10 January 2024 will go down in history as the day the floodgates opened for spot Bitcoin exchange-traded funds (ETFs) in the United States.

In a landmark decision, the Securities and Exchange Commission (SEC) approved over a dozen spot Bitcoin ETFs from major financial institutions like BlackRock, Ark Invest, Van Eck, Invesco, and Valkyrie.

This regulatory clarity and institutional adoption will likely catalyse the next major Crypto bull market.

Unleashing a wave of new demand

These new spot Bitcoin ETFs remove key obstacles for mainstream investment in digital assets. No longer do investors need to directly hold or custody Bitcoin to gain price exposure. Instead, they can simply buy shares of these SEC-approved funds in their existing brokerage accounts and benefit from Bitcoin’s upside potential.

Importantly, the launch of these spot Bitcoin ETFs will drive significant new demand for the Cryptocurrency. The fund managers will need to purchase substantial amounts of Bitcoin to seed their funds and back the shares.

Analysts from Standard Chartered Bank estimate between $50 and $100 billion in inflows in the early days. Additionally, if institutional and retail appetite for these funds is strong, the managers will need to continue accumulating Bitcoin to support further growth. This new baseline demand could strongly impact prices. The bank points to the possibility of $200,000 per coin by 2025.

Accelerating institutional adoption

The approval of spot Bitcoin ETFs will also generate an onslaught of positive media coverage and encourage adoption by banks, hedge funds, pensions, endowments and more. The Crypto industry has been seeking this high-level regulatory clarity for years.

Now, with the SEC effectively deeming Bitcoin mature and acceptable for mainstream investment, many institutions that were previously hesitant may dedicate capital.

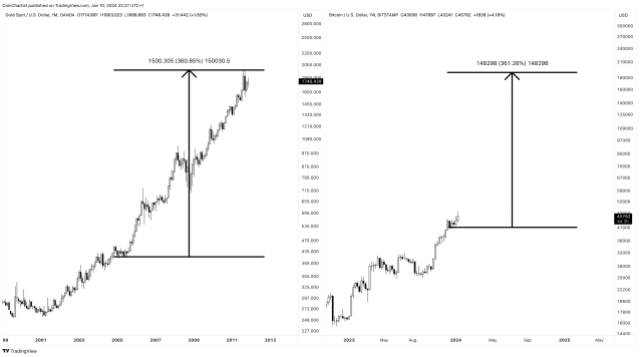

Just as the launch of the first gold ETF by ETF Securities in 2004 brought a surge of interest and investment to the precious metal, Bitcoin ETFs are likely to significantly broaden its appeal and drive prices higher.

Riding the bull run with leverage

For traders seeking to benefit from this imminent crypto bull run, derivatives platforms like PrimeXBT, Binance, and ByBit offer potential solutions. These platforms allow users to trade crypto assets with leverage without taking custody. While they all offer leverage trading, PrimeXBT stands out for its ultra-low fees starting at just 0.05% per trade. This beats even the pricing models of spot exchanges.

By aggregating liquidity pools across various trading venues, the top crypto derivatives platforms can offer competitive pricing and tight spreads, even during high volatility. Traders need to evaluate factors like fees, leverage limits, risk management tools, platform security, and customer support when selecting the best fit for their strategy.

As the new spot Bitcoin ETF era unfolds in 2024 and beyond, flexible derivative trading will empower investors to capitalize on both bull runs and periods of correction. With sound risk management, derivative platforms provide the most efficient way to capture opportunities in this expanding digital asset universe. By opening crypto to mainstream capital, this week’s SEC decisions represent a coming of age for Bitcoin.