Quick Take

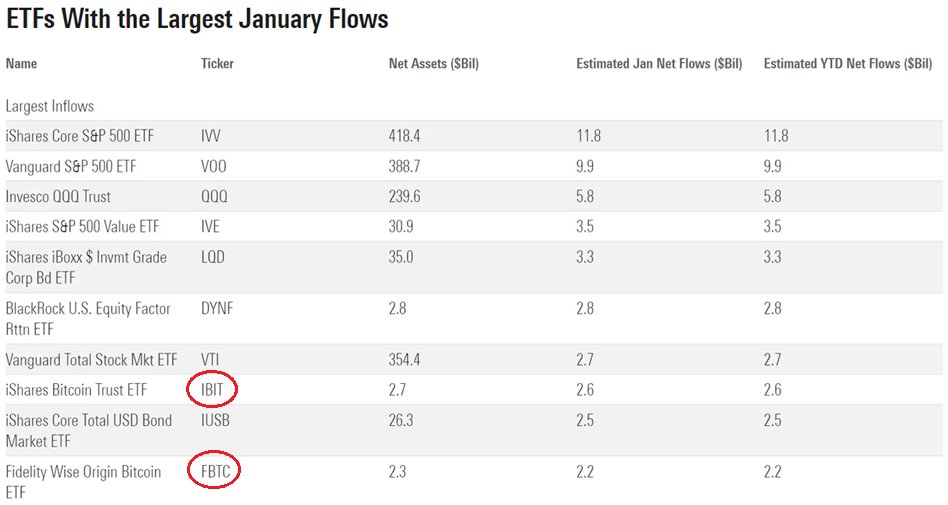

January ETF flows demonstrated a new trend in the investment landscape. Although the iShares Core S&P 500 ETF ($11.8 billion) and the Vanguard S&P 500 ETF ($9.9 billion) led the month, two Bitcoin-focused ETFs carved out a notable place on the leaderboard, according to Geraci.

Despite having a fraction of the net assets, the iShares Bitcoin Trust ETF (IBIT) and the Fidelity Wise Origin Bitcoin ETF (FBTC) had an impressive $2.6 billion and $2.2 billion in net assets, respectively, according to Geraci. In comparison, Vanguard’s Total Stock Mkt ETF (VTI) recorded only marginally higher inflows at $2.7 billion.

This demonstrates a burgeoning investor interest in incorporating Bitcoin into their portfolios, even amid a decline in Bitcoin’s price from $49,000 to approximately $39,000 within the month.

Considering the fact that there were around 3,109 ETFs active in the United States as of December 2023, according to Y Charts, the notable performance of these two Bitcoin ETFs is a significant indication of the evolving investment trends.

While the market dominance of traditional equity ETFs remains unchallenged, the impressive debut of Bitcoin ETFs suggests a steady acceptance of digital assets in the mainstream finance sector, marking a new phase in the digital asset investment era. At the same time, the digital assets industry is waiting on potential approval from the SEC on an Ethereum ETF.

The post Two Bitcoin funds hit top 10 ETF inflows across all categories in January appeared first on CryptoSlate.