Quick Take

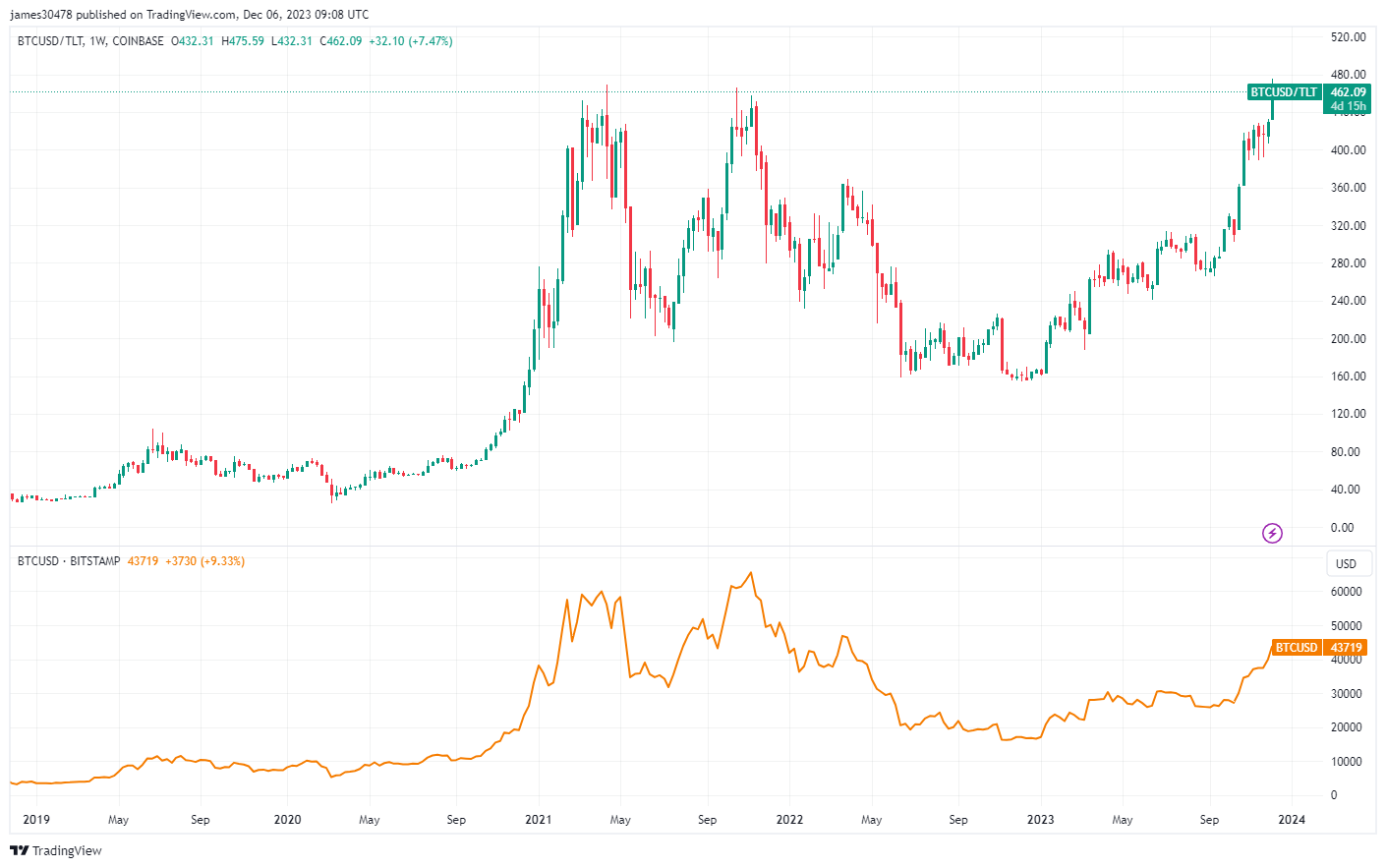

As Bitcoin was catapulted into the ninth position in the global asset rank yesterday, notably ahead of Meta, its performance is juxtaposed with TLT, the US long bond ETF. Currently, Bitcoin stands at 36% short of its all-time high, while TLT, trading approximately at $95, is 49% away from its peak.

However, a deeper dive into the relationship between Bitcoin and TLT reveals an interesting trend. When we consider the number of TLT units required for a single Bitcoin, so BTC denominated in TLT, the figure stands at 462, putting us at a triple top level previously seen in March and November 2021.

Intriguingly, during those periods, Bitcoin was trading at higher values of $57,000 and $65,000, respectively. This indicates that, currently, it takes more TLT units to acquire the same amount of Bitcoin, hinting at a potential ongoing trend where Bitcoin starts to engulf asset premiums across the board.

The post Bitcoin to US long bond ratio matches ATH last seen in 2021 appeared first on CryptoSlate.