In a strategic move, MicroStrategy, the business intelligence (BI) company, and its subsidiaries have made a bold financial maneuver by increasing their Bitcoin (BTC) holdings.

MicroStrategy Bolsters BTC Holdings

According to a recent filing with the US Securities and Exchange Commission (SEC), MicroStrategy has expanded its Bitcoin holdings by acquiring an additional 5,445 BTC, totaling approximately $147.3 million. The average purchase price for these Bitcoins was $27,053 per unit.

With this latest acquisition, MicroStrategy’s total Bitcoin holdings now stand at 158,245 BTC. The company has accumulated this substantial amount of digital assets at an average price of around $29,582 per Bitcoin, equivalent to approximately $4.68 billion.

According to the company, these acquisitions underscore MicroStrategy’s commitment to Bitcoin and long-term belief in its potential. The company has been actively accumulating Bitcoin over time, establishing itself as a major participant in the cryptocurrency market.

In contrast, MicroStrategy’s stock, listed as MSTR on the Nasdaq, has followed a prolonged downward trend since July 13th.

As of the latest trading session, the stock is currently priced at $321.25, reflecting a decrease of 0.14% since the stock market’s opening.

Notably, the stock’s performance has exhibited a significant correlation with the value of Bitcoin over the same period, as both have experienced declines.

Furthermore, MicroStrategy’s decision to expand its Bitcoin portfolio coincides with a consolidation phase in the cryptocurrency market. Bitcoin has been trading between $25,000 to $27,000 since August 16.

The largest cryptocurrency in the market is valued at $26,200, representing a 1.5% decline over the past 24 hours and a decrease of over 4% over the past seven days.

Bitcoin Bearish Fractal Holds Strong

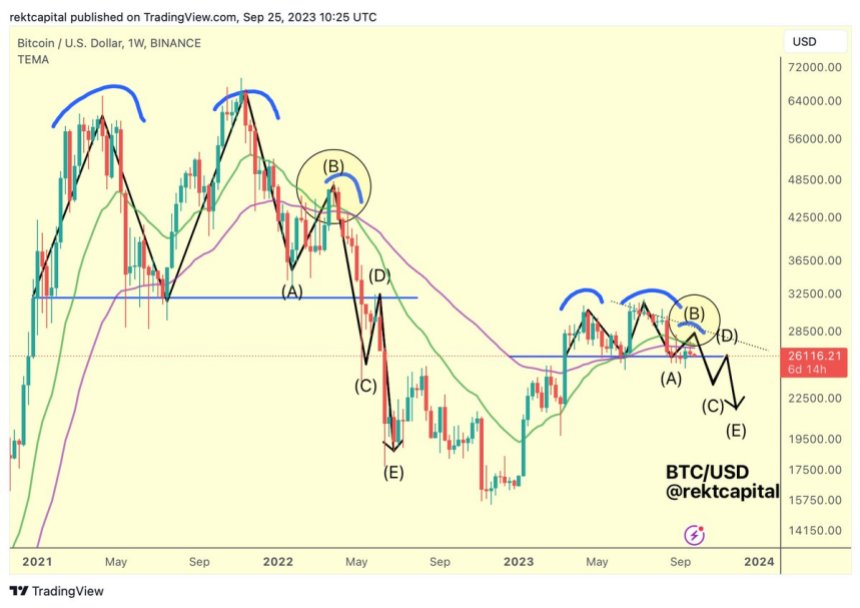

Renowned crypto analyst Rekt Capital suggests that the bearish Bitcoin fractal, previously highlighted by NewsBTC, remains intact, raising whether the cryptocurrency is still in Phase A-B or has transitioned to Phase B-C, as seen in the chart below.

According to Rekt Capita, Bitcoin typically forms a new lower high in Phase A-B, and recent price movements, whether reaching around $29,000 or as low as $27,400, satisfy this criterion.

However, a more pronounced lower high is possible if the support level of $25,000 to $26,000 is broken and the Bull Market Support Band becomes resistant.

For Phase B-C to commence, two conditions need to be met. Firstly, a relief rally must occur, confirming a new lower high. Secondly, the $25,000 to $26,000 support area must be lost.

Although a relief rally forming a new lower high has been witnessed recently, the second condition remains unfulfilled. Phase B-C will be initiated if the $25,000 to $26,000 support area fails.

Several key technical events are anticipated. During the downward movement, Bitcoin may briefly touch the $25,000 to $26,000 area. If the price struggles to surpass $26,000 and acts as resistance, it could indicate weakening support in the $25,000 to $26,000 range.

In such a case, a collapse to the $22,000 to $24,000 region might occur to establish a local bottom denoted as “C.”

To invalidate the bearish Bitcoin fractal, three criteria need to be met. Firstly, the Bull Market Support Band must be held as support. Secondly, a weekly close above the lower high resistance is required. Finally, breaching the yearly high of $31,000 would further challenge the bearish scenario.

Featured image from Shutterstock, chart from TradingView.com