Quick Take

Over the past half-year, a notable divergence was observed between Bitcoin and the prices of Bitcoin mining stocks. However, the past fortnight has witnessed a remarkable turnaround in this trajectory.

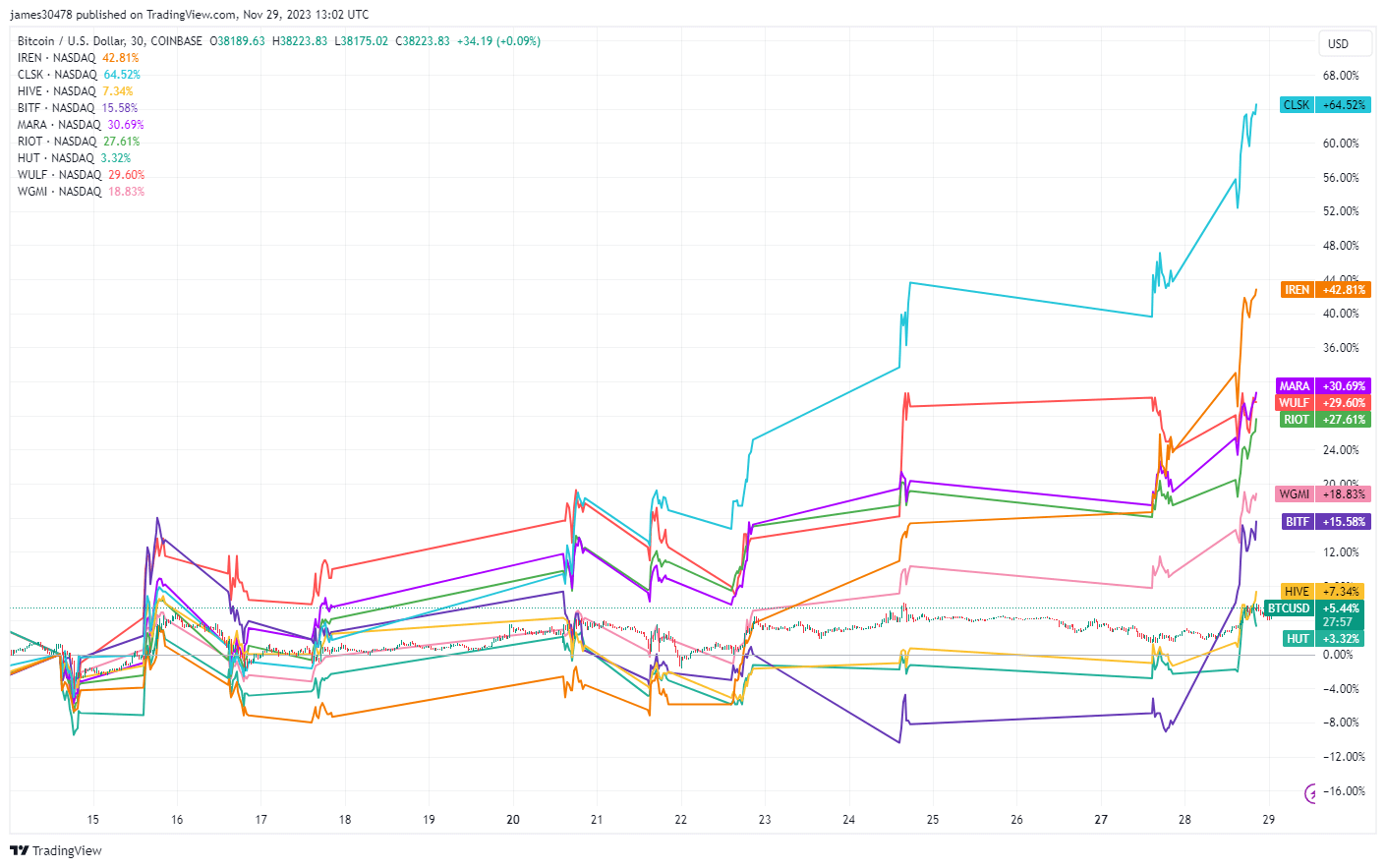

Bitcoin has appreciated by a modest 5.37%. Here’s how various Bitcoin mining stocks have performed:

| Bitcoin Miner | % |

|---|---|

| CLSK | 65% |

| IREN | 42% |

| MARA | 31% |

| WULF | 30% |

| RIOT | 28% |

| WGMI | 19% |

| HIVE | 7% |

| HUT | 3% |

Source: Trading View

Following CryptoSlate’s posting of the divergence, Bitcoin has appreciated by a modest 5.37%. Nevertheless, the real story lies in the resurgence of Bitcoin mining stocks, with the majority posting double-digit growth.

Cleanspark (CLSK), a standout performer, soared by 65%, followed by IREN, which increased by 42%. Meanwhile, MARA, WULF, and RIOT exhibited robust growth with increases of 31%, 30%, and 28% respectively. WGMI and HIVE slightly lagged yet still posted healthy gains of 19% and 7%. The sole outlier was Hut 8 (HUT), which experienced a modest 3% uptick.

In addition, on Nov.22, CryptoSlate identified a disparity between the gold miners’ ETF, GDX, and spot gold prices, with GDX seemingly trailing behind. Since that observation, gold has escalated toward its all-time high, while GDX has experienced a significant uptick of 7%.

This reversal indicates a promising upward price discovery for Bitcoin mining companies, signaling potential investor confidence in the sector’s profitability.

The post Bitcoin miners outshine Bitcoin in market rebound appeared first on CryptoSlate.