Ripple’s comprehensive portfolio of blockchain solutions for finance. https://t.co/LIl3cPEur2

— Ripple (@Ripple) September 8, 2023

Ripple has a long history with Fortress Trust, having participated as an investor in the company’s seed round in 2022.

The bear market hasn’t deterred Ripple from expanding its corporate portfolio. In May, the company acquired Swiss digital asset custodian Metaco for $250 million.

Ripple has been entangled in a multi-year legal battle with the United States Securities and Exchange Commission. In July, a New York judge agreed with Ripple that the public sale of its XRP token on exchanges did not violate securities laws.

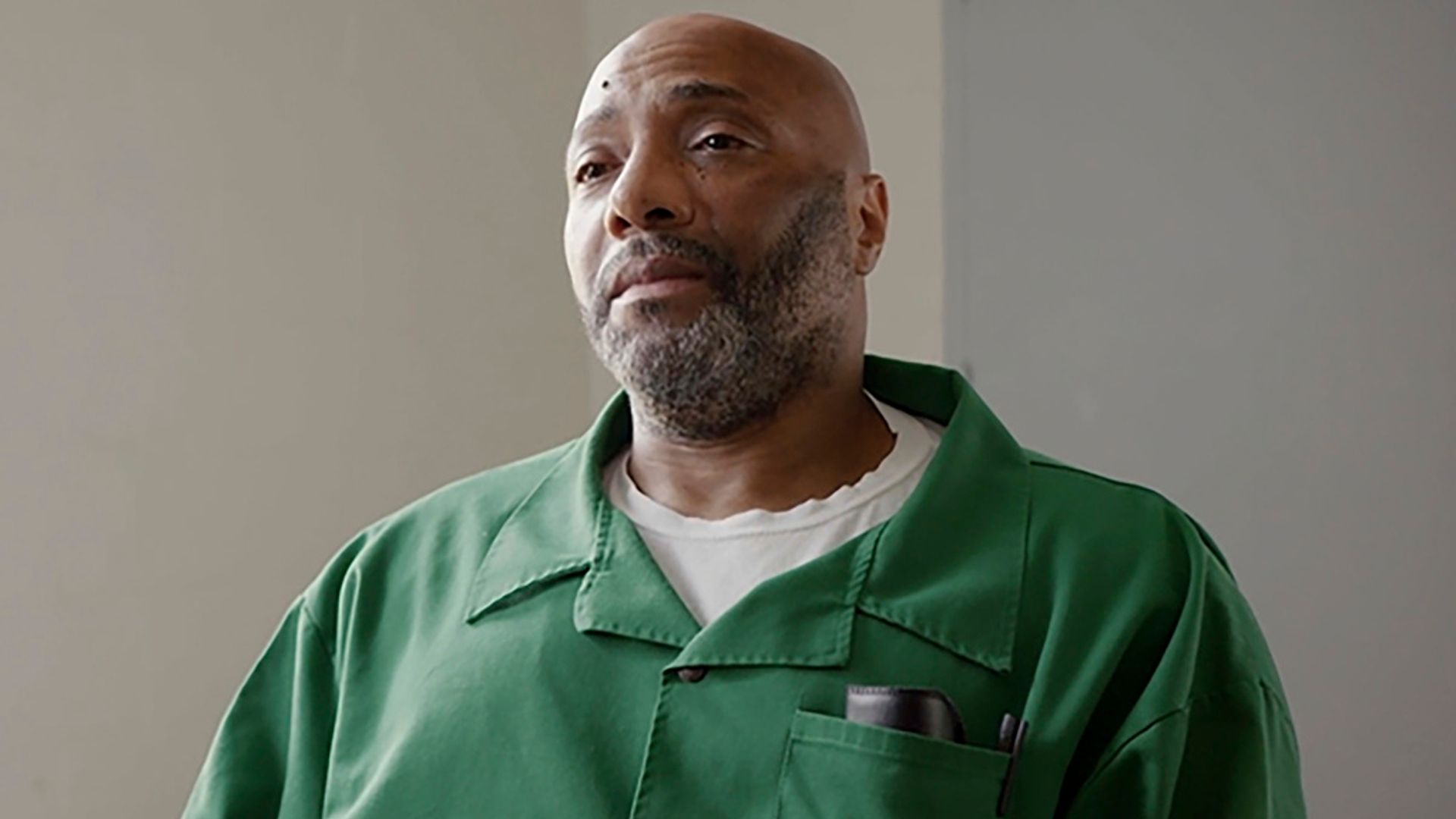

Turkish crypto exchange Thodex CEO gets 11,000-year sentence for $2B scam: Report

The former CEO of Turkish crypto exchange Thodex, Faruk Fatih Özer, was sentenced to 11,196 years in prison by a Turkish court on charges of “establishing, managing and being a member of an organization,” “qualified fraud,” and “laundering of property values.”

The Anatolian 9th High Criminal Court sentenced Özer along with his two siblings to the same jail sentence of 11,196 years, 10 months and 15 days in prison along with a $5-million fine, reported Turkish state-run news agency Anadolu Agency.

The Turkish crypto exchange was one of the largest digital asset trading platforms in the country before it abruptly imploded in 2021. The exchange halted services on the platform without prior notice, and the founder, Özer, fled the country along with users’ assets totaling $2 billion in crypto. At the time, Özer had refuted all claims of a possible exit scam.

The fugitive founder was finally detained in Albania in August 2022, where he was serving a jail sentence, before he was extradited to Turkey in April 2023 on charges of fraud and money laundering. Özer was already in jail for failure to submit tax documents since July, while the most recent conviction comes for defrauding customers.

The founder of the crypto exchange claimed in court that he and his family are facing injustice. He said Thodex was just a crypto company that went bankrupt and had no criminal intentions. A Google-translated version of Özer’s court statement read:

“I am smart enough to manage all institutions in the world. This is evident from the company I founded at the age of 22. If I were to establish a criminal organization, I would not act so amateurishly. What is in question is it is clear that the suspects in the file have been victims for more than 2 years.”

The long-drawn-out case against the Thodex crypto exchange had 21 defendants, five of whom attended the court hearing in person. The court acquitted 16 defendants of “qualified fraud” due to lack of evidence and ordered the release of four defendants. The other defendants in the case received varying degrees of sentences based on their involvement in the fraud.

LBRY files notice of appeal against SEC

Blockchain-based file-sharing and payment network LBRY is planning to fight a federal judge ruling in July that sided with the Securities and Exchange Commission.

On Sept. 7, LBRY filed a notice of appeal to the United States Court of Appeals for the First Circuit, seeking to appeal the final judgment entered on July 11 that ordered LBRY to pay a civil penalty and barred it from participating in unregistered offerings of crypto asset securities in the future.

The SEC first sued developer LBRY, Inc. in March 2021, claiming that its LBRY Credit token (LBC) was sold as a security under the 1933 Securities Act.

These kinds of battles are going to be busting out all over the place. The SEC may find itself in a lot of similar cases in the absence of regulatory clarity. https://t.co/wSDAnqHfqP

— Paul Brody prbrody.eth (@pbrody) September 8, 2023

The U.S. District Court for the District of New Hampshire granted the SEC’s motion for summary judgment against LBRY on Nov. 7, barring the platform from offering “unregistered crypto asset securities” and ordering it to pay a $111,614 civil penalty to the SEC.

In January, LBRY founder and CEO Jeremy Kauffman told Cointelegraph that “LBRY as a company is almost certainly dead.”

However, LBRY’s most recent move appears to be a possible change in course. It also comes amid a number of high-profile crypto industry victories against the federal regulator, including Ripple and Grayscale.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.