In a recent courtroom showdown, Caroline Ellison, the former CEO of Alameda Research, provided key insights into the operations of FTX and its alleged improprieties. Her revelations, documented by Inner City Press correspondent Matthew Russell Lee, could play a critical role in the ongoing fraud trial against Sam Bankman-Fried, the former CEO of FTX.

Former Alameda CEO Caroline Ellison Dives Deep Into the FTX Debacle

On Thursday, U.S. District Judge Kaplan reminded Caroline Ellison of her oath, marking the beginning of a series of revelations about the inner workings of FTX. Mark Cohen, representing Sam Bankman-Fried, delved into specifics, asking Ellison about the “fiat account.” Ellison confirmed its existence, revealing that while she was uncertain about the exact number of sub-accounts, saying there were “at least dozens,” according to the X stream published by Matthew Russell Lee from the Inner City Press.

As the line of questioning progressed, Ellison was probed about her time at Alameda and her interactions with Sam Bankman-Fried. She conceded to Cohen’s assertions that she found some of Bankman-Fried’s claims to be accurate once she joined Alameda. When questioned about Bankman-Fried’s character, she stated he was “ambitious” and he encouraged her to adopt the same trait.

The dialogue took an interesting turn when Cohen broached the topic of Solana, the layer one (L1) blockchain Bankman-Fried championed. Ellison plainly admitted her lack of enthusiasm for it, a sentiment contrasting starkly with Bankman-Fried. The duo’s contrasting personalities were further highlighted when Ellison acknowledged their different reactions to stress and divergent fashion sensibilities.

The discussions grew tense as Cohen introduced various exhibits and statements, met with objections from the prosecution, questioning their relevance. In a notable moment, Ellison expressed her concerns about Alameda potentially jeopardizing FTX customers’ funds. She revealed that she had shared these concerns not only with Bankman-Fried but also with other colleagues, namely Gary Wang and Nishad Singh.

Cohen’s cross-examination took a financial turn when he asked about Ellison’s attempts to hedge financial risks in September 2022. Ellison recounted her calculations, suggesting that billions should be sold to hedge, but also admitting to the uncertainty of the situation. A significant revelation came when she mentioned a loss of $100 million due to the depreciation of UST, an algorithmic coin tied to Luna and the Terra blockchain.

In the final moments before the lunch break, Cohen touched upon an alleged bug in the system, and Ellison detailed the bug was discovered in May. The line of questioning, led by Bankman-Fried’s lawyer focused on Alameda’s financial intricacies. He probed Ellison about Alameda’s liquid assets, to which she confirmed the company’s lack thereof. A significant revelation was made when she disclosed Alameda’s repayment of “$5-10 billion” in the summer, with “$5 billion” being repaid just in June.

Cohen’s examination took a deeper dive into specific exchanges between Ellison and various entities. Discussing her communication with Genesis on June 18, Ellison revealed it revolved around “sending the balance sheet” and that there were “eight” versions of it. A particularly noteworthy quote emerged when she was questioned about third-party loans.

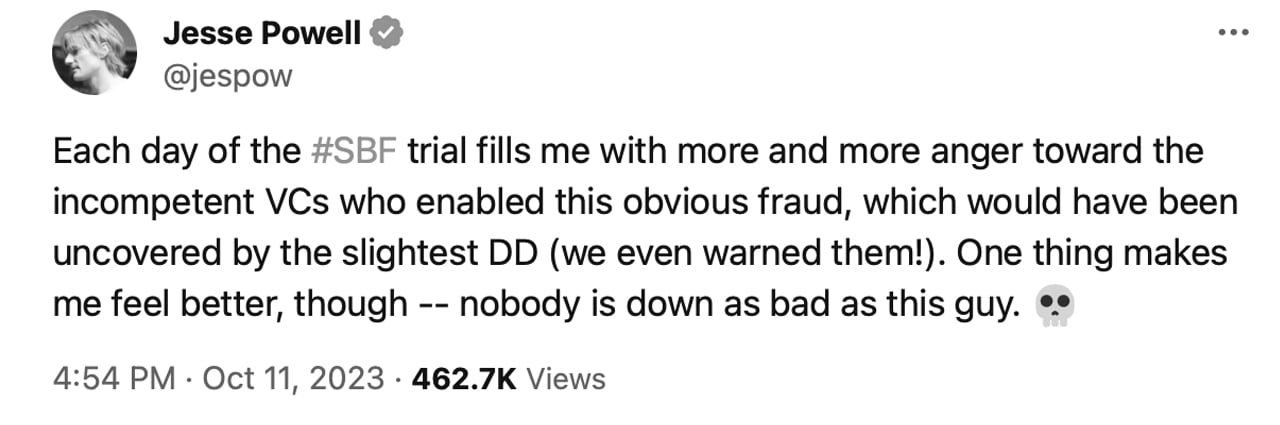

“It might look like Alameda was funneling money to FTX executives,” Ellison candidly shared. The narrative further unwound as Cohen brought up Bankman-Fried’s attempts to raise money from a Saudi prince, and Ellison’s skepticism of FTX’s potential investment in a company named Modulo.

Towards the end, Cohen referenced a tweet by Ellison, where she claimed that Alameda had returned most of its loans. Ellison clarified, stating, “Not really. We returned third party loans, by taking out more loans from FTX.” As the discussion shifted to an all-hands meeting in Hong Kong, Ellison mentioned that Sam Bankman-Fried had hinted at starting a new company.

The cross-examination concluded with a significant admission by Ellison, confirming that she had indeed informed employees about alleged wrongdoing within the company. In a riveting turn of events, a re-direct by government prosecutors centered on pinpointing the individuals involved in the alleged malfeasance.

When questioned about who was involved in the purported wrongdoing, Ellison unhesitatingly responded, “I said Sam, Gary, Nishad and I – and that the decision to repay loans with customer funds was Sam’s.” As the inquiry delved deeper into her motivations for disclosure, Ellison poignantly remarked, “We had already failed. So I could,” Russell Lee’s account of the situation detailed.

At the end of the testimony, Bankman-Fried’s lawyer claimed Caroline Ellison “went beyond the scope of the agency.” The Federal prosecutors responded that “Ms. Ellison said she would always defer to Sam. Here Mr. Bankman-Fried was aware she was going to have this meeting. He did not seek to remove her [as] CEO – instead, he provided input. So she was his agent.”

What do you think about Ellison’s testimony against Bankman-Fried? Share your thoughts and opinions about this subject in the comments section below.