In a significant development for the cryptocurrency market, the long-awaited Bitcoin (BTC) exchange-traded funds (ETFs) have finally received approval from the US Securities and Exchange Commission (SEC).

BlackRock CEO Larry Fink, a seasoned veteran in the financial industry, has made noteworthy statements regarding BTC while also expressing interest in an Ethereum (ETH) spot ETF.

Ethereum ETF As Catalysts For Tokenization?

During a recent interview on CNBC’s Squawk Box, Fink drew a parallel between Bitcoin and gold, stating that Bitcoin is “no different than what gold represented for thousands of years.”

Fink emphasized that Bitcoin is an asset class that offers protection, and unlike gold, there is a limited supply of Bitcoin, reaching a ceiling on the total amount that can be created.

Blackrock’s CEO further explained that BlackRock’s goal with their Spot Bitcoin ETFs is to provide an instrument for storing wealth, creating a reference between Bitcoin and gold.

Interestingly, Fink also expressed his belief in the value of an Ethereum spot ETF. He highlighted that these developments are stepping stones towards tokenization, and he sees this as the future direction of the industry.

Fink’s sentiment towards cryptocurrencies has evolved over time. Initially, he admitted to being a naysayer about them, but over the past two years, he has become a strong believer in their potential. However, Fink does not view cryptocurrencies, including Bitcoin, as currencies but rather as an asset class.

BlackRock’s IBIT Ranks Third In Bitcoin ETF Trading Debut

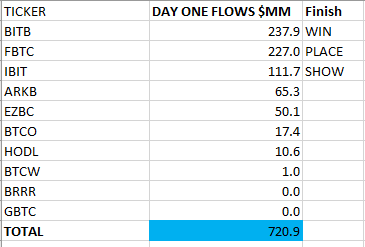

On the first trading day of all 11 spot Bitcoin ETFs, Bloomberg ETF expert Eric Balchunas reported that Bitwise’s Bitcoin ETF (BITB) emerged as the leader, attracting $238 million in inflows. Fidelity’s ETF (FBTC) followed closely behind, while BlackRock’s IBIT ranked third.

Balchunas noted that the total inflows across the ETFs amounted to an impressive $721 million, providing a glimpse into the investor interest in these new financial products. However, he acknowledged that the flow data is still being analyzed and more insights will be available soon. Balchunas further claimed:

Imp note, most of this flow data comes T+0 but cr/rd recording takes time to get into shares out regardless, hence why IBIT could see a blob of money tonight. Also, GBTC is T+1 so NONE of the activity from yest will be reflected in flows till Fri at the earliest and poss Tue night.

At the time of writing, the price of Bitcoin has pulled back to the $45,200 level, experiencing a decline of over 2% in the past 24 hours, despite the much-anticipated approval of the ETFs.

Nevertheless, it is important to note that the true effects of these index funds on the Bitcoin price and the broader Bitcoin market are expected to unfold over the long term.

Featured image from Shutterstock, chart from TradingView.com